US tech giants are holding again the S&P 500 from hitting a report excessive, reversing the function the trade has occupied for the final 18 months as the principle pillar supporting the US blue-chip benchmark.

After a weak US jobs report jolted global markets at first of the month, the S&P has rapidly clawed again the majority of its losses. It was up 1 per cent on Friday, closing simply 21 factors in need of the report excessive set in mid-July.

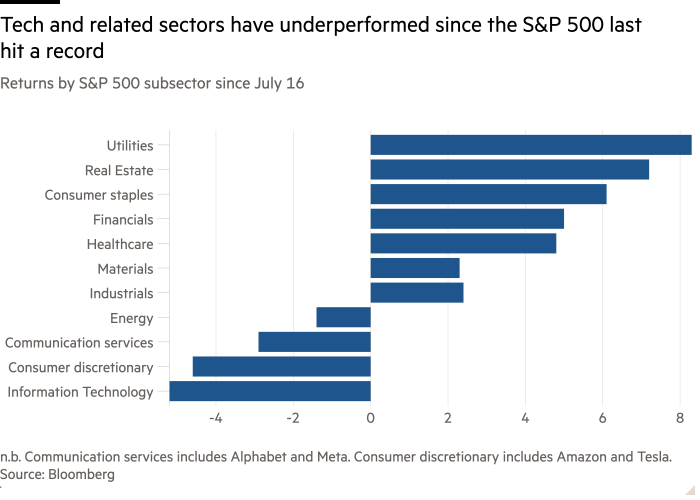

However it has struggled to make the ultimate push over that line, whilst nearly all of shares within the index have superior since coming inside touching distance of a brand new excessive greater than week in the past.

The shortcoming to recover from the hurdle is basically right down to the lowly efficiency of the Silicon Valley tech teams that had been in highest demand within the first half of the 12 months.

“It’s the reverse of what was taking place earlier,” stated Kevin Gordon, senior funding strategist at Schwab. “You’re being weighed down by a number of the mega-caps . . . [and] it wouldn’t shock me to see that dynamic proceed.”

Virtually 70 per cent of firms within the S&P 500 have risen for the reason that index peaked on July 16, in accordance with Bloomberg information. If each firm within the S&P had been weighted equally, the index would have been again at a report by August 23.

However tech and communication companies have an outsized weighting on the S&P, accounting for round 40 per cent of the full, even with Amazon and Tesla categorised as client teams.

As an alternative, their sluggish returns since July are turning into an anchor. Sixteen of the 20 greatest drags on the S&P 500 since its final report had been tech teams, led decrease by six of the so-called “Magnificent Seven” — Microsoft, Amazon, Alphabet, Tesla, Apple and Nvidia.

The exception is Meta, which has risen since mid-July however remains to be down 4 per cent from its peak. Chipmakers and their suppliers like Broadcom, Qualcomm, AMD and Utilized Supplies had been among the many different main drags.

Their leaden returns since July stand in sharp distinction to 2023 and the primary half of this 12 months, when enthusiasm over the potential of synthetic intelligence fuelled an enormous rally in semiconductor shares and different giant tech teams predicted to be early AI beneficiaries.

For many of them, there was no sudden downturn in company efficiency, however the extent of the rally had prompted widespread debate over whether or not inventory costs had been just too excessive.

Bloomberg’s Magnificent Seven index has fallen 10 per cent from its early July peak, however the decline has been even steeper on a worth to earnings foundation. It was this week buying and selling at round 33 instances anticipated earnings over the following 12 months, nonetheless greater than the broader S&P 500 however down 13 per cent for the reason that peak.

Traders have been holding massive tech teams to a excessive normal in the course of the newest quarterly earnings season, with a lot of them punished even after publishing robust outcomes.

Nvidia, which single-handedly drove greater than 1 / 4 of the S&P’s advance within the first half, fell 6 per cent on Thursday despite reporting stronger than forecast results. Alphabet and Microsoft had equally damaging responses to stable outcomes.

In distinction, the equal-weighted S&P 500 is buying and selling at its most costly stage since February on a price-to-earnings foundation. Smaller firms and extra cyclical sectors have been boosted by reassuring financial information, constructive earnings experiences and inspiring feedback from Federal Reserve chair Jay Powell, who declared on the annual Jackson Gap financial symposium that “the time has come” for the US central financial institution to start slicing rates of interest.

“One of many greater themes over the following 12 months goes to be a broadening of the market,” stated Francis Gannon, co-chief funding officer at Royce Funding Companions, which specialises in small-cap investing. “It often begins in matches and begins . . . however I feel we’re on our means.”

The Russell 2000 index of smaller firms is up 8 per cent to date this quarter, in contrast with a 3 per cent improve within the S&P 500. Inside the S&P 500, the best-performing areas have been rate-sensitive sectors like actual property, utilities and financials.

The controversy over tech remains to be removed from settled, nevertheless. Schwab’s Gordon stated many buyers had develop into “exhausted” by the AI commerce, however pressured that even after a “mandatory and comprehensible catch-up” for different sectors, tech was nonetheless by far the best-performing sector of the 12 months thus far.

And regardless of the latest resilient information, US financial progress remains to be slowing, which may put stress on the remainder of the market later within the 12 months.

“There may be extra draw back danger,” stated Drew Matus, chief market strategist at MetLife Funding Administration, highlighting falling client financial savings and rising unemployment. “And if the Fed cuts as aggressively because the market is at present pricing in, [it would mean] nothing good is occurring within the economic system.”

Sebastien Web page, head of worldwide multi-asset and chief funding officer at T Rowe Value, stated “we’re having extra debates between the bulls and bears than we often do in our committee.

“Charges are coming down and earnings are powering via this slower financial setting . . . [but] we’re again to pretty costly markets.”

Web page stated that within the brief time period his division’s funds had been positioned for an extra outperformance in worth shares, however stated “we nonetheless like plenty of the massive tech firms” and will swap if tech turns into oversold.

“Expectations are very excessive for know-how, however it isn’t the tech bubble,” he added.

For a lot of lively buyers, a broadening out of beneficial properties away from the biggest names can be a welcome change, even when it made it much less more likely to see massive rises on the stage of the headline index.

For true believers within the potential of AI, nevertheless, a slight pullback has not shaken their religion.

“We’ve got all this dialogue about ‘bubble bubble bubble’, [but] valuations are nothing like they had been in 2000 and even 2021,” stated Tony Kim, head of know-how investing in BlackRock’s basic equities division.

“We’re within the second 12 months of an entire replatforming of the entire tech trade to this new factor referred to as AI, and I feel we’ve barely began.”