Late one afternoon in October 2023, because the solar slipped down over Tokyo Bay, Masayoshi Son was sitting in his personal workplace at SoftBank headquarters, on the head of a wood desk virtually so long as Vladimir Putin’s within the Kremlin. A diminutive, balding determine dressed casually in a jacket and slacks, Son was recounting to me the low level of his profession, a yr earlier, when he introduced he was disappearing from public view.

“What a shitty life!” he exclaimed, with a hint of self-pity. “You recognize on my Zoom name, I see my face typically on the video display and I hate my face. What an unsightly face. I’m simply getting outdated . . . What have I achieved? . . . I’ve performed nothing that I will be happy with.”

At face worth, it was an astonishing admission. Son, then 66, ranked among the many world’s most famous buyers. He invested in ecommerce giants Yahoo and Alibaba earlier than they turned family names. On the peak of the dotcom bubble in early 2000, he was briefly the richest man on the planet. When it burst, he misplaced 97 per cent of his fortune, round $70bn.

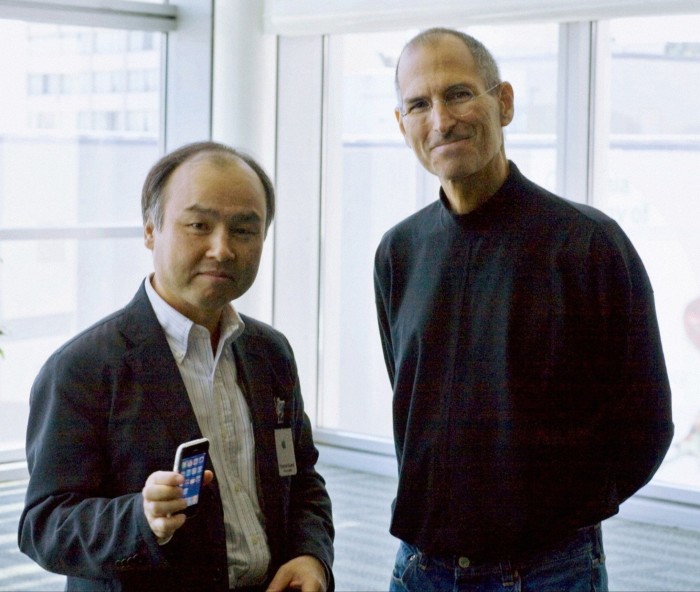

However he bounced again, launching a profitable broadband and cell phone enterprise in Japan, propelled by an unique deal to distribute Apple’s iPhone. Then he disrupted Silicon Valley with the $100bn SoftBank Imaginative and prescient Fund, and ended up making the most important swing and miss within the historical past of investing. (Therefore his short-term vanishing act.)

As editor of the Monetary Instances, I’d met Son twice and he intrigued me as a topic for a biography. A compulsive threat taker, his story was a traditional entrepreneur’s story of survival and perpetual reinvention. However was Son a tech visionary or just an inveterate gambler who received fortunate? Why was SoftBank, the corporate he based in 1981 as a pioneering software program distribution enterprise in Japan, so typically described as a home of playing cards?

Answering these questions proved harder than I anticipated. Twice I flew to Tokyo, solely to be told that the boss was too busy to see me. After I complained that my topic was extra elusive than a Bengal tiger, an ex-SoftBank govt, Indian by beginning, replied: “In that case, I counsel you convey a goat.”

In western media Son typically comes throughout as a cartoon character. He has in contrast himself to Yoda in Star Wars; Napoleon (of which extra later); and Jesus Christ (who was equally misunderstood, apparently). Obsessed by longevity, he has advised mates that he hopes to stay previous 120, and that SoftBank ought to be constructed to final 300 years.

After 4 sit-downs with Son, in addition to interviewing greater than 150 individuals who know or have labored with him, I’ve concluded there’s much more to this stressed character than meets the attention. Whereas Son didn’t invent, management or personal a breakthrough know-how, he’s the archetypal intermediary. He has ridden the technological wave which has created untold wealth and penetrated each nook of our society.

