The winds of change are swirling round Polkadot (DOT). After a month-long stoop that mirrored a broader cryptocurrency market downturn, DOT finds itself at a crucial juncture.

Technical indicators trace at a bullish reversal, with some analysts predicting a major value surge for the interoperable blockchain darling. Nonetheless, a latest spending spree by the Polkadot Basis has forged a shadow of doubt, leaving the group divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Goal

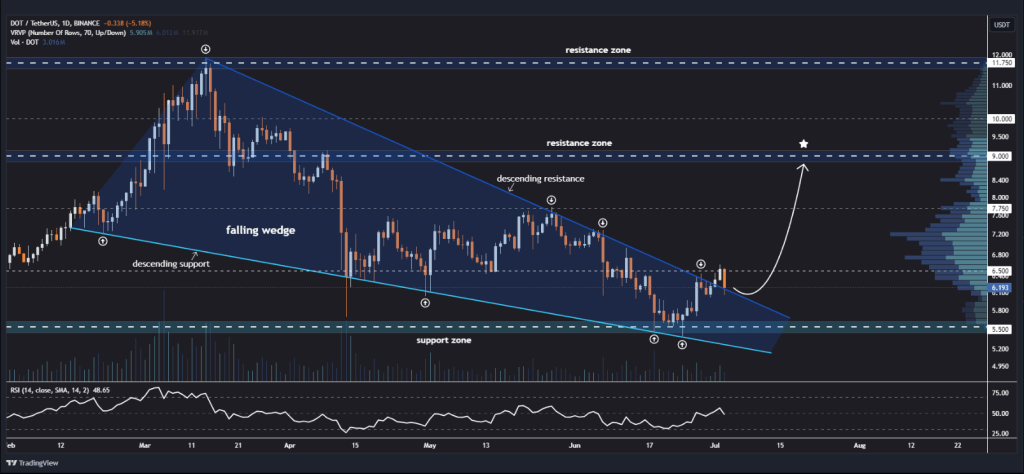

As technical evaluation presents a probably hopeful image, DOT holders’ hope wavers. On the day by day chart, a “falling wedge” sample—traditionally a bullish indication—has been noticed. This sample suggests a value squeeze between converging trendlines, typically culminating in a pointy breakout.

Associated Studying

Famend analyst Jonathan Carter pinpoints $6.50 as the important thing resistance stage. A decisive break above this level may set off a surge in shopping for stress, propelling DOT in the direction of his projected revenue targets of $7.75 and even $9.00.

Polkadot forming falling wedge on day by day timeframe💁♂️

Key resistance at $6.5 – want to interrupt for bullish construction☝️

Take into account setting revenue targets at $7.75 and $9.00 ranges🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge sample and rising buying and selling quantity counsel a possible breakout is imminent. A profitable breach of the $6.50 resistance may sign a major shift in market sentiment, paving the way in which for a considerable value enhance.

Buoying this optimism is the Relative Energy Index (RSI), at the moment hovering round 48.65. This impartial stage signifies that DOT is neither overbought nor oversold, leaving room for additional upward momentum.

Polkadot Basis’s Spending Spree

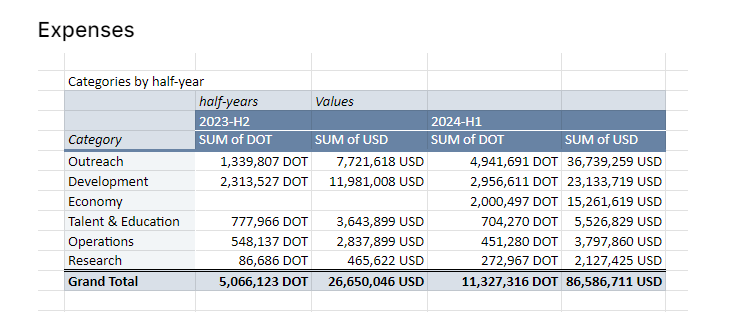

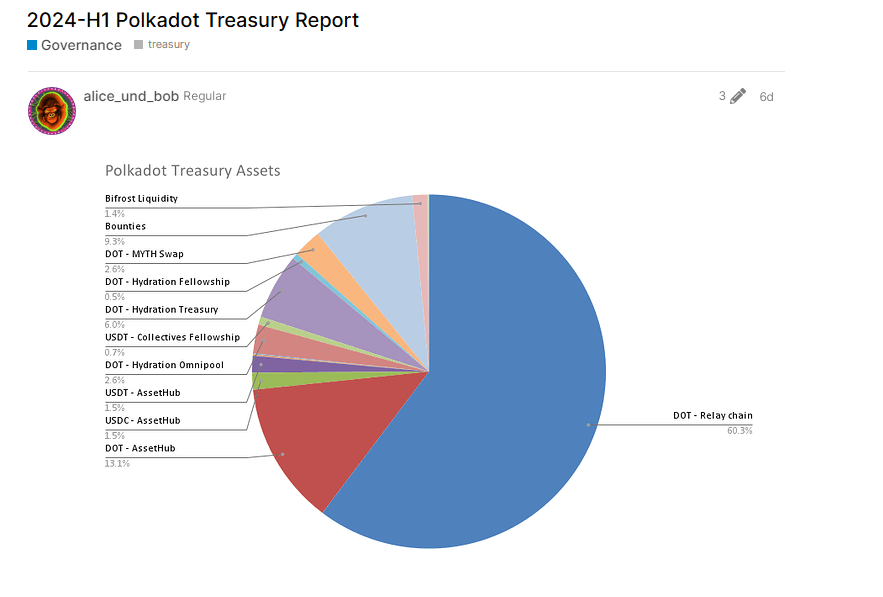

Nonetheless, a latest spending spree by the Polkadot Basis has injected a dose of skepticism into the bullish narrative. Earlier this 12 months, the Basis burned through a staggering $87 million, leaving its coffers with a considerably diminished stability.

The breakdown reveals $36.7 million allotted for promoting and occasions, $15 million for buying and selling platform incentives, and $23 million for improvement. Whereas the Basis maintains these investments are essential for enhancing community visibility and adoption, group members are usually not satisfied.

Many level out that regardless of the hefty spending, Polkadot continues to lag behind rivals like Ethereum and Solana in key metrics like community exercise, developer engagement, and complete worth locked (TVL).

Associated Studying

The spending appears extreme, particularly contemplating the shortage of tangible outcomes, some group members on the Polkadot discussion board stated. The blockchain must see a greater return on funding earlier than the Basis throws extra money at advertising campaigns, they stated.

Will Spending Issues Spook Buyers?

The approaching days might be essential for DOT. If the technical indicators maintain true and the worth breaks above $6.50, a major rally may very well be within the playing cards.

Nonetheless, the group’s considerations concerning the Basis’s spending habits can’t be ignored. If these considerations translate right into a broader sell-off, the potential breakout would possibly fizzle.

Featured picture from Shutterstock, chart from TradingView

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/a_6a6e66.jpg)