One of many options of Vanguard’s Digital Advisor Companies (VDAS) that’s hardest to copy by yourself is the automated tax-loss harvesting (TLH). VDAS will monitor the costs of every of your inventory ETFs each day, promote some or all of them at a loss once they deem applicable, buy a surrogate substitute ETF on the identical time to keep away from IRS wash guidelines, and maintain observe of what could possibly be a whole bunch of various tax heaps on an ongoing foundation. A DIY investor may carry out the same model of this, however it might positively be greater on the continuum of effort and talent required.

Due to this fact, a possible buyer would possibly wish to estimate the profit from TLH, and evaluate that with the VDAS price of ~0.15% yearly. It’s doable that the TLH characteristic may fully offset the price of the complete service. I dug round and located the next sources that designate all the pieces from the final background behind TLH to how VDAS implements them particularly.

I particularly respect the mental honesty of the analysis whitepapers as a result of it is among the few articles from a robo-advisor that truly admits that TLH can really decrease your after-tax return in case your private scenario just isn’t very best. Most different robo-advisors quote some fairly idealistic assumptions to get their numbers. Right here’s a quote:

In recent times, tax-loss harvesting (TLH) has been aggressively marketed as a near-certain strategy to enhance after-tax returns by wherever from 100 foundation factors to 200 foundation factors—in some circumstances even 300!—yearly. […] However many particular person traders don’t match this mould or ought to first give attention to different extra beneficial choices corresponding to investing in tax-advantaged accounts. These traders will ultimately be disillusioned with the scale of their TLH profit in the event that they set their expectation at 100 to 200 foundation factors.

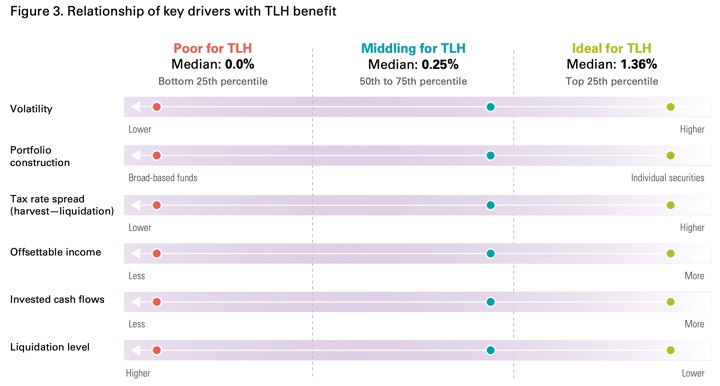

Listed below are the various components that may have an effect on the precise profit from tax-loss harvesting, together with a short description and the way VDAS handles it.

- Future inventory worth volatility. You want losses to reap them, and the larger the losses, the larger the harvest. You then want the inventory worth to bounce proper again, ideally rapidly after you harvest them. Secure and steadily-growing markets aren’t useful in creating TLH alpha.

- How typically will you retain making new investments. You probably have frequent common investments of latest cashflows, this creates extra tax heaps the place a loss may consequence, after which harvested.

- Future time horizon. Markets are likely to go up over time. As time goes on, the advantage of TLH will lower as a result of there shall be fewer losses left to reap.

- How typically will they test for losses. Monitoring the scenario each day ought to assist discover extra alternatives to reap losses. Vanguard Digital Advisor states they are going to test each day.

- >Variety of totally different portfolio securities held. The extra various things you may promote to create losses, the extra TLH alternatives there are. Anticipate “direct indexing”, the place you personal a tiny bit of each inventory as an alternative of a pooled ETF, to be marketed increasingly more closely sooner or later. Vanguard Digital Advisor holds ETFs, not particular person securities.

- Do you could have exterior capital positive factors to offset losses? Tax financial savings are generated by utilizing harvested losses to offset capital positive factors elsewhere. With out capital positive factors, taxable peculiar revenue can solely be diminished by as much as $3,000 a 12 months. Due to this fact, folks with small companies, non-public fairness, actual property, or different investments that generate a variety of capital positive factors usually tend to profit from harvesting losses.

- Your present and future tax brackets. Tax financial savings are generated now by offsetting capital positive factors and revenue at your present tax charge. Nonetheless, you’re reducing your value foundation and thus deferring these capital positive factors to the long run. In case your future tax bracket is greater, then you may very well find yourself paying extra in taxes later. Notice your future tax bracket could also be greater on account of laws, not solely on account of revenue adjustments. Others count on to defer “indefinitely” and use the step-up in foundation upon demise or make a qualifying charitable donation.

- Reinvesting tax financial savings. A major a part of the theoretical TLH profit comes from investing any tax financial savings so that you’re benefiting from these deferred taxes and rising them additional.

- Future inventory market return. This impact from the compounding of reinvested tax financial savings will depend on the scale of the market return, clearly.

As you may see, many of those components rely in your private scenario. Vanguard introduces two imaginary mannequin traders to clarify the potential variations. That is my very own abbreviated abstract.

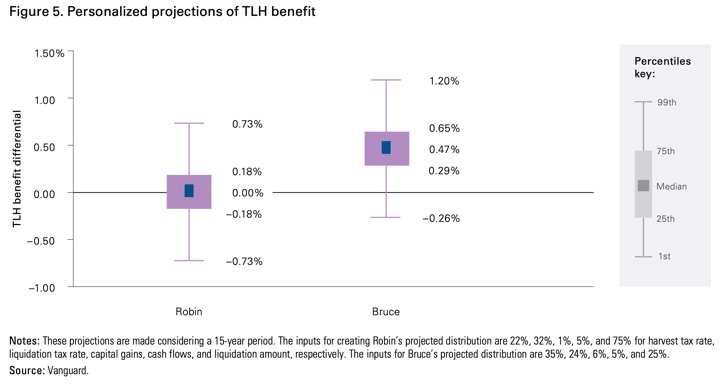

Robin is a health care provider in her early 30s. She is at the moment within the 22% revenue tax bracket. However after she finishes her residency in two years, she expects to spend most of her profession within the 32% bracket or greater. She principally saves in tax-deferred accounts, so she doesn’t count on to generate vital capital positive factors. Resulting from proven fact that her future tax charge is greater than now, and her low expectations for capital positive factors, her possible profit is low, probably zero and even damaging.

Bruce is in his late 50s and a companion at a big consulting agency that frequently realizes capital positive factors when new companions purchase into the partnership and when he ultimately sells all his shares for ~$4 million. Basically, limitless capital positive factors to offset losses. He’s at the moment within the 35% bracket, however, based mostly on his plans for a frugal retirement life-style, he goals to be within the 24% revenue tax bracket all through retirement. Resulting from the truth that he expects his future tax charge to be decrease than now, and his excessive expectations for capital positive factors, his possible profit is excessive, with a median projected advantage of 0.47% yearly.

These look like affordable estimates for the real-world advantage of TLH at two comparatively excessive examples. I believe most individuals shall be someplace in between. So a median expectation of 0% to 0.50%, however simply as necessary, a large doable vary of precise outcomes! Many different robo-advisor displays don’t adequately disclose their assumptions, together with the potential for damaging “alpha” in case your tax charges find yourself being greater in retirement. (Many individuals really feel that greater tax charges will ultimately be coming due after years of deficits.)

I hope that this data will permit a possible VDAS/VPAS buyer to handle their very own expectations of the advantages of TLH, based mostly on their very own particular person components – most significantly, having sizable new investments that will lead to short-term losses, the expectation of decrease tax charges within the retirement/withdrawal part, and having sufficient capital positive factors from different actions to offset any harvested losses.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/vdas_tlh0.jpeg)