retired_dmn wrote: ↑Mon Sep 09, 2024 11:24 am

I’m 4 months from turning 69, I retired after I was 63.Once I retired, the emergency fund was round $30,000; my concern of cash not lasting had me placing extra in as an alternative of getting tasks executed.

Usually an emergency fund (EF) is to cowl month-to-month bills when you’re working in case you get laid off. It is nonetheless positive to carry an EF in retirement however the goal shifts a bit since getting laid off is not the problem anymore; it is about surprising bills that might be tough to soak up inside your $2K month-to-month earnings. Nevertheless, you could have liquid property in your portfolio so that you may not have to preserve an EF or you possibly can scale back the scale to about 1-3 months of bills (or dimension it to the largest unplanned expense you’ll be able to consider like changing the roof, a serious septic system substitute, and so forth.). Personally I do not carry an EF in early semi-retirement. Though I do have a number of months of bills in a cash market fund (MMF), most of my mid-term spending (deliberate and unplanned) is in a 60/40 Balanced Fund and is meant for important dwelling repairs, dwelling upgrades, and substitute automobiles, possibly a elaborate trip above and past our common budgeted trip financial savings (which matches to the MMF not the Balanced Fund).

retired_dmn wrote: ↑Mon Sep 09, 2024 11:24 am

I’ve made lots of errors; happily, I did begin an IRA for my spouse and me about 20 years earlier than I retired and paid off my dwelling. Other than that, I’ve no clue what I’m doing.

Nicely you are right here on Bogleheads so hopefully we may help you study investments, together with a withdrawal methods that gives some reassurance you may seemingly NOT run of cash early.

To begin with, some fundamental information of investing would seemingly be VERY useful for you and your partner. I will recommend you each learn the the 5 introductory matters in Wiki Main Page (left aspect) beneath “Getting Began for US Traders”:

1) Getting began – Begin right here.

2) Funding philosophy – Our funding rules.

3) Investing start-up equipment – A top-down method to start out investing.

4) Funding coverage assertion – Establish your funding goals and the way you intend to fulfill them.

5) Prioritizing investments – Selecting the place to avoid wasting your investing cash, corresponding to an employer’s retirement plan or a financial savings account.

In case you like books, these are a number of I like and there is a broader prompt studying checklist within the Wiki.

The Bogleheads’ Guide to Investing (Lindauer)

The Little Book of Common Sense Investing (Bogle)

Common Sense on Mutual Funds (Bogle) <– private favourite

If You Can – How Millennials Can Get Rich Slowly (Bernstein) <– free & temporary on-line PDF

retired_dmn wrote: ↑Mon Sep 09, 2024 11:24 am

I’ve been dwelling on social safety for the final 6 years. Fortunately, with out a mortgage, we’re doing okay on $2k a month. … Right here is my present portfolio breakdown.

One of many first issues mentioned in 3) Investing Begin-Up Package is selecting an Asset Allocation (AA) applicable to your time frame and risk-tolerance. Your Present portfolio appears to be about 70/30, with 0% worldwide as a share of shares. I’ve prompt a swap in her Trad 401k so as to add 20% of shares in int’l, however that is fully as much as you and your partner. Apart from the dearth of int’l and the considerably odd alternative of mid-caps in Taxable, your portfolio is in nice form (already adheres to Tax-Efficient Fund Placement and no Wash Sale issues)!

You are able to do that form of evaluation of present AA and proposed rebalancing with the template (not your information) linked under.

Asset Allocation Sheet

AA Current and Proposed

retired_dmn wrote: ↑Mon Sep 09, 2024 11:24 am

I’ve but to withdraw any cash from our retirement accounts. I’m beginning to sweat the upcoming RMDs and undecided what I ought to do. I have to be within the lowest tax bracket at round $25,000 a yr earnings. Ought to I be pulling some cash out whereas I am at this low tax bracket? I all the time feared operating out of cash earlier than operating out of time, however I feel I’m most likely doing this all fallacious.

…

There are lots of issues I wish to do round the home: kitchen, lavatory, and yard renovations. However, dwelling in my fears, I’ve but to start out these tasks. Ought to I be withdrawing some cash every year? Perhaps the 4% a yr I initially thought may complement social safety to assist with tasks and serving to with day-to-day life.

