US Financial institution just lately introduced the US Bank Smartly Visa Signature Card, a brand new rewards bank card that gives as much as 4% money again on all purchases, in case you have sufficient qualifying balances with them. That is the most recent entrant to relationship banking, the place banks gives you further perks for combining a number of account sorts with them like financial savings accounts and funding/retirement accounts.

The cardboard shouldn’t be open to purposes but, however you will get on an e-mail waitlist. Listed below are the small print of how that “as much as 4% money again” breaks down in keeping with this US Bank press release and CNBC article.

Base rewards of two% money again on all purchases, with no restrict. Technically, this card earns 2 factors per $1 spent in eligible web purchases. So as get 2% money again, it’s essential to redeem these factors into an eligible U.S. Financial institution checking or financial savings account.

Bonus rewards of 0.5%, 1% or 2% money again based mostly in your qualifying mixed balances at US Financial institution. You should even have an open Financial institution Neatly Financial savings account. Your qualifying mixed balances with U.S. Financial institution embrace “open shopper checking account(s), cash market financial savings account(s), financial savings account(s), CDs and/or IRAs, U.S. Bancorp Investments and private belief account(s).” Enterprise accounts, business accounts, and the Trustee solely (IFI) consumer relationship don’t qualify.

- $5,000 – $49,999.99 earns 2.5% complete money again. Whole of two.5 Factors per $1 (a base of two Factors plus the Neatly Incomes Bonus of 0.5 Factors),

- $50,000 – $99,999.99 earns 3% complete money again. Whole of three Factors per $1 (a base of two Factors plus the Neatly Incomes Bonus of 1 Level).

- $100,000+ earns 4% complete money again. Whole of 4 Factors per $1 (a base of two Factors plus the Neatly Incomes Bonus of two Factors).

Different bits: CNBC article reviews no annual payment. Factors will expire if there isn’t any reward, buy, or steadiness exercise in your account for 12 consecutive assertion cycles. Financial institution Neatly Credit score Card and Financial institution Neatly Financial savings out there in all 50 states.

Financial institution Neatly financial savings account. Let’s take a more in-depth take a look at the Bank Smartly Savings account, which additionally earns distinction charges based mostly on each your steadiness contained in the Neatly financial savings account itself AND your qualifying mixed balances at US Financial institution. Right here’s their current interest rate grid, up to date as of 9/3/2024.

Importantly, these charges can change at any time. However proper now, in case you have no less than $25k in Neatly and $25k in mixed qualifying mixed balances throughout US Financial institution, you will get the present prime price of 4.10% APY.

There’s additionally a $5 month-to-month upkeep payment, which is waived in case you have a Financial institution Neatly® Checking account (or Protected Debit account which additionally prices $4.95 a month). The Bank Smartly® Checking account itself has a $6.95 month-to-month payment, waived with $1,500+ common account steadiness, qualifying U.S. Financial institution shopper bank card, or mixed month-to-month direct deposits totaling $1,000+.

Due to this fact, technically when you get this bank card, that will make the Financial institution Neatly Checking account free, which in flip would make the Financial institution Neatly Financial savings account free. Proper now there’s additionally a $450 bonus for brand spanking new Financial institution Neatly Checking clients with a direct deposit requirement.

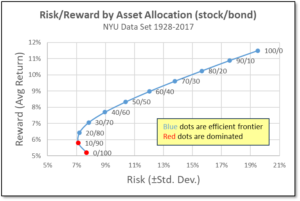

Tough alternative prices with depositing money at Financial institution Neatly Financial savings. Let’s strive some tough theoretical numbers. Let’s say you even have $100,000 in money mendacity round, however you could possibly get ~5.10% APY elsewhere and so you’d be giving up ~1% APY to park your cash at US Financial institution as a substitute. Should you held all of it at Financial institution Neatly Financial savings to qualify for the 4% money again on the bank card, you’d be giving up $1,000 in taxable curiosity every year ($100,000 x 1%).

In change, you might be getting 2% further money again over your current, flat 2% money again card. Money again rewards are typically thought-about non-taxable as they’re a rebate in your buy. Should you assume a marginal tax price of 0% (that is only a guess), then you definately’d want $50,000 in annual purchases ($4,166 a month) at 2% further money again to interrupt even with the hit from the decrease curiosity. Should you assume a marginal tax price of twenty-two%, then you definately’d want rather less: $39,000 in annual purchases ($3,350 a month) at 2% further money again to interrupt even with the hit from the decrease curiosity.

US Financial institution self-directed investments accounts! As with the Financial institution of America Most popular Rewards program, another strategy to fulfill the steadiness necessities with minimal alternative prices is to switch over current belongings right into a self-directed US Bank brokerage account. For instance, you could possibly switch over $100,000 in index ETFs inside an IRA or taxable brokerage account. This would seem to completely fulfill the necessities as a “U.S. Bancorp Investments” account. This fashion, US Financial institution additionally will get a stronger foothold on the earth of wealth administration, as all of the banks appear to need nowadays.

Watch out although, as US Financial institution’s self-directed brokerage account has a barely higher fee schedule than a lot of the competitors. Inventory trades are $4.95 every, though you get 100 free trades per calendar yr in case you have each a Financial institution Neatly Checking account and paperless statements. There’s a $50 annual account payment and a separate $50 annual IRA payment; these are waived in case you have $250,000 in mixed assertion family balances.

My fast take. If all of those particulars really maintain by means of launch, they might be a big enchancment over the most effective present state of affairs of two.62% money again on all purchases by way of the Financial institution of America Most popular Rewards program and a BofA cash back credit card. (The Robinhood 3% bank card remains to be “coming quickly”.) However will it final? Even the BofA 2.62% has remained one thing of an outlier, however my hunch is that it has inspired sufficient of individuals to maintain a ton of money at BofA incomes zero curiosity in order that BofA remains to be blissful general. On condition that this new US Financial institution program really gives a good rate of interest and an excellent increased money again price, I’m involved about its longevity. However, possibly that is US Financial institution’s huge push to develop into a serious participant on the nationwide stage of Financial institution of America or Chase.

I’d should open a number of new accounts to go for this one. Financial savings account, brokerage account, bank card, transfer over belongings, all for a bonus that’s based mostly on my bank card spend so will trickle in slowly. (None of those have a giant upfront bonus.) Given the quantity of shady stuff US Financial institution will most likely should cope with when paying 4% money again, I’d should belief that it’s going to final lengthy sufficient to be well worth the effort.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/smartlycc_gif.gif)