An analyst has defined how, if the historic sample adopted by the ADA value is to be believed, Cardano appears able to go on a parabolic bull run.

Cardano Might Be Set For A Bull Run Based mostly On Historic Developments

In a brand new post on X, analyst Ali Martinez has mentioned what hints historical past could comprise concerning the place ADA’s value would go subsequent from right here. First, here’s a chart shared by the analyst that exhibits the development the cryptocurrency adopted again in 2019:

The sample that the worth of the asset adopted a number of years again | Supply: @ali_charts on X

From the graph, it’s seen that the asset had first consolidated inside a parallel channel throughout this era. A “parallel channel” in technical evaluation (TA) refers back to the area bounded by two parallel development strains.

The higher line of the sample connects the tops within the value, whereas the decrease one joins the bottoms. When consolidating contained in the channel, the worth is possible to seek out resistance on the higher finish and help on the decrease one.

A get away of both of those strains can indicate a continuation of the development in that course. As is seen within the chart, ADA managed to interrupt out of this previous parallel channel with a 75% surge. The asset then adopted this rally up with a correction of round 56% earlier than lastly lifting off into an enormous 4,095% bull run.

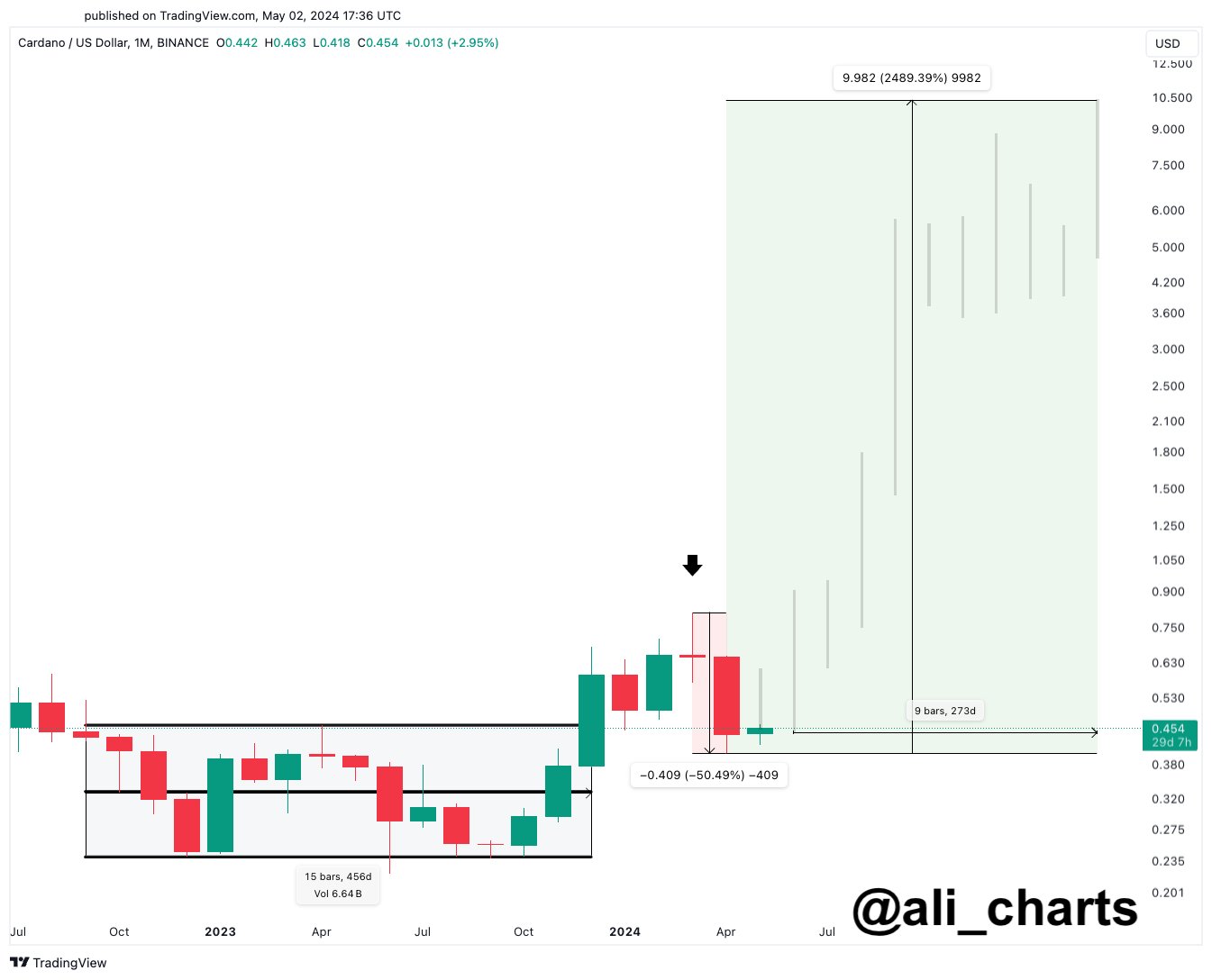

Curiously, similar to in 2019, Cardano was caught inside an analogous parallel channel in 2023. The chart under exhibits this current sample for the cryptocurrency.

Appears like the worth of the asset not too long ago broke out of its parallel channel | Supply: @ali_charts on X

As displayed within the graph, Cardano broke out of this newest parallel channel some time in the past, this time with a rally of round 72%. Lately, although, the asset has misplaced this bullish momentum, because it has seen a drawdown of fifty%. Based on the analyst, nonetheless, this could, in reality, set the stage for a brand new bull run.

Historical past doesn’t repeat itself, nevertheless it typically rhymes! If that’s the case for Cardano, we ought to be positioning ourselves for what’s coming, understanding that the current value correction may simply be one of many final buy-the-dip alternatives ADA offers you.

It now stays to be seen whether or not ADA will repeat the sample from the final bull run or not. That is extra concerning the long-term view, although, so the place may the asset go within the quick time period? This can be answered by a sign that the analyst has shared in one other X publish.

The TD Sequential sign that the ADA value has fashioned not too long ago | Supply: @ali_charts on X

As Martinez explains:

The TD Sequential, which timed the Cardano high, now presents a purchase sign on the ADA every day chart. It anticipates a one to 4 every day candlesticks rebound that would put an finish to the ADA corrective section.

ADA Worth

On the time of writing, Cardano is buying and selling round $0.464, down 3% over the previous week.

The worth of the coin appears to have noticed a pointy plunge over the previous month | Supply: ADAUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site totally at your individual danger.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/05/Crypto-Analyst-Says-Cardano-Ready-For-A-Parabolic-Bull-Run-1024x828.jpeg)