By Natalie Sherman and Nathalie Jimenez, BBC Information, New York

BBC

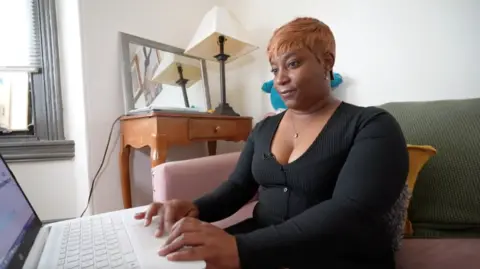

BBC Stacey Ellis, a lifelong Democrat from Pennsylvania, ought to be the sort of voter that US President Joe Biden can rely on.

However after 4 years of rising costs, her help has worn skinny – and each time she outlets on the grocery store, she is reminded how issues have modified for the more serious.

Ms Ellis works full-time as a nurse’s assistant and has a second part-time job.

However she must economise. She has switched shops, reduce out brand-name gadgets like Dove cleaning soap and Stroehmann bread, and all however mentioned goodbye to her favorite Chick-fil-A sandwich.

Nonetheless, Ms Ellis has typically turned to dangerous payday loans (short-term borrowing with excessive rates of interest) as she grapples with grocery costs which have surged 25% since Mr Biden entered workplace in January 2021.

“Previous to inflation,” she says, “I did not have any debt, I did not have any bank cards, by no means utilized for like a payday mortgage or any of these issues. However since inflation, I wanted to do all these issues….I’ve needed to downgrade my life fully.”

The leap in grocery costs has outpaced the historic 20% rise in dwelling prices that adopted the pandemic, squeezing households across the nation and fuelling widespread financial and political discontent.

“I’m a Democrat,” says Ms Ellis, who lives within the Philadelphia suburb of Norristown. “I like voting for them. However Republicans are talking volumes proper now and Democrats are whispering.”

“I would like someone to assist me, assist the American folks,” she provides. “Joe Biden, the place are you?”

For the president, already contending with severe doubts about his age and health for one more time period, the cost-of-living difficulty presents a significant problem, threatening to dampen turnout amongst supporters in an election that may very well be determined, just like the final two, by a number of tens of 1000’s of votes in a handful key states.

Getty Pictures

Getty PicturesThroughout the nation, Individuals on common spent greater than 11% of their incomes on meals, together with restaurant meals final 12 months – a better proportion than any time since 1991.

The bounce in meals costs has hit youthful, lower-income and minority households – key elements of the coalition that helped Mr Biden win the White Home in 2020 – particularly arduous.

However worries in regards to the difficulty are widespread: a Pew survey earlier this 12 months discovered that 94% of Individuals had been a minimum of considerably involved about rising meals and client items costs.

That was almost similar to 2 years earlier, despite the fact that the staggering jumps in meals costs that hit the US and different international locations after Russia’s 2022 invasion of Ukraine have subsided.

Dylan Garcia, a 26-year-old safety guard from Brooklyn, says he’s by no means struggled to purchase groceries as a lot as he has now.

As an alternative of the recent meals and brand-name gadgets he used to take pleasure in, he now shares up on ramen noodles and frozen greens – and solely eats twice a day as a result of he cannot afford extra.

At checkout, he routinely makes use of “purchase now, pay later” schemes, which permit him to pay the invoice in installments, however have led to mounting debt.

“I’m caught in a loop,” he says. “It’s turn into an insecurity to drag up my cellphone on the register and have to make use of these programmes. After they see me, it’s embarrassing.”

Mr Garcia, who has lengthy voted for Democrats, says his precarious monetary scenario has made him lose hope in politics and he doesn’t plan to vote in November’s election.

“I don’t suppose the federal government has our greatest curiosity and I don’t suppose they care,” he says.

John Wirick

John WirickThe White Home maintains Mr Biden has been engaged on problems with meals affordability, preventing to extend meals stamp advantages and different authorities help, initiatives opposed by Republicans.

Finally month’s presidential debate, the primary query was on inflation, and Mr Biden sought to shift blame to large firms, accusing them of value gouging – a declare that’s hotly disputed amongst economists.

However regardless of robust job creation and low unemployment, opinion polls present voters proceed to belief Mr Biden’s opponent, former President Donald Trump, extra on financial points.

On the CNN debate stage, the Republican White Home candidate blamed Mr Biden for stoking inflation, which the White Home denies, and mentioned: “It is killing folks. They cannot purchase groceries anymore. They’ll’t.”

The Trump marketing campaign in flip denies that insurance policies he proposes – together with a ten% tariff on all items coming into the US – would worsen value rises, as many analysts predict.

“We imagine {that a} second Trump time period would have a adverse impression on the US’s financial standing on the earth, and a destabilizing impact on the US’s home financial system,” wrote 16 Nobel prize-winning economists in an open letter final month.

Republicans have accused Mr Biden of making an attempt to mislead the general public in regards to the extent of the inflation downside, noting that Mr Biden has claimed, incorrectly, that inflation was already at 9% when he entered workplace. It was 1.4%.

Katie Walsh, a make-up artist in Pennsylvania, voted for Trump in 2020 and says she plans to take action once more, based mostly on his financial file.

The 39-year-old says her household has struggled to maintain up with inflation, particularly since her enterprise has slowed, as folks squeezed by increased costs reduce.

“I do know he is a giant fats mouth,” she says of Mr Trump. “However he a minimum of is aware of tips on how to run the financial system.”

handout

handoutAnalysts say it’s clear that the financial system is essential to voters, however much less clear it is going to show decisive within the November election.

In 2022, when inflation was at its worst, Democrats did higher than anticipated in mid-term elections, as issues about abortion entry drove supporters to the polls.

This time round, points comparable to immigration and health for workplace are additionally high of many citizens’ minds, whereas financial developments seem like shifting in the suitable course.

Grocery costs had been up simply 1% over the previous 12 months, properly inside historic norms; and the price of just a few gadgets, together with rice, fish, apples, potatoes, and milk, has even come down a bit.

As main chains comparable to Goal, Amazon and Walmart announce value cuts in latest weeks, there are indicators the scenario may proceed to enhance.

Some analysts additionally count on wages, which have elevated however trailed the leap in total costs, to lastly catch up this 12 months, offering additional aid.

“We’re heading in the right direction,” says Sarah Foster, who follows the financial system for Bankrate.com. “Wage progress has slowed, value progress has slowed however, you already know, costs are slowing at a a lot quicker price than wages.”

Stephen Lemelin, a 49-year-old father of two from Michigan, one other electoral battleground, says he was pleasantly stunned by decrease costs on a latest grocery store journey.

No matter his issues in regards to the financial system, the navy veteran says his help for Mr Biden, who bought his vote in 2020, has by no means been unsure, provided that he sees Trump as a menace to democracy.

“No person likes excessive rates of interest or excessive inflation however that’s not below presidential management,” he says. “If you already know politics, there’s actually just one alternative.”

Extra on the election