littlefuse wrote: ↑Mon Sep 16, 2024 6:34 pm

On as for my Merrill Edge accounts, I’ve by no means invested in ETFs in my life, and I do know that Merrill Edge is not less than good for ETFs. All I have been doing these days with these three accounts – for probably the most half – is shopping for some brokered CDs. … I must do one thing.As a substitute of liquidating, do you advocate that I simply maintain this annuity the place it’s at Equitable – or perhaps buying a brand new SPIA annuity is sensible? I feel folks can convert present annuities into a distinct fashion of annuity. I consider I learn that.

If I’m to liquidate the annuity and switch it over to Merrill Edge and provides Vanguard ETFs a strive, which ETFs do you advocate? Or ought to I play it secure do a CD ladder – however do it in a extra structured method? I am on Medicare and I have not beginning drawing from SS but.

That is what I feel you’ve got, however there’s plenty of incomplete info highlighted in yellow.

The issue, as Retired@50 stated, is that you simply gave a number of info, however it’s so incomplete that we won’t make helpful & related suggestions. I am going to reiterate that you need to edit your first submit to incorporate all the pieces you possibly can that is included within the template for Asking Portfolio Questions. That will give us insights about: your emergency fund standing, the rate of interest in your mortgage (and every other debt), your Fed & State tax brackets (for ideas on Taxable account investing), your required Asset Allocation (together with % for int’l inventory), your precise holdings (not simply the greenback worth of the account sorts), and the fund decisions in your 401k. If you’d like extra holistic suggestions in your future retirement, make sure you embrace any estimates for pension and/or SocSec advantages and what age you would be retiring and what age you would be getting these advantages (i.e., the portfolio just isn’t your sole supply of retirement earnings).

With that info we are able to recommend a solution to make investments that’s tax-efficient, avoids wash gross sales, and meets your required Asset Allocation collectively along with your present holding.

As a place to begin, I am going to recommend that you simply decide an Asset Allocation that’s acceptable on your time frame (anticipated lifespan) and your risk-tolerance. Both or each of the workout routines under might help with that.

Management Your Threat

1) Learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was really useful by the quiz based mostly in your information of your private danger tolerance having learn the Wiki article.

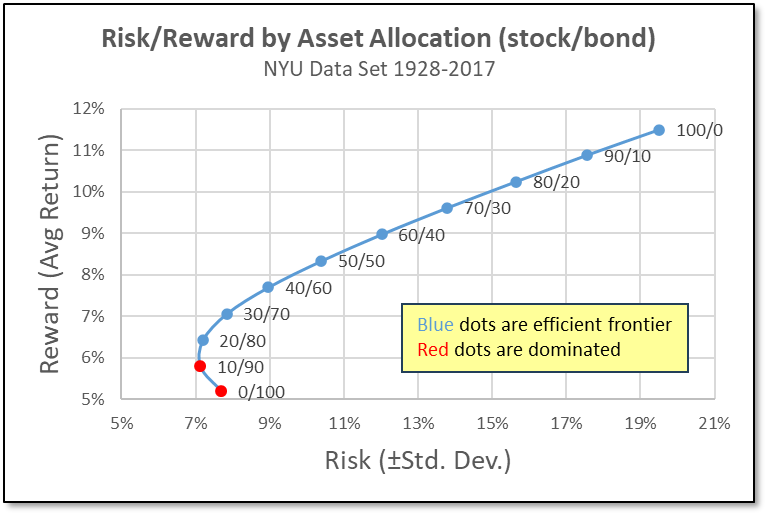

2) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of complete worth can I deal with?” reduce that % in half to get customary deviation, then lookup that std. dev. on the X-Axis of the chart under, and eventually scan as much as see what AA that corresponds to. For example, in the event you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a median and you will get what you get along with your distinctive sequence of returns (there’s plenty of variance in outcomes because of the related volatility of shares so it most likely will NOT be the common, however one thing kind of).

Subsequent, I might most likely attempt to achieve some primary understanding of investing by studying the 5 introductory subjects in Wiki Main Page (left facet) beneath “Getting Began for US Buyers”:

1) Getting began – Begin right here.

2) Funding philosophy – Our funding rules.

3) Investing start-up package – A top-down method to begin investing.

4) Funding coverage assertion – Determine your funding aims and the way you propose to satisfy them.

5) Prioritizing investments – Selecting the place to avoid wasting your investing cash, similar to an employer’s retirement plan or a financial savings account.

———-

The annuity is probably going a separate subject that does not want all that data… it is both an environment friendly & helpful future earnings stream to you (like a bond holding) or it is not that nice compared to a Treasury bond fund or a Whole Bond fund (gov’t & corp. debt) or a 60/40 mixture of inventory & bond index ETFs. All I can inform is that you simply paid $109.3K and it is presently valued at $241.3K. How way back did you purchase it? Did you make any contributions after the preliminary buy or simply the $109.3K buy-in? What are the contract phrases for pay-out? You possibly can money out present(?) worth for $1K cost, however can you are taking it in equal funds over some interval you specify at no cost? Are the withdrawal durations set by the contract (e.g., 5, 10, or 15 yr interval or some RMD life-time desk)? What is the earliest you possibly can take funds (not a money out) with no cost… 80?

I usually suppose annuities are a foul deal for the buyer aside from Single Premium Quick Annuities (SPIA) and Multi-Yr Assured Annuities (MYGAs). So my tendency is to pay the the $1K give up price, get the $241K out and make investments it per your required AA (as soon as you identify what that’s). If the give up phrases additionally means you are solely getting your $109K unique buy again, then you are caught with this sub-par insurance coverage product (do not money out), however that each one actually is dependent upon your contract phrases and what the earnings charge has been since your preliminary buy to now.

Do not do what Bogleheads let you know. Hearken to what we are saying, take into account different sources, and make your personal selections, since you must stay with the dangers & rewards (not us or anybody else).

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Using-Merrill-Edge-and-Allocating-Assets.png)