SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

Half 2:

Up to date on Sept 4, 2024I need to begin out by saying that I actually admire everybody that has helped me on this discussion board. Your assist, knowledge, and the time you set in for a stranger/rookie investor didn’t go unnoticed. Thanks a lot. I most likely spent a median 30mins to an hour per put up (some longer), simply so I can perceive everybody’s recommendation higher. With that being stated, I need to share the progress I’ve made, however there may be nonetheless some extra work to be achieved:

Glad to listen to you bought helpful suggestions and hopefully we will proceed offering useful concepts to your persevering with funding selections.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

a) With everybody’s suggestion, I’ve modified my Desired Asset Allocation:Desired Asset allocation: 80% shares / 20% bonds

Desired Worldwide allocation: 30% of shares

A leap out of your part-1 AA of 60/40 to your part-2 AA of 80/20 is actually extra aggressive. I am going to say that is effective for a pair each age 41, however my solely warning is that must be primarily based on your joint risk-tolerance and never as a result of “everybody’s suggestion” was that you simply be extra aggressive. AA is about your “sleep properly at evening” issue and has the least affect in your stability at retirement; how a lot you contribute and the way lengthy you make these contributions is a a lot, a lot bigger affect than AA, so simply make sure that is best for you (not as a result of some Boghleads stated so) and that you simply will not panic-sell if the inventory market crashes -50% and your portfolio drops -40%. I am emphasizing this as a result of your authentic title included the adjective “excessive nervousness,” which was hopefully nearly not realizing what to do subsequent quite than watching your cash evaporate in a crash after which most likely get well properly earlier than you retire.

Should you’re fairly comfy with the volatility of an 80/20 portfolio (and I do suppose that is effective for a pair of 41y olds), then nice! Should you picked 80/20 as a result of that gave the impression to be a consensus of what others have been saying it is best to maintain, then I believe it is best to do one or each of the workouts under to substantiate that this new AA is acceptable for you and your partner.

1) Learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was advisable by the quiz primarily based in your data of your private danger tolerance having learn the Wiki article.

2) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of whole worth can I deal with?” lower that % in half to get normal deviation, then lookup that std. dev. on the X-Axis of the chart under, and at last scan as much as see what AA that corresponds to. For instance, when you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a median and you will get what you get together with your distinctive sequence of returns (there’s a number of variance in outcomes as a result of related volatility of shares so it most likely will NOT be the typical, however one thing kind of).

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

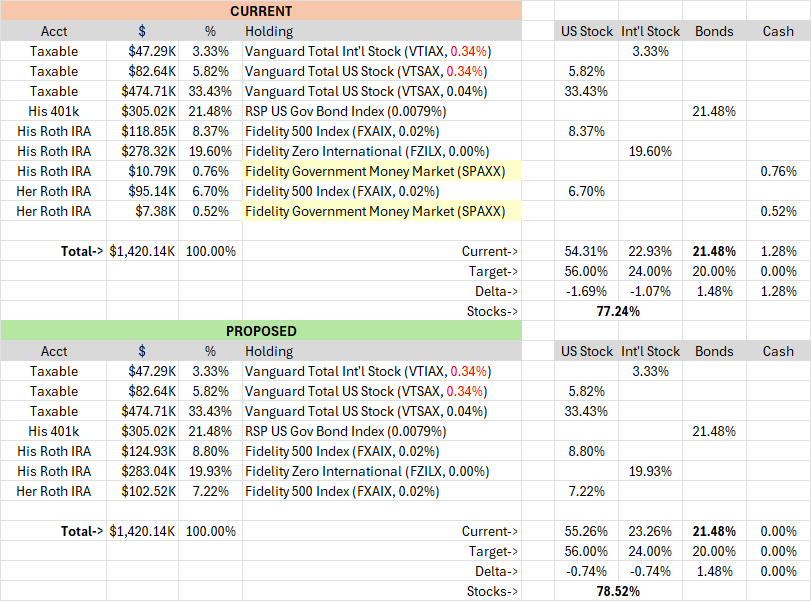

b) Approximate measurement of whole funding portfolio under($1.42mil). I even have a further $200k (HYSA – Capital One 360) that I didn’t embody under, however I’ll need to make investments ultimately. Any suggestions for the setup under?

