The Biden-Harris administration within the U.S. weaponized the IRS to confiscate employees’ tip cash.

In August 2024, former U.S. President Donald Trump’s marketing campaign launched a TV advertisement claiming, “Information studies verify Biden and Harris have weaponized the Inner Income Service (IRS) to confiscate your tip cash. Harris and Biden have actually unleashed the IRS to harass employees who obtain ideas, and so they simply could also be coming to your home subsequent.”

The advert confirmed actors in fits carrying sun shades — an obvious depiction of IRS brokers — invading an American residence to seek for free money.

As its proof, the marketing campaign advert’s onscreen textual content cited a number of sources, for instance a Feb. 8, 2023, article from the Daily Mail tabloid — an internet site as soon as banned by Wikipedia’s editors from getting used as a supply for its lack of reliability. To additional try to help its major claims, the advert additionally talked about a Feb. 10, 2023, article from the libertarian journal web site Reason.com and an Aug. 13, 2024, article from the politically conservative group Americans for Tax Reform.

The marketing campaign advert performed on a rumor claiming that President Joe Biden’s Inflation Discount Act of 2022 talked about the enforcement of totally reporting taxes on ideas. Extra broadly, the rumor claimed the laws — for which Vice President Kamala Harris forged the tie-breaking vote — benefited efforts for the IRS to particularly “go after” individuals who depend upon ideas, similar to restaurant servers, offering $80 billion in funding to rent 87,000 new IRS brokers for enforcement of the center class.

Nevertheless, the claims promoted by the Trump marketing campaign advert — like others surfacing weeks earlier than the November 2024 election — supposed to each mislead and strike worry into voters, all based mostly on a whole misrepresentation of the info.

In sum, the Inflation Discount Act didn’t point out taxes on ideas. The declare that the IRS deliberate to spend $80 billion in funding to rent 87,000 new brokers for enforcement to “come after” and audit middle-class Individuals was false, as we beforehand reported greater than two years in the past. Additional, as we’ll clarify on this story, the a part of this general rumor pertaining to a “new service {industry} tip reporting program,” identified by the acronym “SITCA,” utterly lacked context.

How This Rumor Began

The problem of taxes on ideas emerged as a sizzling matter of debate within the weeks forward of the November 2024 presidential election, after former President Donald Trump first mentioned the thought of not taxing ideas, adopted by Vice President Kamala Harris endorsing the thought for her personal marketing campaign.

In a single on-line instance of the rumor at hand on this reality verify, a consumer on X posted (archived) on Aug. 13, “Remember: Kamala Harris was the tie breaking vote on the Inflation Discount Act which put taxes on ideas and employed 87,000 IRS brokers to go after the center and decrease class to get the cash.”

