choral54 wrote: ↑Sat Sep 14, 2024 11:01 am

My advisor at Constancy is recommending that I maintain including to Puritan or Balanced, however am leaning extra towards index funds particularly within the taxable accounts. I’ve shut to three million {dollars} in CD’s and treasuries and really feel I might tackle extra threat as the cash in my accounts will principally be for long run care and future generations.

In case your advisor is recommending balanced funds like Puritan (70/30) or Balanced (65/35) on your Taxable account, that may be extra tax-efficient than holding $3M in CDs and short-term T-Payments, but it surely’s nonetheless not nice as a result of bonds & money in Taxable shouldn’t be tax-friendly and each of these funds have bonds. To amplify @retiredjg’s suggestion of holding bonds in a Trad 401k or IRA, see the Wiki subject on Tax-Efficient Fund Placement (basically, Taxable and Roth Tax-Free accounts must be 100% shares, whereas Tax-Deferred accounts ought to ideally maintain all of your bonds/money and the stability of your shares).

Do you may have Tax-Deferred accounts to work with?

choral54 wrote: ↑Sat Sep 14, 2024 11:01 am

I’m enthusiastic about SPY, VTI, VOO, VTSAX for the inventory portion of my portfolio. I even have some cash at Vanguard. What bond funds would you suggest for such a situation or what ought to I take into account or analysis some extra? Undecided what index bond fund(s) to go along with?

With out extra data I might recommend VTI (Complete US Inventory Index) for shares and BND (Complete US Bond Index) for bonds. Your fund selections in Taxable shouldn’t even be held in any tax-advantaged accounts so as to cleanly keep away from Wash Sale considerations.

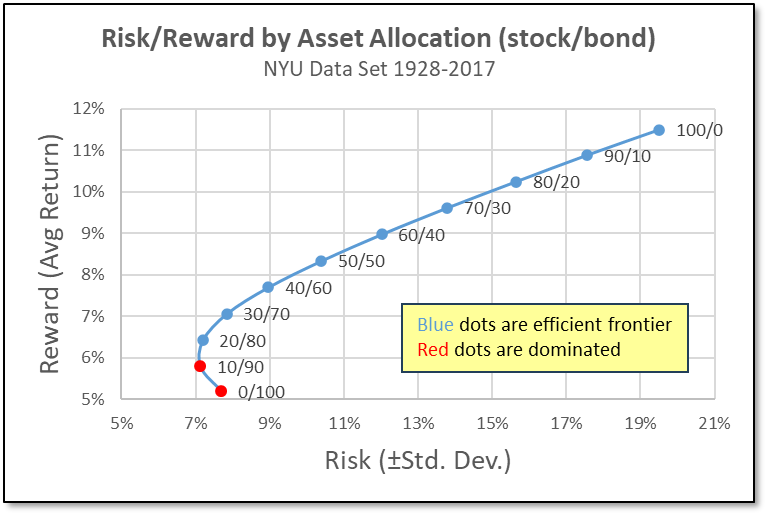

Is 60/40 or 70/30 only a guess or “the following step or two up in threat”? It could be worthwhile to do one or each of the workout routines beneath (in case your advisor did not already undergo one thing comparable with you, which he ought to have!).

Management Your Threat

1) Learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was really useful by the quiz based mostly in your data of your private threat tolerance having learn the Wiki article.

2) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of whole worth can I deal with?” minimize that % in half to get normal deviation, then lookup that std. dev. on the X-Axis of the chart beneath, and eventually scan as much as see what AA that corresponds to. For example, should you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a mean and you will get what you get along with your distinctive sequence of returns (there’s a number of variance in outcomes as a result of related volatility of shares so it most likely will NOT be the typical, however one thing roughly).

Do not do what Bogleheads inform you. Take heed to what we are saying, take into account different sources, and make your personal selections, since you must dwell with the dangers & rewards (not us or anybody else).