prioritarian wrote: ↑Mon Aug 26, 2024 9:21 pmWhich market? The Dow 30, S&P 500, Russell 2000, or Wilshire 5000 (and lots of microcaps aren’t mirrored within the Wilshire).

I am going to assume you meant “Russell 3000?” These aren’t “markets,” they’re market indexes that attempt to mirror “the” inventory market (which is admittedly a slippery idea in itself). The Dow is actually solely a couple of quarter of the market by cap weight so I believe we are able to ignore it. The S&P 500 was supposed to be one of the best approximation to the entire market that may very well be realized in 1957 with obtainable computing energy, and is round 80% of the market.

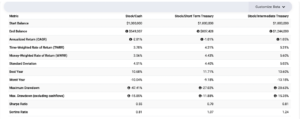

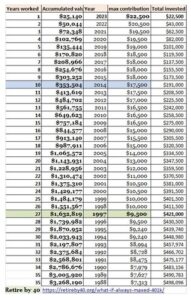

Past that, the entire “trendy” whole market indexes, judging from suppliers’ statements after they make them, handle to incorporate over 98% of the market. It would not matter which you employ, as a result of the collective measurement of the variations, measured in capitalization, is so small. We are able to see this each in overlap and in real-world efficiency. For instance–there are not any Wilshire 5000 ETFs–IWV, Russell 3000, versus VTI, CRSP Complete Inventory Market:

And in real-world precise efficiency:

For the “fundamentalism” I each agree and disagree with you. Small to medium departures from market cap weighting do not make a lot distinction, and it is principally a crapshoot whether or not the result’s outperformance or underperformance. There’s a huge swarm of funds, ETFs, indexes, and methods for which I personally imagine “you simply cannot inform if they are going to be higher or worse than a complete market index fund going ahead.” Subsequently, Bogleheads together with me are inclined to get on a head of steam and indignation over what we expect are phony claims, and other people taking cash below false pretenses, even when the quantities concerned are fairly small and would not make a distinction in retirement financial savings success.