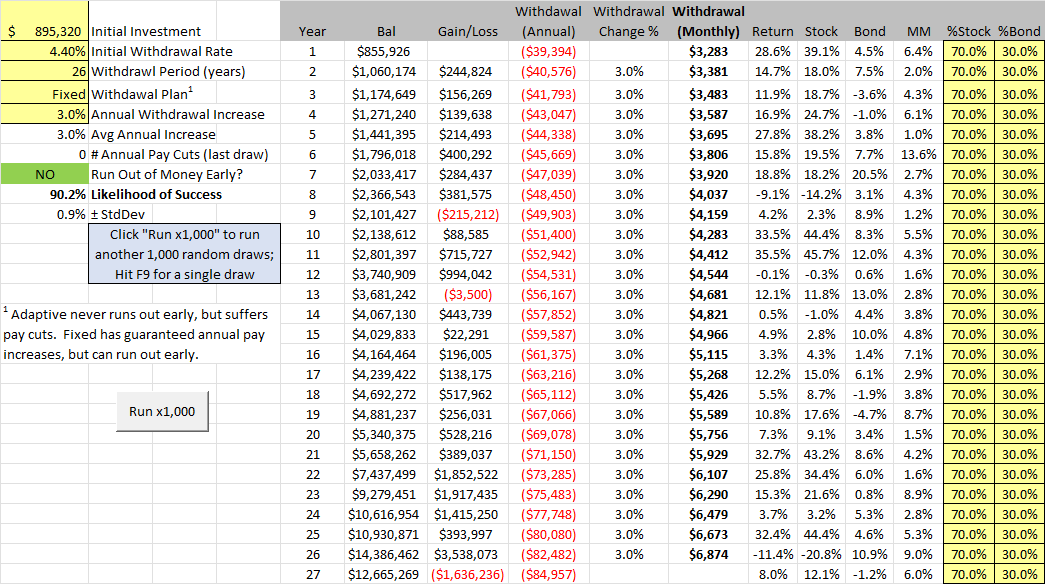

You did not say how previous your partner is, however let’s assume she’s additionally 69. If at the least certainly one of you has a life expectancy to age 95, then that is a 26-year withdrawal part. The usually-cited 4% Rule from the Trinity Study relies on a 30-year interval, so you possibly can safely withdraw 4.4% of your $895K in year-1 after which improve that withdrawal by +3%/yr over year-2 to year-26, with a few 90% likelihood of portfolio survival (NOT operating out early).

(I can hyperlink this mannequin if in case you have an Excel license and are thinking about taking part in with it.)

I might most likely take into consideration a withdrawal technique, begin taking round $40-50K/yr out of your portfolio, and get began with that unique thought to complement SocSec to assist with tasks and day-to-day life. The Trinity Research with it is fastened preliminary share after which adjusted for inflation every year thereafter is a constant-dollar technique, however Alternative Withdrawal Strategies embrace constant-percentage and variable-percentage (plus any customized variants you possibly can consider). VPW is explicit helpful if in case you have no need to go away a legacy to heirs/charity and would relatively benefit from the fruits of your labor throughout your lifetime, whereas constant-dollar tends to go away a big residual that goes to whoever you designate in your will (or beneficiary designations on particular accounts). That one sequence-of-returns (out of 1,000 trials that do not all seem like that) within the picture above was a $14M residual at year-26, which is why VPW is widespread amongst some (even perhaps many)!

In case you do not spend your cash, then any person else certainly will, together with the Fed & State gov’t if in case you have no will and no court-recognized heirs for an intestate property.

So issues to do instantly…

a) Reaffirm that 70/30 is an applicable AA to your risk-tolerance now that you just’re within the spending part with ~25 years to go.

b) Overview your finances to see the way it will change when you add $40-50K/yr earnings earlier than taxes (most likely can do some dwelling tasks!).

c) Select a Withdrawal Technique (we may help with this when you ask follow-on questions, however finally as much as you).

d) Look into Estate Planning when you don’t have an property lawyer already dealing with your planning paperwork.

Relating to a) above, listed below are two concepts to contemplate when assessing what AA is best for you and your partner (it is best to each do that train after which common your two outcomes for a joint AA).

Management Your Threat

1) Learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was beneficial by the quiz based mostly in your information of your private threat tolerance having learn the Wiki article.

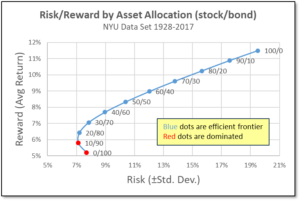

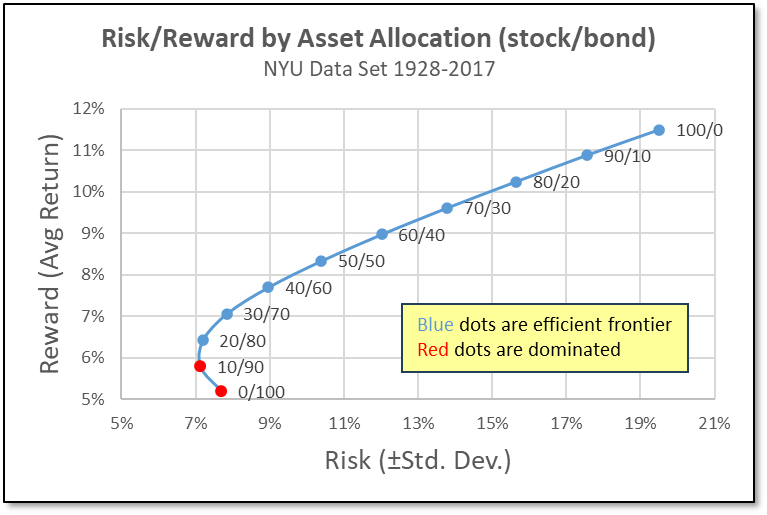

2) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of complete worth can I deal with?” reduce that % in half to get normal deviation, then lookup that std. dev. on the X-Axis of the chart under, and at last scan as much as see what AA that corresponds to. For instance, when you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a mean and you will get what you get together with your distinctive sequence of returns (there’s lots of variance in outcomes as a result of related volatility of shares so it most likely will NOT be the common, however one thing kind of).

Do not do what Bogleheads let you know. Hearken to what we are saying, contemplate different sources, and make your personal choices, since it’s important to stay with the dangers & rewards (not us or anybody else).

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Please-help-not-sure-what-Im-doing.png)