HanSolo wrote: ↑Tue Nov 28, 2023 9:05 amlearnbehumble wrote: ↑Tue Nov 28, 2023 5:51 am

2% is extra dangerous than 5% as a result of it’s extra conceivable to see charges rise to 12% then fall to -5%.That is actually a perception somewhat than a reality. Yeah, should you can select between the 2 on the identical time, go together with the higher deal. However you may’t (as I defined above).

Additionally, selecting absolute numbers (12% and -5%) is sort of synthetic. For instance, you would as a substitute examine the chance of rates of interest doubling vs. getting lower in half.

A greater analogy (than the chemistry one) is the inventory market. Some individuals consider the inventory market is riskier at CAPE=25 than at CAPE=20. However the two are by no means true on the identical time (i.e., at a given second in time, you may’t select between a US complete fairness market ETF at CAPE=20 and one other one at CAPE=25, all containing the identical shares… should you might, then yeah, I would purchase the cheaper one, however guess what, that does not occur in actuality). CAPE=20 was comparatively dangerous throughout the twentieth century as a result of the market tended to commerce beneath that. And as far as we will inform, CAPE=25 has been comparatively low-risk throughout the twenty first century, as a result of the market tends to commerce above that. And I don’t know what might be true within the 2030s.

I recall Homer declaring this fallacy many occasions. The fallacy is making assumptions about what dangers are implied from the numbers available in the market, and that is a fallacy within the case of shares, bonds, pork bellies and the whole lot else. The reality is that you do not know, and the remainder is hand-waving.

We do not know something about future realized outcomes, that is apparent even when some posters consider they’re scoring debating factors every time they repeat it, v the supposed (truly principally non-existent) posters who assume realized outcomes of danger asset returns are predictable.

However you are additionally repeating a fallacy you, and Homer, do on a regular basis. Danger of a fall in valuation shouldn’t be the one factor about valuation. The next valuation means a decrease anticipated return should you assume the anticipated future valuation is identical as now’s. That is the idea below which E[r]=1/CAPE makes tough sense, the derivation is repeated beneath*. In the event you knew (some prognosticators assume they do, I do not) that CAPE was extra prone to fall than rise then E[r]<1/CAPE, conversely should you knew it was extra prone to rise than fall (which just about no one ever argues explicitly, however is principally what’s being argued when substituting greater previous realized returns for 1/CAPE as E[r] now, with out exhibiting why the derivation* shouldn’t be solely unsuitable, it is certainly not 100% proper, however biased to offer a really low estimate of E[r] when E/P is low).

Danger in theoretical fashionable finance is std dev of return. Everyone knows that is an incomplete measure in the true world, however lack of a greater, easy, goal one is IMO a giant hurdle to discarding it. And there’s no cause to consider the next/decrease earnings yield implies the next or decrease std dev of return.

Let’s take a look at a tough theoretical measure of allocation, the Merton Fraction.

https://en.wikipedia.org/wiki/Merton%27 … io_problem

Assuming fixed relative danger aversion, the allocation could be (inventory anticipated return-riskless yield)/vol^2*gamma. Gamma is the private consider CRRA, ‘the chance appropriate for me’ in BH phrases. However the high half ERP, and the underside vol, are separate. The fraction is simply fixed with various ERP should you assume vol routinely goes down the correct amount when the ERP narrows and vice-versa. We certainly do not know the long run fairness danger the market perceives now in comparison with different occasions. However assuming it neatly offsets altering ERP to given fixed allocation appears out of tune with the true world. Fairness choices markets (although long run ones are skinny and opaque) do not appear to assume this.

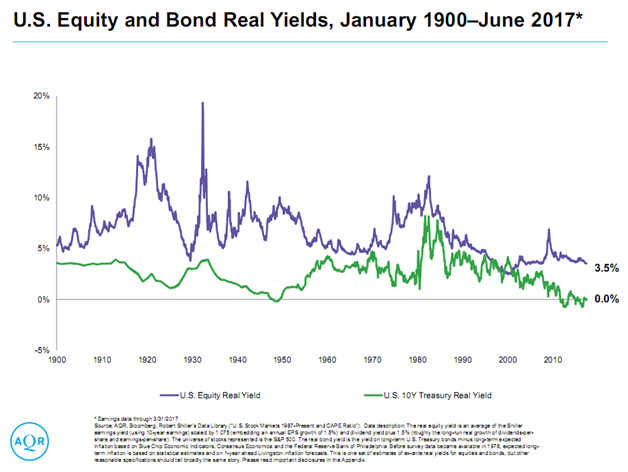

So, does anticipated ERP so far as we will measure keep fairly fixed? In some durations, however not currently. Estimating inventory E[r] as a hybrid common of 1/CAPE and div yield plus the historic comparatively secure 1.5% actual EPS development of final century+ within the US and evaluating to the true 10 yr yield, that margin has dropped greater than 1/2 within the final 2 yrs, from ~4.4% in late 2021 to ~1.9% now. The graph reveals the connection 1900-2017. Even when quibbling with varied particulars within the foregoing, laborious to know what invisible enchancment in inventory anticipated return or lowered inventory danger makes shares equally enticing relative to bonds now as late 2021. Although if one had been by no means danger averse the theoretical reply would at all times be 100%+ inventory, and if unwilling to lever simply at all times 100%. However for a 70/30 particular person in 2021, it is more durable to see how 70/30 continues to be the best reply now (although clearly different actual world constraints to altering allocation, like cap beneficial properties tax).

*worth of a inventory S=Div/(r-g) S the inventory worth, r the return, and g the dividend development fee, or r=S/Div+g, the return the perpetual payout of the dividend plus dividend development. However dividend development comes from earnings development comes from return. Assume in equilibrium the true anticipated return on the inventory is the return on capital of the corporate. Then S= p*E/(r-(1-p)*r), the place p is the payout ratio, ie Div=p*E, div development fee is (1-p)*r. Subsequently r=E/S.