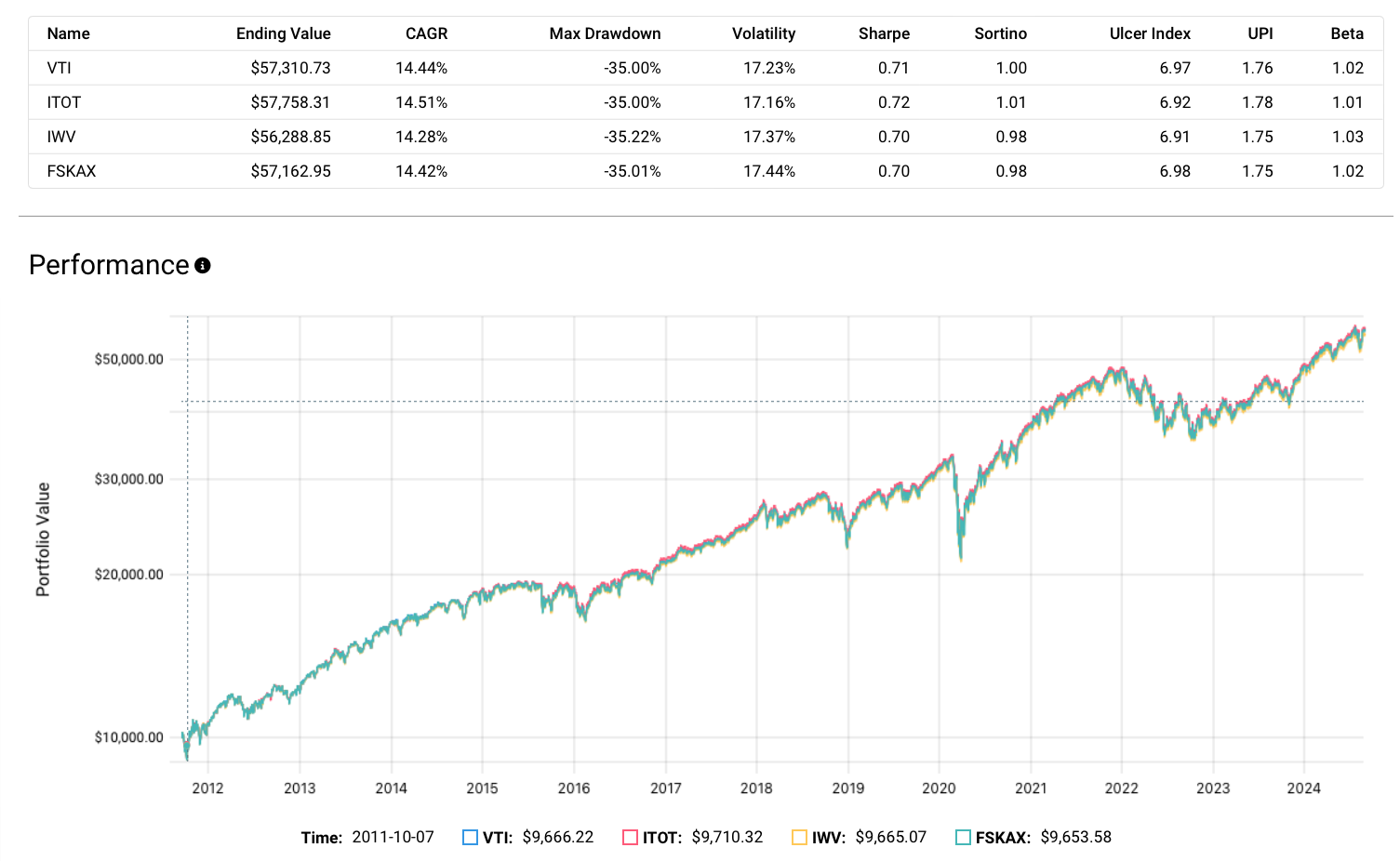

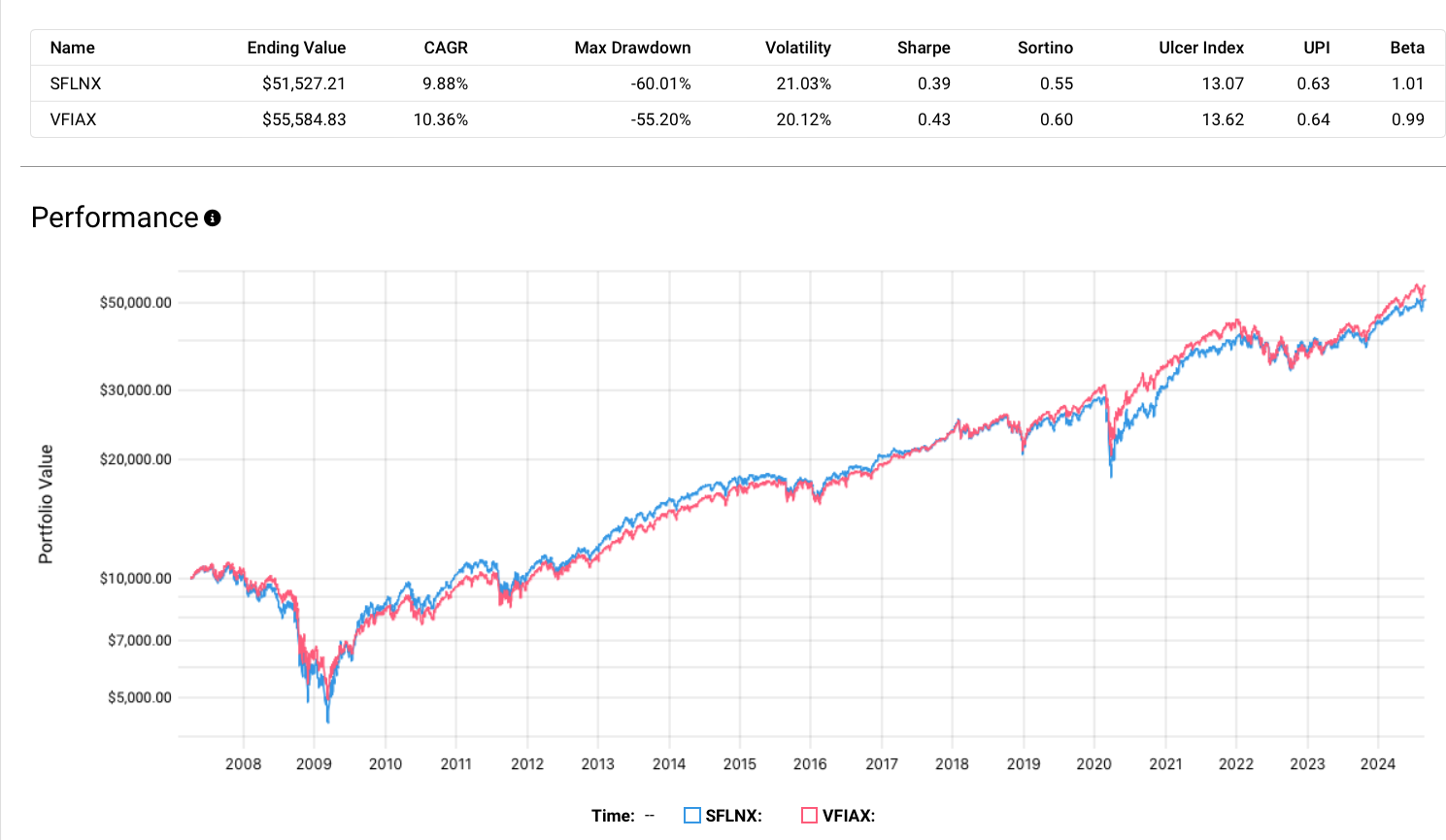

For instance, because you used the phrase “fundamentalism,” the Schwab Basic Massive-cap Index Fund, SFLNX, versus the Vanguard [S&P] 500 Index Fund, VFIAX:

Is it a criminal offense for Schwab to supply this fund with an ER of 0.25% when S&P 500 index funds and ETFs have ERs of <0.04%? Will it damage anybody to make use of this as a substitute of Complete Inventory as a core holding? Definitely not. But it surely gripes me that there was a lot massive discuss in regards to the essential and significant superiority of basic indexing again round 2007. I believed it was snake oil then, the outcomes are according to snake oil, and snake oil promotion makes me cranky.

Sadly for Boglehead orthodoxy, the keystone is Bogle’s “value issues speculation,” and for years the argument was “no one can really inform which of a whole lot of broad, diversified market methods is greatest, so that you would possibly as effectively choose the only and least expensive.” This has been critically undercut by value reductions all over the place.

These unusual “give the S&P 500 shares a weight of 1, however give the opposite 3,500 shares a weight of zero” methods are on the border of the place the distinction from cap-weighting does begin to matter. However the non-fundamentalist downside right here is that if you would like “the cap-weighted market,” 80% of the market by cap-weight (S&P 500) is an honest approximation. However if you would like “the equal-weighted market,” 12% of the market by title depend is not an honest approximation. And I do not see any logical argument for doing it. The arguments for equal-weight all lead logically to eager to equal weight a fairly excessive share of the entire market.

The arguments for funds like RSP are primarily much like the arguments for actively managed funds: no actual purpose, simply “golly, look, that is considered one of many ETFs that outperformed the S&P 500.”

In case your interior spirit strikes you to spend money on the Invesco S&P 500 Equal-Weight ETF, or the Schwab Basic US Massive-cap Index Fund, or Constancy Contrafund, or the Vanguard US Multifactor ETF, or Berkshire Hathaway inventory as a core US inventory holding, high quality. John C. Bogle mentioned that “Profitable investing includes doing just some issues proper and avoiding critical errors.” I do not suppose anybody may name any of these selections a “critical” mistake. However you possibly can and will anticipate Bogleheads to current arguments towards them.

Annual revenue twenty kilos, annual expenditure nineteen nineteen and 6, end result happiness; Annual revenue twenty kilos, annual expenditure twenty kilos ought and 6, end result distress.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/08/SP500-or-SP500-equal-weight-1024x487.png)