Shares didn’t do a lot yesterday, with the S&P 500 index closing simply 0.09% increased. The market has additional prolonged its short-term consolidation following a retreat from final Thursday’s new report excessive of 5,505.53. At the moment, the index is more likely to open 0.4% increased, as indicated by futures contracts. The Core PCE Worth Index launch has been as anticipated at +0.1% month over month. The S&P 500 stays comparatively near report highs, and for now, it solely appears to be like like a comparatively flat correction of the uptrend.

In my forecast for June, I wrote “For the final three months, the S&P 500 index has been fluctuating alongside new report highs, above the 5,000 degree which was damaged in February. It appears to be like like a consolidation inside a long-term uptrend, however it might even be a topping sample earlier than some significant medium-term correction. What’s it more likely to do? Because the saying goes, ‘the pattern is your buddy’, so the most certainly state of affairs is extra advances sooner or later.

Nonetheless, a adverse sign could be a breakdown beneath the 5,000 degree. That will elevate the query of a deeper correction and downward reversal. I believe that the probability of a bullish state of affairs is 60/40 – a downward reversal can’t be fully dominated out. The market will probably be ready for extra alerts from the Fed about potential rate of interest easing, plus, on the finish of the month, the approaching earnings season might dictate the market strikes.”

The investor sentiment remained principally unchanged on Wednesday, as indicated by the AAII Investor Sentiment Survey, which confirmed that 44.5% of particular person buyers are bullish, whereas 28.3% of them are bearish (up from final week’s studying of twenty-two.5%). The AAII sentiment is a opposite indicator within the sense that extremely bullish readings might recommend extreme complacency and a scarcity of concern available in the market. Conversely, bearish readings are favorable for market upturns.

The S&P 500 index continues sideways after breaking its upward pattern line, as we will see on the every day chart.

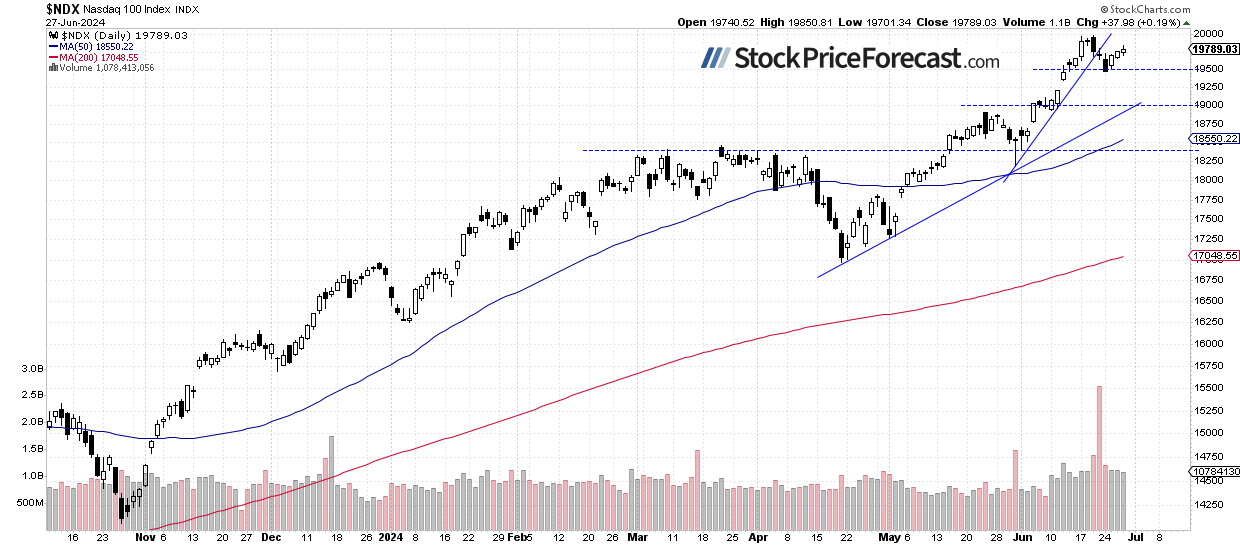

Nasdaq 100 extends its rebound

Final Thursday, the technology-focused Nasdaq 100 index reached a brand new report excessive of 19,979.93, earlier than retracing the advance and shutting decrease. On Friday and Monday, the market traded decrease, however since Tuesday, it has been rebounding, reaching as excessive as 19,850 yesterday. This morning, the Nasdaq 100 is poised to open 0.5% increased, getting nearer to the report excessive from final week.