Your setup appears nice to me! It adheres to tax-efficient placement and there is not any wash sale points that I can see. You’re quick on bonds by -1.48%, however that can doubtless be mounted over time as he continues to make 401k contributions to the bond fund. The proposed part is a suggestion on how the money ready to be deployed (light-yellow spotlight from current Trad->Roth conversion) in His Roth IRA could possibly be break up amongst US and Int’l inventory such that the error relative to the goal AA is about the identical (assumes her Roth IRA money would go to Fido 500 Index).

You’re paying for Vanguard Private Advisor Choose (VPAS), nevertheless it’s just for about 9% of your portfolio; are they making suggestions (just like the 529 contribution) outdoors of the portfolio which can be well worth the 0.30% charge to you (which I believe is added to the underlying fund ERs, so 0.34% quite than simply 0.30%)? In the event that they’re making funding portfolio suggestions, do they learn about all of your different holdings? If they’re however do not learn about your whole portfolio then they may present recommendation that is smart for the 2 funds they see, however which within the context of all the portfolio of accounts doesn’t make sense. Simply one thing to pay attention to if you take recommendation out of your advisor that will not have a whole monetary image.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

c) I’ve modified His 401k contribution to Pre-tax, as a substitute of After-tax. Transferring ahead, I plan to max out my Conventional 401k first, then use After-tax 401k.

That is doubtless effective because it offers you a right away tax-break now and you’ll at all times do Roth conversions in retirement however earlier than you acquire SocSec, if you would possibly be in a decrease tax bracket. I believe it is a good objective for placement flexibility to have Taxable, Tax-Deferred, and Tax-Free balances which can be fairly related greenback quantities on getting into retirement, quite than one account kind dominating the opposite two. Nevertheless, that usually occurs with the 401k being largest (or generally Taxable being largest for very excessive earners) and is addressed by Trad to Roth conversions in early retirement.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

d) I’ve zero out my Rollover IRA and transfer the funds into my Conventional 401k to get rid of an account. This additionally permits me to do a Backdoor Roth IRA, which for 2024, I’ve contributed $7k to my spouse’s Backdoor Roth IRA, and $7k to His Backdoor Roth IRA.

This was an excellent transfer to allow backdoor contributions to His Roth IRA!

Is that this ample for 6-18 months of bills (not web earnings) if considered one of you is unexpectedly laid off? The particular time must be matched to how lengthy it might doubtless take to discover a alternative job at related wage (greater wage sometimes means an extended job hunt). This is likely to be effective (or much more than sufficient) when you can in the reduction of on discretionary spending and stay on simply the lesser of the 2 salaries (assuming your not each working for a similar employer).

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

1) His 401k contribution is at the moment set for RSP US Gov Bond Index_(n/a)(0.0079%) each month. This could unbalance my Asset Allocation extra on the bond facet if I contribute to it $3k+ each month. What ought to I concentrate on with my 401k contribution? Is there one other funding I ought to think about in my 401K account additionally if the Bond AA is simply too excessive, and if that’s the case, which one?

Since contributions to the 401k could possibly be as much as $23K/yr whereas Roth IRA is restricted to $7K/yr, sure you may ultimately need to divert your contributions from 100% into bonds to a inventory/bond break up (say 80% shares, then 20% bonds to begin on paper then regulate primarily based on what you suppose the year-end contribution imbalance could be throughout all accounts). You need not suppose too laborious or fear an excessive amount of on this, since you would simply repair it in your annual or quarterly rebalancing (i.e., simply go away contributions 100% bonds, 80/20 break up, or 100% shares, or no matter after which in your rebalancing date, shift some bonds into shares, or vice-versa, contained in the 401k to carry the overall portfolio throughout all accounts again on the right track).

