The investing data supplied on this web page is for academic functions solely. NerdWallet, Inc. doesn’t supply advisory or brokerage companies, nor does it suggest or advise traders to purchase or promote explicit shares, securities or different investments.

Giving cash to teenage youngsters may sound easy, however it could rapidly turn out to be sophisticated. Mother and father usually wish to set limits on how a lot their teenagers can spend, educate them about cash administration and defend them from fraud, all on the similar time.

“It’s about understanding your youngsters and tailoring the strategy just a little bit to the kid,” says Amy Spalding, a licensed monetary planner at District Capital Administration, a Washington, D.C.-based agency. Some youngsters want extra energetic assist to remain organized and learn to keep inside a funds, whereas others have to be inspired to apply spending in the actual world.

Listed here are some methods to contemplate when providing money to your teenager:

Begin with money

When youngsters are utilizing cash on their very own for the primary time, sticking with money will be the best means for them to learn to handle it, says Dan Tobias, a CFP and founding father of Passport Wealth Administration in Cornelius, North Carolina. “First, get them to know and admire cash with paper. Then, when it’s good to, you possibly can swap to digital strategies,” he says.

That’s the strategy he makes use of for his personal three youngsters. He provides them a money allowance and lets them resolve tips on how to spend it, which incorporates letting them make errors.

“Don’t be afraid to allow them to fail,” Tobias says. Youngsters may lose a $20 invoice, splurge on one thing that breaks the subsequent day or, in his case, purchase a fish and a tank that they quickly don’t need anymore. These errors are crucial instructing moments, he says, so it’s vital dad and mom don’t micromanage their youngsters’ spending.

Leverage acquainted apps

As soon as youngsters begin incomes and spending their very own cash with out you close by, digital funds turn out to be extra interesting. You need to use strategies you and your youngsters could already know, like Apple Pockets, Venmo or different apps already related to your cellphone. They’re usually related to a mother or father’s bank card or checking account, except a toddler already has their very own.

Sarah Behr, a monetary planner and proprietor of Simplify Monetary in San Francisco, says apps will be useful as a result of a mother or father can intently monitor a toddler’s spending and “preserve the guardrails up” whereas nonetheless giving them the liberty to make their very own spending selections.

If a teen overspends with out permission, that may result in a useful dialog about budgeting. On the similar time, dad and mom can discover methods to ensure their very own accounts are protected, by utilizing the apps to set spending limits or creating separate accounts with low balances and low credit score limits.

Spalding turned to digital fee apps when her youngsters began spending cash on their very own. She arrange a separate checking account with a low steadiness to restrict the potential injury if the account was compromised or a teen overspent.

Attempt paid merchandise for extra assist

Debit cards and apps designed for youths like Greenlight, GoHenry and BusyKid supply extra assist for households, comparable to permitting them to actively handle a funds and chores, however they usually include a price.

Greenlight, which prices between $5.99 and $14.98 a month, affords parental controls, the flexibility to assign chores and allowance automation, amongst different options. “Youngsters can perceive the larger image of cash administration” and in addition set financial savings objectives for themselves, says Jennifer Seitz, director of training at Greenlight.

Gregg Murset, a CFP and CEO of BusyKid, a debit card and chore app for youths, says the app helps dad and mom educate youngsters vital classes about monitoring cash, investing and giving to charity. “That’s what we do as adults — save, make investments and share — so we’re modeling actuality,” he says, including that youngsters ages 5 via 17 can use the app, which prices $4 a month.

Encourage financial savings

Whatever the methodology you select, saving cash needs to be a part of the dialog along with your youngsters, Spalding suggests. When her youngsters have been younger youngsters, she took them to a neighborhood financial institution to arrange a financial savings account so they might deposit cash they’d amassed from babysitting jobs and items. She says you could possibly additionally use a web based high-yield financial savings account to see the cash compound extra rapidly.

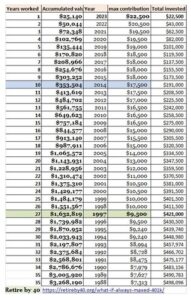

Investing in a Roth IRA could be a good subsequent step for kids incomes their very own cash. Behr supplied her daughter a financial savings match as much as the quantity she contributed to encourage her to avoid wasting extra for the long run. “I’m hoping the self-discipline of this train in delayed gratification sinks in,” she says. Teenagers can save as much as the quantity of their earned revenue with a restrict of $7,000 for 2024.

With that form of apply, saving for the long run may even turn out to be a lifelong behavior.

Get extra monetary readability with NerdWallet

Monitor your credit score, monitor your spending and see your entire funds collectively in a single place.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/GettyImages-1356940817-1440x864-1024x614.jpg)