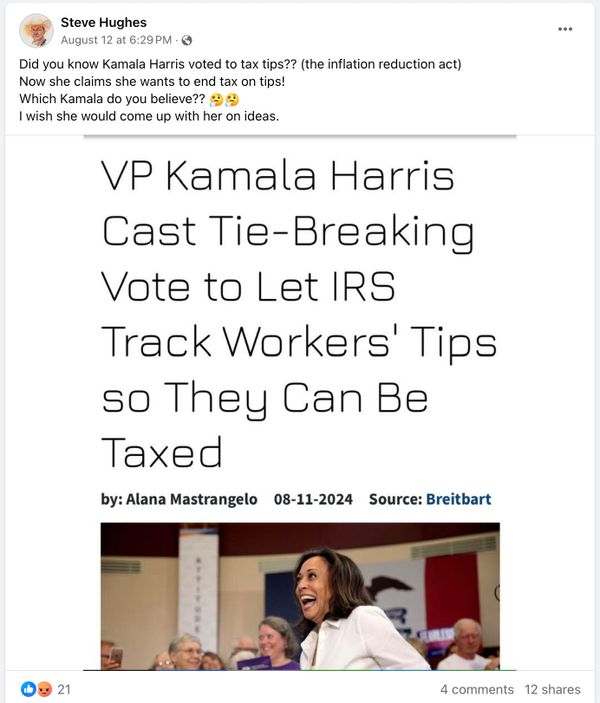

Some Facebook posts mentioning the rumor additionally shared a screenshot of an article revealed by the conservative information web site Breitbart.com on Aug. 11. The headline of the Breitbart story learn, “VP Kamala Harris Solid Tie-Breaking Vote to Let IRS Observe Staff’ Ideas So They Can Be Taxed.” An alternate headline equally stated, “Kamala Harris Voted to Move Laws Permitting IRS to Observe Staff’ Ideas So They Can Be Taxed.”

The Breitbart article gave the impression to be the originating cause why some or all the different on-line customers created their posts within the days and weeks that adopted, in addition to the attainable inspiration for the Trump advert, seeing because the marketing campaign launched the advert days later.

The Breitbart article started, “Harris forged the tie-breaking vote to cross the Inflation Discount Act that offered $80 billion in extra funding to the Inner Income Service (IRS), which then set to work cracking down on the service {industry}’s reporting of ideas in order that they might be taxed.” The Breitbart story then tied that info to a February 2023 IRS proposal for a “new service {industry} tip reporting program” named SITCA — a voluntary program that the Tampa Bay Times later reported on Aug. 28, 2024, didn’t find yourself being carried out. The Breitbart story revealed days earlier didn’t inform readers of this system’s defunct standing.

The Inflation Discount Act Does Not Point out Ideas

Whereas Harris did forged the tie-breaking vote for the Inflation Discount Act, the laws — which can be read in full here — didn’t as soon as point out ideas. It did, nonetheless, function a quick space labeled “Funding the Inner Income Service and Enhancing Taxpayer Compliance.” That part’s identify learn, “Enhancement of Inner Income Service Assets.” (Readers can discover this part by utilizing a browser’s “discover” perform to look here for the textual content “SEC. 10301,” with out quotes.)

That part of the laws offered practically $80 billion to the IRS for a number of functions. As The Washington Post reported in August 2022, “Years of congressional underfunding of the IRS has left the company with out the assets to shortly course of returns, not to mention assess the advanced tax-avoidance methods of well-heeled people. So audit charges have fallen dramatically and extra taxpayers are presumed to be not paying what they owe.”

The laws allotted $45,637,400,000 of the practically $80 billion in funds for enforcement. The outline for the aim of the funds didn’t point out ideas however did be aware that the cash’s utilization spanned by way of 2031 and concerned quantities “along with quantities in any other case obtainable for such functions”:

For obligatory bills for tax enforcement actions of the Inner Income Service to find out and gather owed taxes, to offer authorized and litigation help, to conduct prison investigations (together with investigative know-how), to offer digital asset monitoring and compliance actions, to implement prison statutes associated to violations of inner income legal guidelines and different monetary crimes, to buy and rent passenger motor automobiles (31 U.S.C. 1343(b)), and to offer different providers as licensed by 5 U.S.C. 3109, at such charges as could also be decided by the Commissioner, $45,637,400,000, to stay obtainable till September 30, 2031: Supplied, That these quantities shall be along with quantities in any other case obtainable for such functions.

The False Rumor About 87,000 New IRS Brokers

Concerning the a part of the rumor mentioning the hiring of 87,000 new IRS brokers for enforcement functions, we beforehand reported in regards to the misrepresentative efforts from different customers who failed to inform the reality.

The individuals who promoted this misinformation sourced the “87,000” quantity from a Might 2021 report revealed by the U.S. Division of Treasury. That report specified the deliberate hiring of 86,852 new IRS workers by 2031. However as Time.com reported, most of these hires would not be IRS brokers devoted to tax enforcement, nor would all of them be new positions:

In accordance with a Treasury Division official, the funds would cowl a variety of positions together with IT technicians and taxpayer providers help employees, in addition to skilled auditors who can be largely tasked with cracking down on company and high-income tax evaders.

