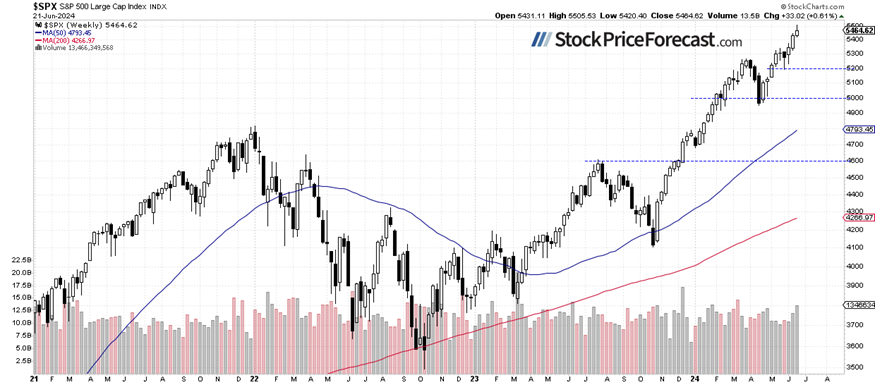

Friday’s buying and selling session didn’t carry a lot change for the inventory market, with the S&P 500 index closing 0.16% decrease. It fluctuated following its Thursday retreat from a brand new document excessive of 5,505.53. At present, the index is prone to open nearly flat, additional extending a short-term consolidation.

In my forecast for June, I wrote “For the final three months, the S&P 500 index has been fluctuating alongside new document highs, above the 5,000 degree which was damaged in February. It seems to be like a consolidation inside a long-term uptrend, however it might even be a topping sample earlier than some significant medium-term correction. What’s it prone to do? Because the saying goes, ‘the pattern is your buddy’, so the probably state of affairs is extra advances sooner or later.

Nevertheless, a adverse sign can be a breakdown under the 5,000 degree. That will elevate the query of a deeper correction and downward reversal. I feel that the probability of a bullish state of affairs is 60/40 – a downward reversal can’t be utterly dominated out. The market shall be ready for extra indicators from the Fed about potential rate of interest easing, plus, on the finish of the month, the approaching earnings season could dictate the market strikes.”

Investor sentiment remained fairly unchanged, as indicated by the AAII Investor Sentiment Survey final Wednesday, which confirmed that 44.4% of particular person buyers are bullish, whereas 22.5% of them are bearish (down from final week’s studying of 25.7%). The AAII sentiment is a opposite indicator within the sense that extremely bullish readings could counsel extreme complacency and a scarcity of concern available in the market. Conversely, bearish readings are favorable for market upturns.

The S&P 500 index broke its upward pattern line on Friday, as we will see on the day by day chart.

S&P 500 prolonged its bull market final week

In comparison with the earlier Friday’s closing worth, the index gained 0.61%, reaching a brand new document excessive and increasing its long-term uptrend on Friday. Nevertheless, Friday’s retreat is prone to mark a short-term native excessive, and a consolidation or correction could observe.

Quoting an article from Could 13: “The current worth motion confirmed the significance of the 5,000 degree as a medium-term assist. It’s exhausting to say whether or not the market will proceed its long-term uptrend; nonetheless, it’s going to probably stay above 5,000 within the coming weeks or months.”

