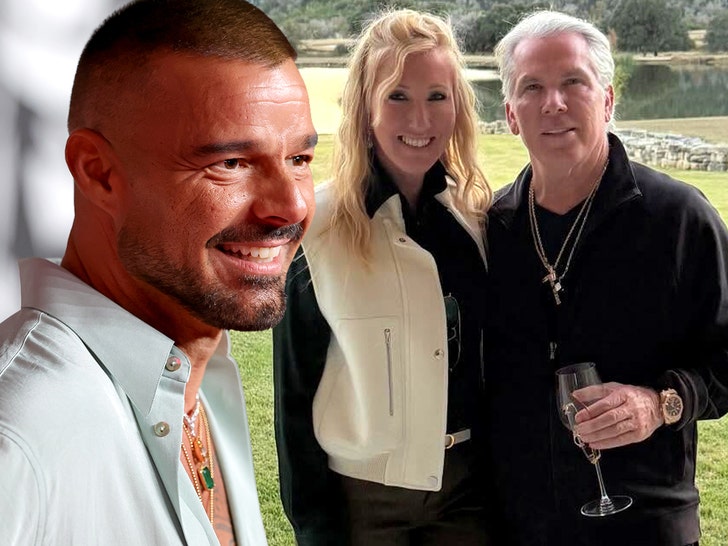

Ricky Martin

High-Dollar Performance at Lawyer’s Party!!!

Published

Personal injury lawyer Thomas J. Henry proved he throws a party like nobody else … dropping a TON of money to hire Ricky Martin for a secret performance at his engagement celebration … TMZ has learned.

Sources familiar with the party tell TMZ … the powerhouse personal injury attorney brought in Ricky for a 45-minute private concert Saturday night at the Fairmont El San Juan Hotel in Puerto Rico, where Thomas celebrated his engagement to Dr. Elena Alvarez Westwood.

We’re told 500 guests — including Marc Anthony — had no clue Ricky was going to hit the stage. Our sources say the party absolutely exploded when Ricky launched into his hits.

A massive scaffolding went up on the property ahead of the event. Even the staff working the bash weren’t spared the glam … they were all custom-measured for tailored outfits specifically for the night.

TMZ obtained a note slipped under hotel guests’ doors from Thomas and Elena ahead of the big party, alerting them that a large projection would be displayed on the side of the building and asking them to keep all curtains closed from 6 PM to 2:30 AM to help create the magical moment for the philanthropic couple.

Waiting for your permission to load the Instagram Media.

We’re told the couple gifted every hotel room Montadero Chocolate and Don Q Gran Reserva Añejo Rum. Our sources say a 20-minute late-night firework show sparked some complaints, but things were smoothed over by wiping several extra charges from guests’ bills.

We broke the story … Thomas spent $1.5 million to have Pitbull and Nick Jonas perform at the quinceañera for his daughter Maya Henry, who famously dated Liam Payne, back in 2016.