Your Asset Allocation is just a flowery method of claiming what you set in your funding portfolio. It’s additionally one of many elementary elements of your retirement plan. It defines the way you unfold your investments throughout several types of belongings—like shares, bonds, and money—and finally determines the steadiness between danger and return that you just tackle.

Merely put, what you set into your portfolio determines what you’ll get out of it.

That is each blindingly apparent, and likewise crucially vital.

Danger and Return are Associated

Investments will not be interchangeable, and their danger and return traits will not be random. By taking the time to deliberately resolve on what you need to embrace (and exclude) out of your portfolio you’ll be able to be particular about what you need your funding expertise to appear to be.

We all know that there is no free lunch with investing. When an funding has a better anticipated return, there’s a cause for that – that funding is riskier than different investments.

In flip which means that by being intentional about our investments, we are able to decide what our funding expertise will appear to be over the long run.

Avoiding the Rollercoaster of Market Feelings

A great way to consider it’s that the majority traders are on the Danger and Return Rollercoaster.

A well-designed asset allocation may help you keep away from the widespread pitfall of the worry vs. greed rollercoaster. This rollercoaster describes the sample of traders getting actually excited by the markets when issues are going nicely, taking over extra danger, after which panicking when the markets inevitably flip downward.

This cycle can result in shopping for excessive and promoting low—the precise reverse of what profitable investing appears to be like like. By having a well-thought-out asset allocation, you may keep away from the emotional ups and downs, permitting you to remain off the rollercoaster and preserve a comparatively clean funding expertise.

Widespread Asset Allocation Misconceptions

A standard mistake is pondering that asset allocation is nearly selecting particular person investments or chasing the best returns. As an alternative, it’s about designing a method that aligns along with your targets and luxury stage. Profitable investing is all about staying disciplined, and the precise asset allocation is what helps you try this. In case your allocation is simply too aggressive, market downturns may push you to panic and promote on the worst time. If it’s too conservative, you may miss out on the expansion it’s essential to fund your retirement.

The bottom line is steadiness. There’s no such factor as an ideal portfolio—the precise asset allocation is the one which helps you keep on observe and keep snug, even when markets get rocky. Which means understanding your personal tolerance for danger and ensuring your allocation displays it. The markets will go up and down, and one of the best asset allocation is one that you just’re capable of follow by way of each the nice instances and the unhealthy.

Your Asset Allocation Ought to Be Intentional

However too typically traders’ portfolios simply type of occur.

They have a tendency to concentrate on the particular investments and ways—like which funds or securities to purchase and promote—that are (by far) the least vital elements of investing. They usually ignore the broader strategic choices which have the most important influence on what occurs to their portfolio.

They get wrapped up in the entire noise of investing – what they’re seeing within the media, what the entire folks round them are saying, and what they’re feeling within the second – and so they do what appears good NOW. However additionally they did what appeared good final month. And final 12 months. And ten years in the past. All the way in which again to once they began investing for retirement.

Their portfolios are constructed by accretion, and simply type of occur.

Nothing about your investments (or your retirement plan typically) ought to simply occur. The whole lot ought to serve a particular goal. There’s solely a restricted quantity of area in your portfolio, so it’s essential to suppose strategically about what you need in your funding portfolio. And particularly, how what you embrace (and don’t embrace) will influence your portfolio, and aid you preserve shifting in direction of the retirement that you really want.

And to try this, you want a plan. Not simply on your investments, but additionally for what you need these investments to do, and the way they match within the context of your broader retirement revenue plan.

How Your Asset Allocation Suits Into Your Retirement Plan

Your retirement plan must work as a cohesive entire. It doesn’t matter when you have essentially the most pristinely designed funding portfolio for those who aren’t capable of meet your retirement targets.

There aren’t an entire lot of people that would disagree with that assertion.

However, not less than based mostly on what their funding portfolios appear to be, there aren’t an entire lot of people that put that into follow.

It doesn’t matter what your retirement income style is, most individuals may have a few of their belongings invested within the markets (or not less than in dangerous belongings). Nevertheless, what you’re asking of your portfolio might be very totally different.

For some folks, the majority of their spending will come from their investments. For others, they’re solely searching for their investments to cowl their most discretionary expenses. These conditions name for very totally different approaches to portfolio building, as a result of these portfolios exist inside very totally different retirement plans.

Organizing Your Asset Allocation

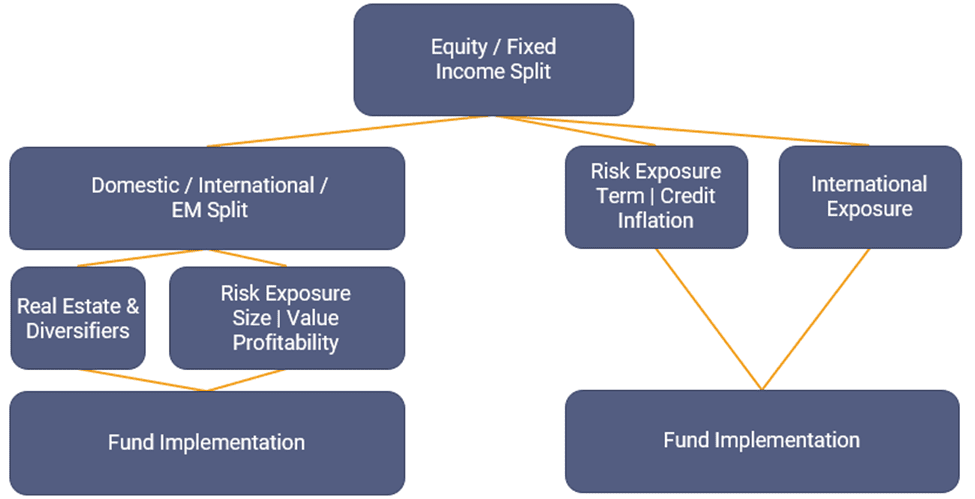

Determining your asset allocation can really feel like lots, however the Asset Allocation Choice Tree makes it considerably simpler. It helps you make choices step-by-step, beginning with the large stuff and dealing your method down. Consider it like a roadmap: begin on the prime and transfer down.

The large choices are proper on the prime. Crucial one is determining your mix of stocks and bonds — that’s the selection that actually shapes your total funding expertise.

Sadly, lots of people do it backwards, getting caught up within the little particulars like which investments to purchase or when to purchase them. However not solely are these the least impactful choices, they’re additionally ones which might be mainly not possible to get proper. It’s straightforward to get misplaced in that noise, however it’s higher to start out with the large image.

When you’ve acquired your stock-bond cut up sorted out, you may transfer down the choice tree and work out methods to arrange the totally different items of your portfolio.

On the left hand facet, now we have the entire totally different choices you may have a look at on your inventory allocation:

On the precise, now we have the selections on your bond portfolio:

For most individuals, protecting it easy is the way in which to go. The market portfolio—mainly proudly owning a broad slice of the entire market—generally is a nice choice. However when you have particular wants or need to tweak your danger and return, the choice tree helps you make these changes thoughtfully. Beginning on the prime and dealing down helps you to create a plan that works for you, with out getting sidetracked by the small stuff.

However nevertheless you construction your portfolio, crucial factor is to do it deliberately. Deciding what you need out of your portfolio is the important thing to maintaining your discipline by way of regardless of the markets resolve to throw at us.

Be intentional about what you set into your portfolio, and keep targeted on ensuring that your portfolio will aid you attain your total targets.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/11/Microscope-1024x810.jpg)