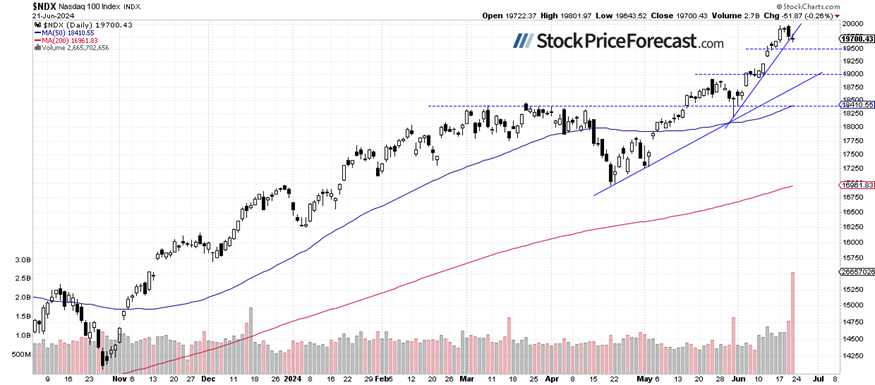

Nasdaq 100 remained under 20,000

The technology-focused Nasdaq 100 index reached a brand new document excessive of 19,979.93 on Thursday, earlier than retracing a few of the current advances. On Friday, it went sideways regardless of financial information and “quadruple witching” derivatives expiration.

Is that this a high? For now, it seems to be like a correction; nonetheless, a breakdown under 19,500 would possible improve promoting stress. This morning, the Nasdaq 100 is prone to open 0.1% decrease.

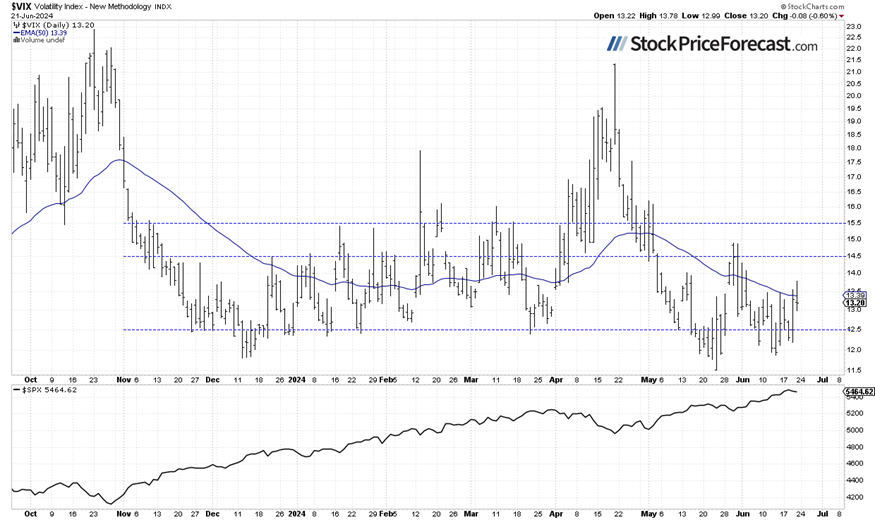

VIX remained above 13

The VIX index, also referred to as the concern gauge, is derived from choice costs. In late Could, it set a brand new medium-term low of 11.52 earlier than rebounding as much as round 15 on correction worries. Just lately, the VIX got here again in direction of 12, and on Thursday and on Friday, it closed above 13, displaying growing concern available in the market.

Traditionally, a dropping VIX signifies much less concern available in the market, and rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the likelihood of the market’s downward reversal.

Futures contract going sideways

Let’s check out the hourly chart of the S&P 500 futures contract. On Thursday, it reached a brand new excessive of round 5,588, and on Friday, it was buying and selling alongside the 5,530 degree. This morning, it retains going sideways, with resistance at 5,550 and assist at 5,520.

Conclusion

The S&P 500 index is prone to open flat this morning, as indicated by futures contracts. Has the uptrend reversed final Thursday? For now, it’s a consolidation following Thursday’s retreat. Evidently the market could go sideways for a while. Traders shall be ready for economic data this week: tomorrow, the CB Shopper Confidence launch, the GDP on Thursday, and the essential Core PCE Worth Index on Friday.

For now, my short-term outlook stays impartial.

Right here’s the breakdown:

-

The S&P 500 reversed decrease from a brand new document excessive on Thursday; for now, it’s a downward correction.

-

Just lately, inventory costs had been reaching new document highs regardless of combined information and rising uncertainty.

-

For my part, the short-term outlook is impartial.

Need free follow-ups to the above article and particulars not out there to 99%+ buyers? Sign up to our free newsletter today!

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/market-analyze-18914145_Large.jpg)