His is a narrative of our instances.

Masayoshi Son is a quintessential outsider. This will clarify his bottomless threat urge for food and his need to show himself, again and again. He was born in 1957 to poverty-stricken second-generation Korean immigrants on the island of Kyushu within the western Japanese archipelago. The household residence was the equal of a cowshed, one in every of dozens of makeshift dwellings on a plot of unregistered land close to the railway station.

Years later, Son confessed to a buddy that he suffered from a recurring dream, waking as much as the stench of pig faeces in his nostrils. His buddy advised him it wasn’t a nightmare however a childhood reminiscence. “We began on the backside of society,” Son advised me. “I didn’t even know what nationality I used to be.”

As Korean-Japanese, the Son household adopted custom and lived beneath a Japanese title, Yasumoto. (Son later persuaded the authorities to let him mix his Japanese first title and Korean surname — a notable breakthrough.) His father Mitsunori was a bootlegger on the age of 14, later diversifying into pig breeding, mortgage sharking and pachinko, a type of low-stakes playing that supplied a livelihood to Koreans shut out of the Japanese financial system.

In April 2023, Mitsunori, 87, sitting within the household residence adorned with images of his favoured second son, described how he rearranged the pins on his pachinko slot machines so that everyone on the town thought they have been a winner. His upfront losses have been eye-watering. Then he moved the pins again into place — and began making severe cash.

Watching his father, Son learnt learn how to hustle. However the boy’s ambitions went means past pachinko playing. He wished to flee Japan and a lifetime of discrimination. Aged 16, he introduced he wished to study English and research within the US. His household have been dismayed, however quickly relented.

Son’s six years in California, which included three years as a scholar on the College of California at Berkeley, have been a life-changing expertise. He noticed first-hand the PC revolution. He examine Microsoft’s Invoice Gates and Apple’s Steve Jobs. He additionally made his first fortune, growing a pocket speech synthesiser with the assistance of a workforce of UC Berkeley engineers led by Professor Forrest Mozer, a nuclear particle physicist.

I tracked down Professor Mozer, then aged 92, throughout a go to to Berkeley in October 2021. He described Son as a modest scholar with little technical background however a businessman with a capital B. “That man goes to personal Japan sooner or later,” he advised his spouse.

Later Mozer claimed that Son had gone behind his again and contracted with Japanese firms to promote American microchips (for the speech translator) that didn’t exist and for costs that he’d invented. He mentioned he was not advised Son was because of earn virtually $1mn in charges. “I used to be his first enterprise accomplice,” Mozer advised me, “and on his first enterprise deal he lied and cheated me.”

When questioned, Son rejected that, and insisted he had wrongly assumed he had permission to do what he did. (Mozer himself concedes there was no written contract between the 2, only a gentleman’s settlement.) Son unravelled the Japanese offers and vowed to take extra care in future. Maybe the episode marks Son’s “authentic sin”, a short-cut on the way in which to the highest that many entrepreneurs would recognise.

After his sojourn in California, Son returned residence. In 1980, Japan appeared destined to be the world’s number-one financial energy. Son was completely positioned to behave as a gateway for US tech companies looking for to penetrate the Japanese market.

Invoice Gates describes Son as a cultural interpreter as a lot as a business intermediary. “Everytime you’ve been three or 4 days in Japan, and have had nothing however well mannered issues to say to one another, invariably by means of an interpreter. . . then there’s this man who speaks excellent English. It was such a aid. Masa was straightforward to speak to. He was an insider however an outsider too.”

After software program distribution, Son pivoted to investing in internet-related enterprise, putting two spectacular bets: on Yahoo, which earned him a six-fold return ($3.5bn), and on Alibaba, which gave a 1,310-fold return ($97bn). Whereas he constructed a profitable Japanese affiliate, Yahoo Japan, he by no means took his eye off the US market.

