Analysts’ rankings for Martin Marietta Supplies (NYSE:MLM) over the past quarter fluctuate from bullish to bearish, as supplied by 4 analysts.

Within the desk under, you may discover a abstract of their current rankings, revealing the shifting sentiments over the previous 30 days and evaluating them to the earlier months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Scores | 4 | 0 | 0 | 0 | 0 |

| Final 30D | 1 | 0 | 0 | 0 | 0 |

| 1M In the past | 0 | 0 | 0 | 0 | 0 |

| 2M In the past | 0 | 0 | 0 | 0 | 0 |

| 3M In the past | 3 | 0 | 0 | 0 | 0 |

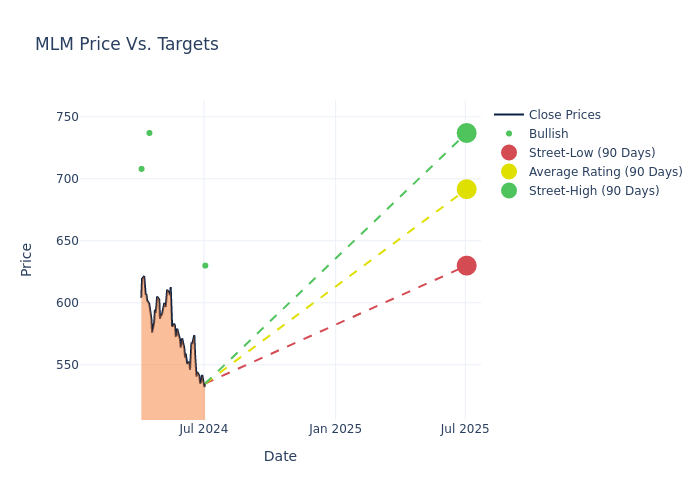

Analysts’ evaluations of 12-month value targets supply further insights, showcasing a median goal of $681.25, with a excessive estimate of $737.00 and a low estimate of $630.00. Observing a 6.95% enhance, the present common has risen from the earlier common value goal of $637.00.

Understanding Analyst Scores: A Complete Breakdown

The standing of Martin Marietta Supplies amongst monetary consultants is revealed by means of an in-depth exploration of current analyst actions. The abstract under outlines key analysts, their current evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| Stanley Elliott | Stifel | Lowers | Purchase | $630.00 | $650.00 |

| Jerry Revich | Goldman Sachs | Raises | Purchase | $737.00 | $642.00 |

| Stanley Elliott | Stifel | Raises | Purchase | $650.00 | $621.00 |

| Anthony Pettinari | Citigroup | Raises | Purchase | $708.00 | $635.00 |

Key Insights:

- Motion Taken: Analysts reply to adjustments in market circumstances and firm efficiency, often updating their suggestions. Whether or not they ‘Preserve’, ‘Elevate’ or ‘Decrease’ their stance, it displays their response to current developments associated to Martin Marietta Supplies. This data affords a snapshot of how analysts understand the present state of the corporate.

- Score: Analyzing developments, analysts supply qualitative evaluations, starting from ‘Outperform’ to ‘Underperform’. These rankings convey expectations for the relative efficiency of Martin Marietta Supplies in comparison with the broader market.

- Worth Targets: Understanding forecasts, analysts supply estimates for Martin Marietta Supplies’s future worth. Analyzing the present and prior targets supplies perception into analysts’ altering expectations.

For precious insights into Martin Marietta Supplies’s market efficiency, contemplate these analyst evaluations alongside essential monetary indicators. Keep well-informed and make prudent choices utilizing our Scores Desk.

Keep updated on Martin Marietta Supplies analyst rankings.

Get to Know Martin Marietta Supplies Higher

Martin Marietta Supplies is likely one of the United States’ largest producer of building aggregates (crushed stone, sand, and gravel). In 2023, Martin Marietta offered 199 million tons of aggregates. Martin Marietta’s most necessary markets embody Texas, Colorado, North Carolina, Georgia, and Florida, accounting for many of its gross sales. The corporate additionally produces cement in Texas and makes use of its aggregates in its asphalt and ready-mixed concrete companies. Martin’s magnesia specialties enterprise produces magnesia-based chemical merchandise and dolomitic lime.

A Deep Dive into Martin Marietta Supplies’s Financials

Market Capitalization: Exceeding trade requirements, the corporate’s market capitalization locations it above trade common in measurement relative to friends. This emphasizes its vital scale and strong market place.

Income Challenges: Martin Marietta Supplies’s income development over 3 months confronted difficulties. As of 31 March, 2024, the corporate skilled a decline of roughly -7.61%. This means a lower in top-line earnings. When in comparison with others within the Supplies sector, the corporate faces challenges, attaining a development charge decrease than the typical amongst friends.

Web Margin: The corporate’s internet margin is a standout performer, exceeding trade averages. With a formidable internet margin of 83.53%, the corporate showcases sturdy profitability and efficient value management.

Return on Fairness (ROE): Martin Marietta Supplies’s ROE surpasses trade requirements, highlighting the corporate’s distinctive monetary efficiency. With a formidable 12.36% ROE, the corporate successfully makes use of shareholder fairness capital.

Return on Belongings (ROA): Martin Marietta Supplies’s ROA stands out, surpassing trade averages. With a formidable ROA of 6.66%, the corporate demonstrates efficient utilization of belongings and robust monetary efficiency.

Debt Administration: The corporate maintains a balanced debt strategy with a debt-to-equity ratio under trade norms, standing at 0.53.

Understanding the Relevance of Analyst Scores

Scores come from analysts, or specialists inside banking and monetary methods that report for particular shares or outlined sectors (sometimes as soon as per quarter for every inventory). Analysts normally derive their data from firm convention calls and conferences, monetary statements, and conversations with necessary insiders to succeed in their choices.

Analysts might complement their rankings with predictions for metrics like development estimates, earnings, and income, providing buyers a extra complete outlook. Nonetheless, buyers ought to be aware that analysts, like several human, can have subjective views influencing their forecasts.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/1720053437_analyst_ratings_image_4.png)