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

2) I at the moment have two investments (approx. $130k) in my Joint Taxable at Vanguard which can be beneath the Vanguard Private Advisor Choose Portfolios (expense ratio = 0.3% + $75 quarterly charge). I attempted to name them to cancel the service, however they transferred me to their retention specialist, and he satisfied to remain. His gross sales pitch was that I can name to an Advisor for assist if wanted. Ought to I name again in to cancel it, and simply transfer the 2 funds to a non-advised account?

This goes again to my earlier query about whether or not this 0.3% charge is “value it to you.” What recommendation are you getting that you would not get right here or discover by yourself with somewhat internet analysis? Does getting access to a CFP (for simply 9% of your whole portfolio, so maybe not that huge a price) offer you peace of thoughts to scale back your excessive nervousness? In my first response to your authentic put up, I stated that such nervousness can result in bodily stress which may trigger well being issues (or exacerbate present ones), so if having knowledgeable CFP to speak to helps keep away from well being points, I would say that was value it to me, however it is a private alternative you must resolve. Many DIY Bogleheads will let you know to ditch the advisor and save the prices however that is them and their high-confidence, zero-anxiety, expertise with self-managing their portfolios… when you get that response from others, think about how your expertise (or lack of) and concern differs from these which can be providing you with recommendation to ditch the advisor.

The opposite factor to make clear (or negotiate) is the Private Advisor Choose (PAS) price. PAS requires $500K, however you solely have $130K beneath administration with PAS, so the additional $75/qtr ($300/yr) is more likely to compensate for the truth that you do not have not less than $500K “beneath administration,” however they let you will have entry to a devoted CFP for this nominal cost as a result of you will have $600K “at Vanguard.” So in whole your devoted CFP is costing you slightly below $700/yr ($129,930 x 0.30% + $300 = $690). Only for comparability in opposition to different advice-only advisors, Rick Ferri costs about $1,000 for preliminary session & planning, then $450/hr for follow-on consulting; Mark Zoril (of Plan Imaginative and prescient) costs one thing on the order of $300 for setup, however then a decrease annual “upkeep” price (I am not recommending both of these, they’re merely cited for price comparability).

To be clear, I additionally would ditch the advisor in a heartbeat, however I’ve high-confidence and zero-anxiety, in order that’s me, not essentially you.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

3) For the $200k in my HYSA (Capital One), how ought to I begin investing it? Ought to I dive proper in, and embody it with my Asset Allocation plan (80 inventory/20 bond)? Ought to I slowly use it to feed our Backdoor Roth yearly? Ought to I take advantage of it to assist rebalance my portfolio if wanted?

You may doubtless make investments it instantly in your joint Taxable account. Taxable accounts must be 100% shares per tax-efficient placement, so it could possibly be break up amongst VTSAX and VTIAX to attempt to preserve your AA on observe (your bond allocation will fall somewhat behind however that can catch up shortly with $3K/mo contributions to His 401k). I say “instantly” as a result of lump-sum beats DCA 67% of the time, however when you’re in any respect nervous and/or would have important remorse if the market have been to right/crash simply after you made a lump-sum funding, then think about solely lumping in half after which DCA the opposite half into joint Taxable over 6-12 months. Once more, it is a private name that it’s important to resolve.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

4) Is there a rule of thumb on when to rebalance the portfolio? Is it each 3 months, or is it when the Asset Allocation is off by 5%+?

There’s an both/or to your chosen periodicity (private alternative of month-to-month, quarterly, or yearly) -OR- at any time when the allocation is off by greater than some threshold (±5% is usually advisable). See the Wiki matter on Rebalancing Approaches.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

5) Simply curious, what’s the distinction between the three bond funds choices (RSP US GOV BOND INDX (0.0079%), RSP BOND INDEX (0.0262%), RSP SHORT TERM BOND (0.0181%)) in my 401k, and why was RSP US GOV BOND INDX advisable over the opposite bond funds? Do I would like to fret about bond funds with the rate of interest fluctuating up and down?