Within the mid-Nineties, he acquired Las Vegas-based Comdex, then the number-one tech commerce truthful, the Ziff Davis laptop publishing empire and a bunch of dotcom properties. In 2013, he went one higher and acquired Dash, the lossmaking US telecoms operator, lastly pulling off a merger with T-Cellular that created a “third drive” alongside Verizon and AT&T.

All through, SoftBank took benefit of the virtually three a long time of close to zero rates of interest in Japan. Son borrowed cheaply to pay beneficiant costs for US property, elevating billions on the company bond market. “You don’t perceive,” he as soon as advised a fretting colleague, “in Japan, cash is free.”

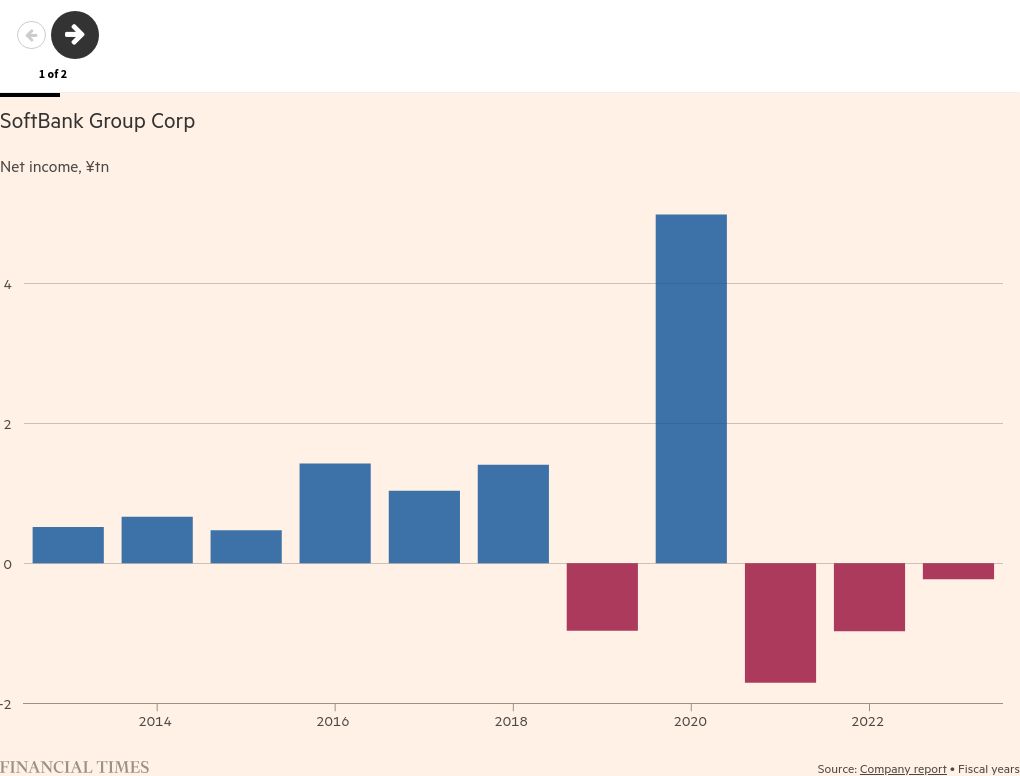

In assessing Son’s monitor report, it is very important distinguish between SoftBank Corp, the listed firm chargeable for the working firms, and SoftBank Group, the publicly quoted group holding firm and main investor.

Companies similar to Yahoo Japan and SoftBank Cellular have proved extremely profitable and worthwhile. The Dash acquisition, initially a dud, proved a winner after the T-Cellular merger. However Son has at all times cared extra about development than earnings. SoftBank Group has lengthy been extremely leveraged, that means it has numerous debt in its capital construction. At instances, it has ranked as one of many world’s prime 10 indebted firms — not a cushty place when inflation roared again in 2021.