“It’s wholly inaccurate to explain any of those assets as being about rising audit scrutiny of the center class or small companies,” Natasha Sarin, a counselor for tax coverage and implementation on the Treasury Division, tells TIME.

On the similar time, greater than half of the company’s present workers are eligible for retirement and are anticipated to go away the company throughout the subsequent 5 years. “There is a massive wave of attrition that is coming and numerous these assets are nearly filling these positions,” says Sarin, an economist who has studied tax avoidance extensively and who was tapped by the Biden administration to beef up the IRS’s auditing energy.

In all, the IRS may web roughly 20,000 to 30,000 extra workers from the brand new funding, sufficient to revive the tax-collecting company’s employees to the place it was roughly a decade in the past.

The IRS’ SITCA Program for Reporting Ideas

The August 2024 Breitbart.com article featured a Feb. 8, 2023, post (archived) from podcaster Patrick Wager-David, by which Wager-David misleadingly tied the false rumor in regards to the hiring of 87,000 new IRS brokers for enforcement to the headline of an IRS website page for the Service Business Tip Compliance Settlement (SITCA) program, titled, “IRS introduces new service {industry} tip reporting program.” That web page displayed the date of Feb. 6, 2023.

This publish lacked context. In February 2023, the SITCA program existed as a proposal in search of “public feedback.” As with pre-existing packages, SITCA was introduced as voluntary. The IRS stated the brand new program featured purported advantages together with the advance of tip-reporting compliance, the lower of taxpayer and IRS administrative burdens, and “extra transparency and certainty” for taxpayers. Additional, the IRS said its intention with the SITCA proposal was to interchange three different packages involving taxes and ideas — which means a single program to deal with all wants. As soon as once more, although, the IRS did not implement the brand new program.

The Washington Post reported in late August 2024 an announcement from U.S. Division of Treasury spokesperson Ashley Schapitl, who stated, “Treasury and the IRS don’t have any plans to maneuver ahead with the voluntary program and, as such, there are not any new reporting or compliance elements.” She additionally added, “We proceed to fastidiously contemplate feedback obtained in response to the proposed steerage.” By electronic mail, Schapitl confirmed to Snopes her assertion’s authenticity.

As of September 2024, the IRS web site hosted another page titled, “Tip recordkeeping and reporting.” That web page listed different “voluntary tip compliance agreements” supposed to “improve tax compliance amongst tipped workers and their employers by way of taxpayer schooling.” Two of these packages — packages SITCA would have changed — had been in impact since 1993.

Sources

“2024 Trump ‘No Tax on Ideas’ Advert.” YouTube, The Jim Heath Channel, 23 Aug. 2024, https://www.youtube.com/watch?v=NYLXvhEkS9k.

Ahmed, Sofia. “Kamala Harris Did Not Vote for a Invoice That Would Tax Ideas.” PolitiFact, 15 Aug. 2024, https://www.politifact.com/factchecks/2024/aug/15/instagram-posts/no-kamala-harris-didnt-vote-in-2022-for-a-law-that/.

Cortellessa, Eric. “No, Biden Is Not Hiring 87,000 New IRS Brokers.” TIME, 10 Aug. 2022, https://time.com/6204928/irs-87000-agents-factcheck-biden/.

Decker, Casey. “No, the IRS Is Not Altering Tip Reporting Necessities to Crack down on Waiters.” VerifyThis.com, 6 Mar. 2023, https://www.verifythis.com/article/information/confirm/taxes-verify/irs-not-changing-tip-reporting-requirements-service-workers-waiters/536-a2623b7d-d3b8-4794-b4af-828ce164809b.

