- USD/CHF is falling on US Greenback weak point as knowledge out of the US paints an image of a cooling US financial system.

- Latest companies’ sector and labor-market knowledge trace at a softness which could lead on the Federal Reserve to enact Greenback-negative insurance policies.

- The Swiss Franc, nevertheless, stays basically weak because the Swiss Nationwide Financial institution continues reducing rates of interest in Switzerland.

USD/CHF reached a four-week excessive of 0.9050 on July 3 earlier than continuing to roll over and fall. It’s at present buying and selling within the 0.8980s. The decline has been put all the way down to US Greenback weak point greater than Swiss Franc (CHF) energy. A run of poor knowledge from the US has made it extra probably the Federal Reserve (Fed) will begin to ease financial coverage – a transfer that may weaken the US Greenback.

USD/CHF 4-hour Chart

The poor knowledge that has began weighing on the US Greenback contains the ISM Providers PMI knowledge for June which got here out at 48.8 from 53.8 beforehand. This was vital as a result of the companies’ sector has been singled out as a key contributing issue to the stubbornly excessive inflation within the US financial system, which in flip has prevented the US Federal Reserve (Fed) from reducing rates of interest.

Nevertheless, the weak ISM Providers PMI knowledge in June signifies the sector is perhaps starting to chill down which may additional deliver down inflation extra typically and permit the Fed to chop rates of interest. Though decrease rates of interest are constructive for companies as a result of they cut back borrowing prices, they’re unfavorable for a foreign money as a result of they make it much less engaging to overseas buyers as a spot to park their capital. Thus the info weighed on the US Greenback and USD/CHF.

Indicators of a softening labor market are additionally weighing on the US Greenback. The Nonfarm Payrolls (NFP) report for June has proven an increase within the Unemployment Charge to 4.1% from 4.0% when no-change was anticipated. That is its highest since November 2021 simply after the pandemic. Moreover, Preliminary Jobless Claims rose greater than anticipated in late June, and Persevering with Claims climbed to 1.858 million – additionally the best since November 2021. The general softer employment knowledge, provides to the image of a cooling financial system.

Swiss Franc depreciates on decrease rates of interest

For any foreign money pair the distinction between the rates of interest of the 2 currencies, or the “interest-rate differential” is essential. As such, it isn’t simply the projection for rates of interest within the US but in addition for Switzerland, that could be a determinant of the change charge.

USD/CHF rose 2.5% in simply two weeks on the finish of June after the Swiss Nationwide Financial institution (SNB) determined to chop its essential rate of interest by 0.25% to 1.25%, at its June 20 assembly. This was the second time this 12 months that the SNB had determined to chop its coverage charge.

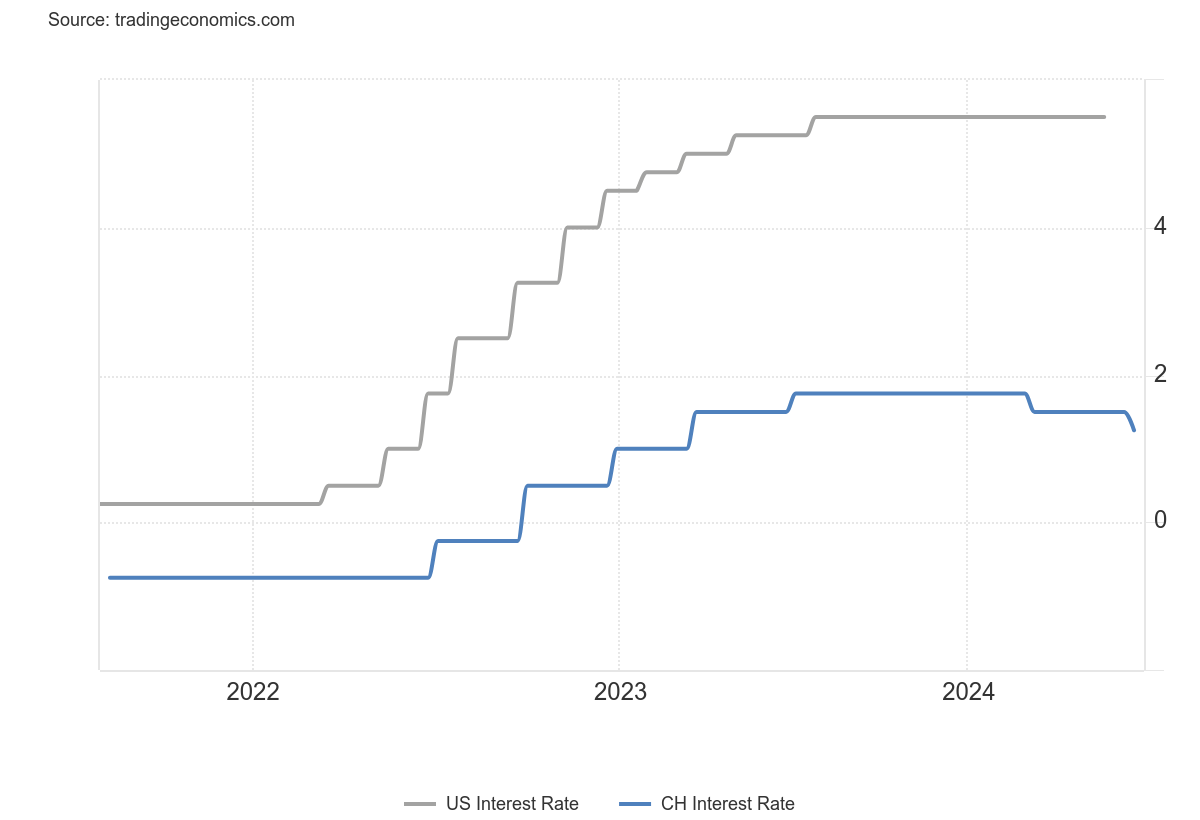

The chart under compares the SNB and Fed’s coverage charges during the last three years. As may be seen, while each started elevating rates of interest to fight excessive inflation after the Covid pandemic, inflation fell again all the way down to regular ranges extra rapidly in Switzerland so the SNB was in a position to cut back rates of interest earlier there. The Fed, in distinction, has but to start chopping rates of interest within the US on account of stubbornly excessive inflation. This has benefited the US Greenback.

The current run of weak US knowledge, nevertheless, makes it extra probably the Fed will even start chopping rates of interest at its assembly in September.

The chance of the Fed chopping its principal coverage charge, the Fed Funds charge, by 0.25% to an higher restrict of 5.25% by September, has elevated from the mid-60s on the finish of June to round 75% on Friday July 5, based on the CME FedWatch device, which makes use of the worth of the 30-day Fed Funds futures in its calculations

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/computer-keyboard-with-swiss-franc-and-dollar-buttons-56260438_Large.jpg)