Son is a significant shareholder and a significant borrower, utilizing his SoftBank shares as collateral. Threat is inbuilt. Suppose SoftBank shares fall sharply, decreasing the worth of the collateral, as has occurred many instances throughout Son’s wild experience. Then panicky banks would possibly demand the loans be repaid, destabilising your complete company construction.

Son bristles when challenged, emphasising that as a co-investor he has “pores and skin within the recreation” and subsequently an incentive to take a position responsibly. Nonetheless, some associates imagine SoftBank’s founder is “addicted” to leverage. They advised me he turned hooked after the $20bn bid in 2006 to purchase Vodafone Japan, the biggest leveraged buyout in Asia on the time. He succeeded because of a monetary magician by the title of Rajeev Misra, a former Deutsche Financial institution debt dealer whose reward was to be put in command of the $100bn SoftBank Imaginative and prescient Fund in 2017.

Misra was one in every of a number of proficient executives educated as mathematicians, who utilized their engineering abilities to finance relatively than academia. Over time, they lent a mercenary streak to SoftBank, stoking their boss’s urge for food for dealmaking.

To a point, the cultural shift was inevitable as SoftBank advanced from a Japanese know-how conglomerate to a worldwide funding group. However it was additionally a recipe for infighting on the prime, latterly between Misra and Marcelo Claure, a 6ft 6in Bolivian-American who led the Dash turnaround. Usually the spats performed out within the media. “They leaked like septic tanks,” says a SoftBank colleague.

Though Son adopts an abstemious public profile, his personal consumption is extra extravagant (albeit drawing on his personal cash relatively than the corporate’s). He pays for his personal airplane and his favorite purple wine (from Domaine de la Romanée-Conti, at a minimal $6,000 a bottle). He has intensive properties world wide, together with three conjoining homes in central Tokyo likened by one customer to Wayne Manor, fictional residence of Batman.

The basement options a synthetic golf course the place Son and visitors can play in all-weather circumstances on any course on the planet. One portion of the home is adorned within the Empire type, the interval between 1800 and 1815 when Napoleon modernised France and redrew the map of Europe. I found Son has a fascination with the Corsican Little Corporal, a fellow outsider.

In early 2020, a workforce from Elliott Administration, the New York activist investor, paid a go to to Japan. Having purchased a 3 per cent stake in SoftBank, their objective was to influence Son to enhance company governance, thereby boosting the share worth. When an Elliott govt invoked the instance of Mark Zuckerberg, Fb’s founder, or Invoice Gates of Microsoft, Son erupted in frustration.

“These are one-business guys. I’m concerned in 100 companies and I management your complete [tech] ecosystem,” he remonstrated. “The correct comparability for me is Napoleon, Genghis Khan or Emperor Qin [who built the Great Wall]. I’m not a CEO. I’m constructing an empire.”

Delusional? Not if you happen to imagine that Son is bent on “Making Japan Nice Once more”. After the collapse of the bubble financial system in 1989-90, Japan entered a “misplaced decade” characterised by deflation and tepid development. Son, the outlier, stays an object of suspicion among the many Japanese enterprise institution. He counters by enjoying the patriot, claiming he needs to revive the nation’s animal spirits. However his imaginative and prescient of a resurgent Japan incorporates a megalomaniacal streak.

When Son launched the $100bn SoftBank Imaginative and prescient Fund, an arms race on the planet of enterprise capital ensued, resulting in wholesale worth destruction. Doling out sums of between $100mn and $200mn would have meant Son assembly a whole lot of particular person founders to verify their credentials. Even along with his legendary stamina, working 20-hour days, typically flying on his personal jet by means of a number of time zones, that was a bodily impossibility.