Simply trying on the fund names, I would say GOV BOND is simply US Treasuries & Gov’t-backed Mortgages, whereas BOND INDEX is probably going extra like a Whole Bond Fund that has each Gov’t debt and company debt; each of those are doubtless intermediate time period (avg. length round 6-7 years), whereas SHORT TERM BOND, is because the identify implies quick quite than intermediate (much less volatility and decrease yield). GOV BOND is the bottom price amongst these three, in order that is likely to be driving the advice; all three are doubtless appropriate you probably have a desire. I believe worrying about fluctuations in shares and bonds is just not a fruitful expenditure of emotion… you possibly can’t management what occurs, you possibly can solely react if there is a huge change by rebalancing your portfolio to keep up your danger profile.

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

6) Is there a greater place to stash majority ($40k) of my emergency fund as a substitute of leaving all $60k in my checking account?

Since you will have a joint account at Vanguard and Vanguard’s MMF charges are usually higher than Schwab & Fido, I would counsel transferring the quantity you need to maintain outdoors checking to the Taxable account, after which investing it in VUSXX @ 5.23% however exempt from CA taxes, so a Tax-Equal Yield (TEY) of 5.23% / (1 – 9.3% CA) = 5.77%, so higher than the settlement fund (VMFXX) at 5.25%. I solely preserve $5K in my credit score union financial savings account as I can get by means of a month of bills on that; all the remainder of my EF was within the VMFXX since I can transfer cash between VMFXX and my checking account in about 2-3 days, so I noticed no must preserve that a lot money in checking/financial savings (incomes basically nothing). $20K retained in checking is ok, if that is what you are comfy with, however you would most likely maintain a lot much less there (sufficient to pay all month-to-month payments that converge on a due-date in the identical week, so you will have time to maneuver money from MMF to checking).

SacramentoInvestor wrote: ↑Mon Jul 29, 2024 1:51 am

7) The advisor from Vanguard Private Advisor Choose Portfolios group advisable that I put a one-time $10k contribution into every of my youngsters 529 accounts. This fashion, their 529 can probably double by the point they go to school. The funds would come from my HYSA. Is that this advisable?

This looks like an affordable suggestion. If $10K have been to double (that is solely a “potential” development case, however not an unreasonable expectation), then there’d be $20K within the 529, which is under the $35k lifetime rollover restrict to a Roth IRA if the funds are NOT used for training bills (i.e., the kid opts out of pursuing a level program). Some individuals load up their 529s with significantly extra property (sufficient to pay for practically all 4 years of faculty), since if used for training the expansion is tax-free, and I am certain a lot of these take pleasure in that profit, however there’s at all times the likelihood that your children simply aren’t all for faculty, regardless of all of your finest efforts to persuade them it is a profession benefit (esp. when you’re paying for it and so they do not graduate saddled with $100K to $400K in debt).

Maybe the advisor has this in thoughts and is making an attempt to maintain 529 accounts beneath the $35K rollover restrict within the occasion that they are not used (you possibly can nonetheless get the cash if they do not go to school, however funds in extra of $35K have a ten% non-education penalty plus taxes on earnings at atypical earnings tax charges, which is fairly stiff in comparison with tax-free rollover to a Roth). I are inclined to agree with the advisor to maintain whole development in 529s to $35K and put the rest of funds in direction of faculty in UTMA accounts or your personal Joint Taxable account.

Do not do what Bogleheads let you know. Take heed to what we are saying, think about different sources, and make your personal selections, since it’s important to stay with the dangers & rewards (not us or anybody else).

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/1725970337_430_Portfolio-Review-Investor-with-High-Anxiety-Page-2.png)