Durbin, Dee-Ann. “Why Trump’s and Harris’ Proposals to Finish Federal Taxes on Ideas Would Be Troublesome to Enact.” The Related Press, 13 Aug. 2024, https://apnews.com/article/harris-trump-tips-taxes-pay-workers-election-9ed6e049a53b1943471ce2b6479b9ffb.

“Employer-Designed Tip Reporting Program for the Meals and Beverage Business.” Inner Income Service, https://www.irs.gov/pub/irs-drop/n-00-21.pdf.

Goodnough, Abby, et al. “Well being Teams Denounce G.O.P. Invoice as Its Backers Scramble.” The New York Instances, 8 Mar. 2017. NYTimes.com, https://www.nytimes.com/2017/03/08/us/politics/affordable-care-act-obama-care-health.html.

“H.R.5376 – Inflation Discount Act of 2022.” Congress.gov, https://www.congress.gov/invoice/117th-congress/house-bill/5376/textual content.

Ibrahim, Nur. “Is IRS Hiring 87K New Brokers To Audit Center-Class Individuals?” Snopes, 11 Aug. 2022, https://www.snopes.com//fact-check/irs-87000-new-agents/.

“Inflation Discount Act Handed In Senate.” YouTube, MSNBC, 7 Aug. 2022, https://www.youtube.com/watch?v=rjmQxnaMlvo.

“Inner Income Bulletin: 2023-06.” Inner Income Service, 6 Feb. 2023, https://www.irs.gov/irb/2023-06_IRB.

“Inner Income Bulletin: 2023-6.” IRS.gov, 6 Feb. 2023, https://www.irs.gov/irb/2023-06_IRB#NOT-2023-13.

“IRS Introduces New Service Business Tip Reporting Program.” Inner Income Service, 6 Feb. 2023, https://www.irs.gov/newsroom/irs-introduces-new-service-industry-tip-reporting-program.

Jackson, Jasper. “Wikipedia Bans Every day Mail as ‘unreliable’ Supply.” The Guardian, 8 Feb. 2017, https://www.theguardian.com/know-how/2017/feb/08/wikipedia-bans-daily-mail-as-unreliable-source-for-website.

Kenton, Will. “What Is Tax Fairness and Fiscal Accountability Act of 1982 (TEFRA)?” Investopedia, https://www.investopedia.com/phrases/t/tefra.asp.

Kessler, Glenn. “Hyperbolic GOP Claims about IRS Brokers and Audits.” The Washington Put up, 11 Aug. 2022, https://www.washingtonpost.com/politics/2022/08/11/hyperbolic-gop-claims-about-irs-agents-audits/.

—. “Trump’s Advert Assaults Harris for a Tax Program That Does not Exist.” The Washington Put up, 26 Aug. 2024, https://www.washingtonpost.com/politics/2024/08/26/trump-tipped-workers-factcheck/.

Sherman, Amy. “Did Harris Vote to Rent 87,000 IRS Brokers to Go after Tipped Revenue, as Trump Says? | Truth Verify.” Tampa Bay Instances, 28 Aug. 2024, https://www.tampabay.com/information/florida-politics/2024/08/28/did-harris-vote-hire-87000-irs-agents-go-after-tipped-income-trump-says-fact-check/.

“The American Households Plan Tax Compliance Agenda.” U.S. Division of the Treasury, Might 2021, https://residence.treasury.gov/system/recordsdata/136/The-American-Households-Plan-Tax-Compliance-Agenda.pdf.

“Tip Recordkeeping and Reporting.” Inner Income Service, https://www.irs.gov/companies/small-businesses-self-employed/tip-recordkeeping-and-reporting.

Vigdor, Neil. “In Las Vegas, Trump Calls Harris a ‘Copycat’ Over ‘No Tax on Ideas’ Plan.” The New York Instances, 23 Aug. 2024, https://www.nytimes.com/2024/08/23/us/politics/trump-harris-no-tax-tips.html.