Crucially, a lot bigger sums — $500mn or extra — have been required to maneuver the needle in a large fund just like the Imaginative and prescient Fund. The goal firms couldn’t be start-ups as such; they have been “later-stage” firms, turbocharged for development by the injection of SoftBank capital. One in all these firms was WeWork, based by Adam Neumann, a tall Israeli with a planet-sized ego.

Son was totally bought on Neumann, a fellow dreamer who spoke about world domination. When WeWork’s losses piled up, colleagues pleaded with Son to cease. The boss refused to budge.

“As you all object, I’m changing into increasingly on this firm,” he mentioned. “I’m Alibaba and solely he [Neumann] appears to be like like Alibaba in the present day.”

The preliminary Alibaba funding in 2000 — two bets of $20mn and $80mn — seems to have been a curse as a lot as a blessing. Desirous to show his success wasn’t a one-off, Son talked about creating 10 SoftBank Imaginative and prescient Funds with a complete warfare chest of $1tn {dollars}. These have been castles within the air — the stuff of hubris.

Those that know Son say he is a superb operator (when he focuses), a median investor and a horrible dealer. Between 2019-21, as markets turned down, Son suffered heavy losses on Imaginative and prescient Funds 1 and a pair of. He tried to get better by speculating wildly on choices buying and selling, utilizing an in-house hedge fund referred to as Northstar. SoftBank was left nursing multibillion-dollar losses.

For 18 months, he withdrew from public view, ostensibly serving penance however in actuality plotting a comeback. Right now, he’s betting the home on synthetic intelligence with the intention to reclaim his place as one of many world’s main entrepreneur futurists.

Thus far, his report is fitful at greatest. Between 2017 and 2022, he talked about “AI” greater than 500 instances in quarterly and annual outcomes displays. But when it got here to OpenAI and its breakthrough product ChatGPT, the lead investor was Microsoft. Son by no means received a glance in.

A part of the issue was timing. Within the Imaginative and prescient Fund years, AI companies have been both small scale, early in improvement or out of the general public eye. Through the Covid pandemic, Son was grounded in Tokyo. In early 2022, when journey restrictions have been lastly lifted, aside from China, SoftBank was sandbagged by report losses.

Had Son conserved his firepower relatively than splurging cash on greater than 500 separate firms within the Imaginative and prescient Funds, he would have been completely positioned. With firm valuations crushed down by larger rates of interest, Son might have acquired stakes in promising AI-related companies at cut price costs. In hindsight, he admits, “Timing-wise perhaps we have been somewhat too early.”

It’s a well-known story: proper instincts, incorrect timing. (If he’d held on to his 5 per cent stake in superior chipmaker Nvidia in 2019, he might have made one other fortune.) But one in every of Son’s AI bets has paid off handsomely. UK chip designer Arm — acquired in 2016 — is on the centre of yet one more super-vision: a $64bn plan to remodel SoftBank Group right into a sprawling AI powerhouse, together with a foray into the event of artificial-intelligence chips, introduced in Might. The objective is to construct a prototype by 2025, with every chip having the ability to course of huge volumes of information. This massively bold enterprise goals to create SoftBank Group’s personal vertically built-in AI ecosystem, from manufacturing chips and working information centres to industrial robots and energy era.

True, SoftBank can not contact the likes of Amazon, Google and Microsoft, however Son is a buyer and provider to the hyperscalers. His new chipmaking enterprise includes billions of {dollars} of funding. As soon as a mass-production system is established, the AI chip enterprise may very well be spun off, realising billions of {dollars} of worth to its guardian SoftBank.

How does this film finish? These betting on a monetary apocalypse have been disenchanted. Name Son fortunate, name SoftBank too large to fail. After 4 years learning the world’s biggest disrupter, my message is unequivocal.

Don’t ever rely him out.

‘Playing Man: The Wild Experience of Masayoshi Son’ by Lionel Barber is revealed by Allen Lane on October 3

Discover out about our newest tales first — comply with FT Weekend on Instagram and X, and subscribe to our podcast Life & Art wherever you hear