Swiss Market Index Elliott Wave Evaluation (Day by day Chart).

Swiss Market Index Elliott Wave technical evaluation

Perform: Pattern.

Mode: Corrective.

Construction: Grey wave 2.

Place: Orange wave 3.

Course subsequent increased levels: Grey wave 3.

Particulars: Grey wave 2 of orange wave 3 is in play and looking out close to to finish. Wave cancel invalid stage: 11130.21.

The Swiss Market Index (SMI) is at the moment analyzed via Elliott Wave Principle on the every day chart. This evaluation identifies the operate as a pattern, indicating the market’s anticipated continuation in an general route. The pattern mode is corrective, suggesting a brief reversal or consolidation section somewhat than a robust impulsive transfer.

The construction underneath evaluation is grey wave 2, half of a bigger orange wave 3. In Elliott Wave terminology, wave 2 usually represents a corrective section that retraces some positive aspects or losses made in wave 1. The market’s present place inside this orange wave 3 signifies that after grey wave 2 completes, the market is anticipated to renew its main pattern in wave 3.

The route for the following increased levels is grey wave 3, suggesting that after grey wave 2 completes, the market will transfer into grey wave 3. This wave is often robust and impulsive, indicating a big transfer within the main pattern’s route.

Particulars of the evaluation present that grey wave 2 of orange wave 3 is at the moment in play and nearing its finish. This suggests that the corrective section of grey wave 2 is nearly full, and the market is making ready to transition into grey wave 3 of orange wave 3. This transition is anticipated to lead to a robust motion within the main pattern’s route.

The wave cancel invalid stage is about at 11130.21. This stage serves as a vital threshold; if the market strikes past this level, the present wave depend could be invalidated, necessitating a reassessment of the wave construction.

Abstract

The Swiss Market Index on the every day chart is in a corrective section inside grey wave 2 of orange wave 3, which is nearing completion. The market is anticipated to transition into grey wave 3, indicating a robust motion within the main pattern’s route. The wave cancel invalid stage is 11130.21, past which the present evaluation would must be reconsidered.

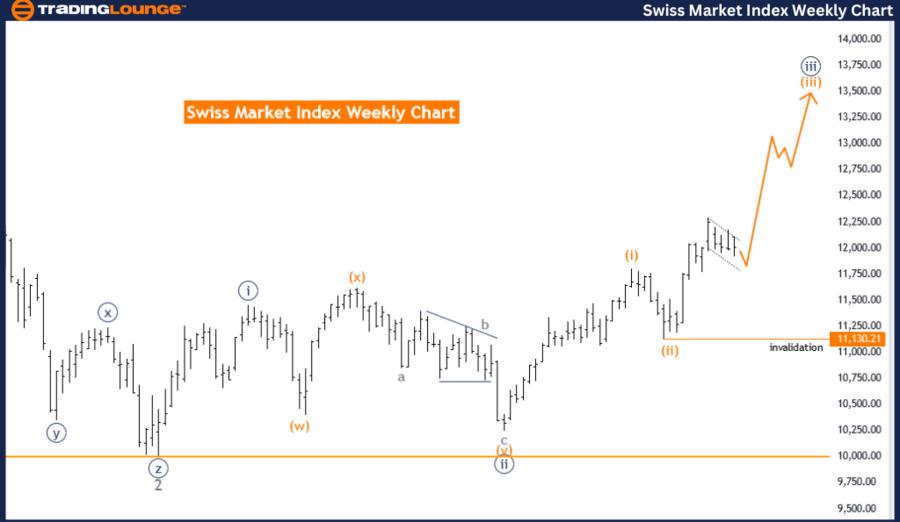

Swiss Market Index Elliott Wave evaluation – weekly chart

Perform: Pattern.

Mode: Impulsive.

Construction: Orange wave 3.

Place: Navy blue wave 3.

Course subsequent increased levels: Navy blue wave 3 (proceed).

Particulars: Orange wave 2 wanting accomplished, now orange wave 3 is in play. Wave cancel invalid stage: 11130.21.

The Swiss Market Index (SMI) is analyzed utilizing Elliott Wave Principle on the weekly chart. This evaluation identifies the operate as a pattern, indicating the market is anticipated to comply with a basic upward or downward trajectory. The pattern mode is impulsive, signifying a robust, directional motion available in the market.

The construction into account is orange wave 3, suggesting a big and highly effective motion as a part of the general wave sequence. At the moment, the market is positioned in navy blue wave 3, a vital section indicating continued momentum within the main pattern route.

The route for the following increased levels stays navy blue wave 3, suggesting that the market will preserve its robust, impulsive motion because it progresses additional inside navy blue wave 3.

Particulars of the evaluation reveal that orange wave 2 is now thought of full. With orange wave 2 concluded, orange wave 3 is at the moment in play. This transition marks a shift from a corrective section to a robust, impulsive section, indicating a strong continuation of the market pattern.

The wave cancel invalid stage is recognized at 11130.21. This stage acts as a vital threshold; if the market surpasses this level, the present wave depend could be invalidated, necessitating a re-evaluation of the wave construction.

Abstract

The Swiss Market Index on the weekly chart is in a robust, impulsive pattern inside orange wave 3, at the moment positioned in navy blue wave 3. With orange wave 2 accomplished, the market is now within the midst of orange wave 3, indicating a robust continuation of the first pattern. The wave cancel invalid stage is about at 11130.21, past which the present evaluation would must be reconsidered.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/swiss-flag-20552432_Large.jpg)