Minneapolis

Alex Jeffrey Pretti Identified as Citizen Killed By Federal Agents

Published

The U.S. citizen shot to death by federal agents in Minneapolis has been identified.

Alex Jeffrey Pretti — a 37-year-old man — was the individual killed by feds, according to the Associated Press, which cites Pretti’s parents. AP says Pretti is an ICU nurse.

Video of the harrowing incident has gone viral online … with several masked agents standing over a man they’re apparently in a violent confrontation with.

Eventually, one pulls out a weapon and fires multiple shots at the man lying on the ground … and officials have since said he wasn’t the only officer to fire shots.

City of Minneapolis

Department of Homeland Security officials have said he approached officers with a weapons. However, state authorities say Pretti was a lawful gun owner with a permit to carry the weapon. He has no serious criminal history, they add.

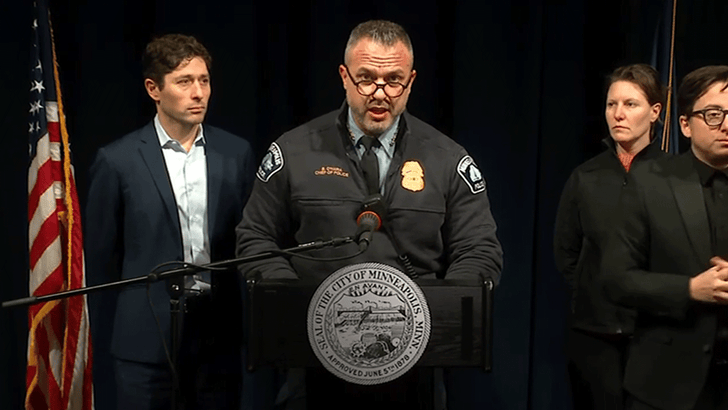

Pretti’s death led to protesters gathering in the streets and law enforcement officers firing off tear gas to disperse the crowd. City officials like Mayor Jacob Frey have asked citizens to remain peaceful while also calling on the Trump administration to remove federal agents from the city.

1/7/26

Pretti isn’t the first person who has been shot by federal agents in the city this month. As you know, Renee Nicole Good was shot and killed by officers in her car earlier this month, while an unnamed Venezuelan man was shot in the leg in a separate incident.

We’ve also reached out to Pretti’s family … so far, no word back.

Story developing …