- US CPI for Might unchanged at 0% MoM, beneath estimates of 0.1%, with annual improve at 3.3%.

- 10-year Treasury bond yield drops 14 foundation factors to 4.266%, lowest since April.

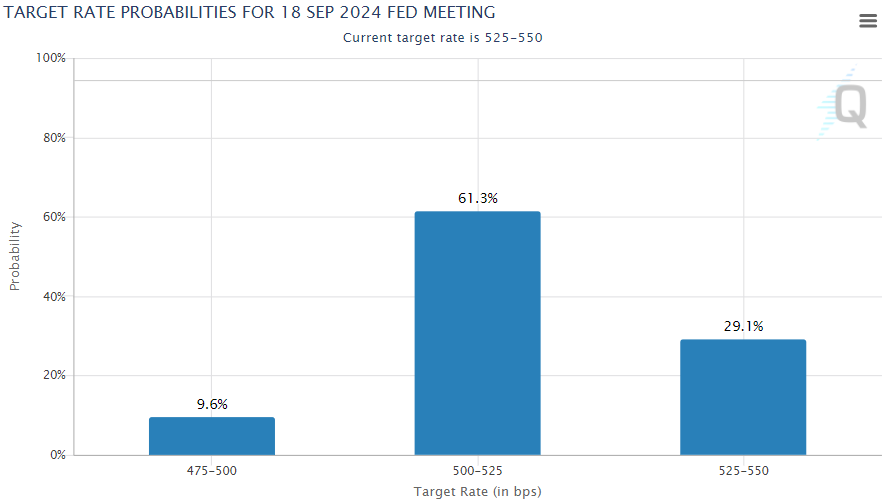

- Gold hits weekly excessive of $2,341; merchants anticipate potential 25 bps charge reduce by September with 61.3% odds.

US Treasury yields collapsed on Wednesday after a colder-than-expected Might US Client Price Index (CPI) report elevated hypothesis concerning the Federal Reserve’s charge cuts in 2024. Regardless of that, warning is warranted, because the Federal Open Market Committee (FOMC) will reveal its financial coverage choice at round 18:00 GMT.

Colder-than-expected inflation report drives hypothesis of charge cuts forward of FOMC coverage choice

The US Bureau of Labor Statistics (BLS) revealed that the CPI was unchanged at 0% MoM, beneath estimates of 0.1% and April’s 0.3% improve. Within the twelve months to Might, it rose by 3.3%, beneath April’s and the three.4% consensus.

Underlying inflation figures decreased from 0.3% to 0.2% MoM, whereas on an annual foundation, hit 3.4%, decrease than expectations of three.5% and April’s 3.6%.

The US 10-year Treasury bond yield plummeted 14 foundation factors to 4.266%, its lowest degree since April, after starting the session at 4.426%. This pushed Gold prices towards a weekly excessive of $2,341 earlier than stabilizing at round $2,324.

Knowledge from the Chicago Board of Commerce (CBOT) exhibits that merchants anticipate 39 foundation factors (bps) of easing, in response to December’s 2024 fed funds charge futures contract. Within the meantime, the CME FedWatch Device exhibits odds for a 25 bps charge reduce in September jumped from 46.8% a day in the past to 61.3%.

US inflation knowledge got here forward of the Federal Reserve’s financial coverage choice. The Fed is predicted to maintain charges unchanged whereas updating its financial projections. Merchants could be on the lookout for hints concerning the future rate of interest path.

Inflation FAQs

Inflation measures the rise within the value of a consultant basket of products and companies. Headline inflation is normally expressed as a share change on a month-on-month (MoM) and year-on-year (YoY) foundation. Core inflation excludes extra unstable components akin to meals and gas which may fluctuate due to geopolitical and seasonal elements. Core inflation is the determine economists concentrate on and is the extent focused by central banks, that are mandated to maintain inflation at a manageable degree, normally round 2%.

The Client Worth Index (CPI) measures the change in costs of a basket of products and companies over a time period. It’s normally expressed as a share change on a month-on-month (MoM) and year-on-year (YoY) foundation. Core CPI is the determine focused by central banks because it excludes unstable meals and gas inputs. When Core CPI rises above 2% it normally leads to larger rates of interest and vice versa when it falls beneath 2%. Since larger rates of interest are constructive for a forex, larger inflation normally leads to a stronger forex. The alternative is true when inflation falls.

Though it could appear counter-intuitive, excessive inflation in a rustic pushes up the worth of its forex and vice versa for decrease inflation. It’s because the central financial institution will usually increase rates of interest to fight the upper inflation, which are a magnet for extra world capital inflows from buyers on the lookout for a profitable place to park their cash.

Previously, Gold was the asset buyers turned to in instances of excessive inflation as a result of it preserved its worth, and while buyers will usually nonetheless purchase Gold for its safe-haven properties in instances of maximum market turmoil, this isn’t the case more often than not. It’s because when inflation is excessive, central banks will put up rates of interest to fight it. Increased rates of interest are unfavorable for Gold as a result of they improve the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or putting the cash in a money deposit account. On the flipside, decrease inflation tends to be constructive for Gold because it brings rates of interest down, making the brilliant steel a extra viable funding various.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/cuff-2251146_960_720.jpg)