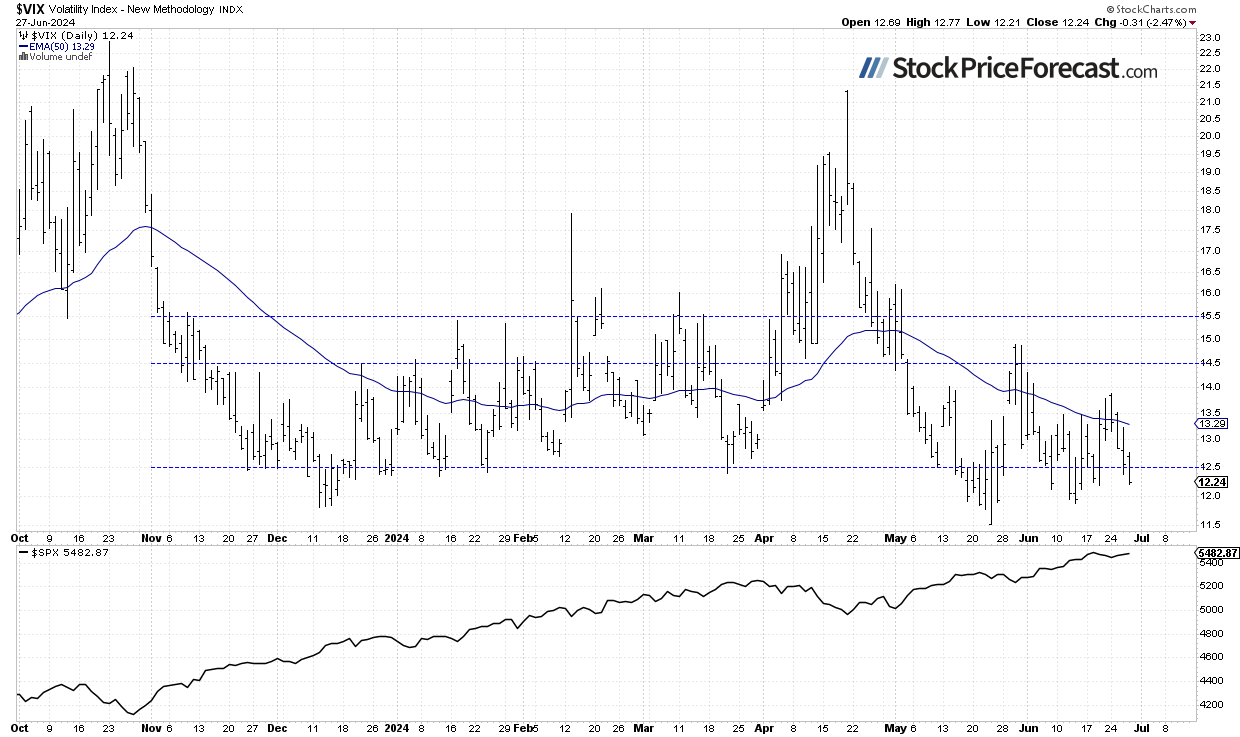

VIX will get nearer to 12

The VIX index, also called the concern gauge, is derived from possibility costs. In late Might, it set a brand new medium-term low of 11.52 earlier than rebounding as much as round 15 on correction worries. Since final Thursday, it has been closing above the 13 degree, exhibiting growing concern available in the market. Since Tuesday, the VIX is closing closed beneath 13 on hopes {that a} correction in stocks could also be ending. Yesterday, it went nearer to the 12 degree.

Traditionally, a dropping VIX signifies much less concern available in the market, and rising VIX accompanies inventory market downturns. Nonetheless, the decrease the VIX, the upper the likelihood of the market’s downward reversal.

Futures contract trades above 5,550

Let’s check out the hourly chart of the S&P 500 futures contract. Final Thursday, it reached a brand new excessive of round 5,588. Since then, the market has been fluctuating, reaching the help degree at round 5,520. This morning, it’s buying and selling increased, but nonetheless beneath the current excessive.

Conclusion

The S&P 500 index is more likely to open 0.3% increased right this moment. For a couple of classes, the market continued buying and selling sideways after final Thursday’s intraday retreat, and right this moment, it might try and get nearer to the report. The current buying and selling motion is finest described as a flat correction of the uptrend.

For now, my short-term outlook stays impartial.

Right here’s the breakdown:

-

The S&P 500 reversed decrease from a brand new report excessive on Thursday; this week, it stored extending a consolidation.

-

Not too long ago, inventory costs have been reaching new report highs regardless of blended information and rising uncertainty.

-

For my part, the short-term outlook is impartial.

Need free follow-ups to the above article and particulars not obtainable to 99%+ buyers? Sign up to our free newsletter today!

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/mexican-stock-exchange-or-bolsa-mexicana-de-valores-mexico-city-45071436_Large.jpg)