Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Chipmaker Qualcomm approached its struggling rival Intel a couple of potential takeover in current days, based on two folks accustomed to the matter.

A deal is way from sure and no formal supply has been made, based on folks with information of the method. An individual near Qualcomm stated the chipmaker would solely pursue a pleasant deal, and other people with information of Intel’s considering stated the corporate harbours considerations {that a} deal could be stymied by antitrust regulators.

A full takeover of Intel would prime Microsoft’s $69bn acquisition of Activision as the biggest know-how deal in historical past. Intel’s market capitalisation was $93bn on Friday after its share worth jumped 8 per cent following an preliminary report on Qualcomm’s method by The Wall Street Journal.

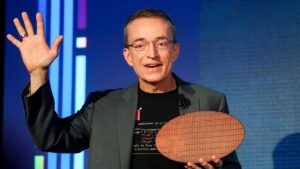

As soon as the world’s largest chipmaker, Intel’s years-long fall from grace has accelerated in current months. The corporate misplaced practically $30bn in market worth in August after a disastrous earnings report wherein chief govt Pat Gelsinger announced 15,000 job cuts and scrapped its dividend.

Intel’s share worth has declined 50 per cent for the reason that begin of this 12 months, placing the corporate on the defensive concerning the danger of approaches from potential bidders and the specter of hostile shareholders.

Intel is working with Goldman Sachs and Morgan Stanley to guage Qualcomm’s method, folks with information of the matter stated. For a number of months funding bankers from Morgan Stanley have been advising it on the right way to defend itself from activist traders, a transfer previously reported by CNBC.

Intel is contemplating a variety of asset gross sales, folks accustomed to the corporate’s considering stated.

Qualcomm raised the potential for a full takeover of Intel after exploring an acquisition of a number of Intel property, folks accustomed to the matter stated, confirming an earlier report by Reuters.

In contrast to Intel, Qualcomm doesn’t construct its personal chips and as a substitute outsources manufacturing to exterior producers. Qualcomm, which has a $188bn market capitalisation, is working with funding financial institution Evercore to guage its method to Intel.

It’s unclear how it will fund a wholesale takeover of Intel, or whether or not it will divest property as a part of a takeover. A deal is more likely to face intense antitrust scrutiny and political considerations over nationwide safety.

Ought to a deal go ahead, it will be pitched to US regulators as a bid to strengthen American chipmakers of their race to compete with Chinese language producers, based on folks accustomed to the matter.

The folks cautioned {that a} prolonged acquisition course of might trigger the chipmakers to fall behind overseas rivals, a priority that will scuttle a deal.

Intel and Goldman Sachs declined to remark. Morgan Stanley, Evercore and Qualcomm didn’t instantly reply to requests for remark.

The method provides to mounting stress on Gelsinger, who was appointed in 2021 and is three years right into a five-year turnaround plan to remodel Intel right into a chip producer that rivals trade chief Taiwan Semiconductor Manufacturing Firm.

The corporate has hit a number of obstacles alongside the way in which: excessive profile executives have departed, together with trade veteran Lip-Bu Tan who left the corporate’s board. Intel has additionally lagged rivals Nvidia and AMD in gross sales of synthetic intelligence chips to information centres.

Intel shareholders would most likely balk at a sale to Qualcomm, analysts at Citi argued in a notice printed on Friday. They stated Intel ought to as a substitute exit its semiconductor manufacturing enterprise “as we consider the corporate has a really small likelihood of turning into a worthwhile modern foundry”.

Takeover talks are “virtually too foolish to touch upon”, they wrote.