pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

This is a breakdown of our present portfolio:After-tax brokerage:

Complete: $1,182k

– VTI: $550k

– VOO: $590k (together with $320k in parental funds)

– VXF: $40k401k:

Complete: $460k

– S&P 500 index fundsRoth IRA:

Complete: $185k

– FXAIX: $160k

– VXF: $25kHSAs:

Complete: $45k

– VTI and S&P 500 index fund529 Plan:

Complete: $125k

– VTI

An issue I see with this structure is the potential for Wash Sales, since your three Taxable holdings (VTI, VOO, and VXF) are additionally held in tax-advantaged accounts: VTI is within the HSA and 529; VOO is within the 401k, Roth IRA (FXAIX is an S&P-500 index), and the HSA; VXF is within the Roth IRA. The one Wash Sale pair that appears simple to repair is VXF since you can merely transfer the $25K within the Roth IRA into one thing else with no tax penalties, however because you’re holding about equal quantities of VTI and VOO in Taxable, cleansing up these Wash Sale counterparts in tax-advantaged is tougher.

Wash Gross sales aren’t against the law, it simply means in the event you ever promote at a loss in Taxable (say for TLH), then you might not be capable of declare that loss in your tax return in the event you inadvertently bought the identical or “considerably similar” fund in a tax-advantaged account (say by an computerized contribution or reinvestment) inside ±30 days of the loss sale date. If all funds are held on the similar brokerage, they could flag field 1g in your 1099B in order that your tax-prep software program (or your CPA) is aware of to not declare the loss, however no matter whether or not field 1g is checked or not, it is on you to file your return accurately and never declare the loss if there was a wash sale. The Wiki subject linked earlier explains wash gross sales, but it surely’s a nuanced subject and one of the best article I’ve discovered on it’s at Fairmark: Wash Sales.

That is seemingly enough in the event you and your partner don’t work for a similar firm (i.e., solely considered one of you is laid off and it’ll solely take 6 months to discover a alternative job at related wage). If it’ll take longer than 6 months to discover a alternative job or each of you’re employed for a similar firm and will face simultaneous lay-offs, you then would possibly wish to improve this buffer to 12 months or 18 months or no matter is acceptable for a alternative job search in your trade along with your age & expertise (increased salaries normally take longer to exchange).

pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

1) Transfer to Bonds and Money Place Technique:

If I want to extend our allocation to bonds, how a lot ought to I contemplate allocating, and what could be the simplest strategy to implement this alteration? One strategy I’m contemplating is growing our cash-like place to round 10% of our liquid internet value, just like Warren Buffett’s technique of sustaining 90% in equities (just like the S&P 500) and 10% in money or cash-like investments. This could contain accumulating roughly $200k in money over the following couple of years. I’d obtain this by step by step saving up, whereas persevering with to maximise contributions to our tax-advantaged accounts (401k, Roth IRA, and HSA). Would this be a balanced strategy to diversifying threat, or ought to I contemplate a distinct technique?

Is your desired/goal Asset Allocation (AA) altering from 100/0 to 90/0/10 as a result of that is applicable in your joint risk-tolerance or as a result of “that is what Warren Buffett does?” If it is the latter, you must simply purchase BRK.B and let Buffett do his magic, as a result of it is not possible which you could match what he does. In truth about 80% {of professional} energetic fund managers have a acknowledged goal to beat the market index (to justify their increased expense ratios and gross sales commissions), however 80% of Active Managers Fail to Beat the Market. What makes you suppose you’ll be able to simply “observe Buffett” utilizing your individual cash? If it was that simple, would not everybody try this (and thus 80% of execs would simply purchase BRK.B slightly than attempt to fail)?

I do not suggest holding money as an “on a regular basis investor” so you’ll be able to execute a technique “just like Warren Buffet’s”. I’d suggest that any improve in bonds (not money) is in response to a reassessment of the private risk-tolerance that’s joint between you and your partner. Two concepts on the way to make that reassessment…

a) Every of you learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was beneficial by the quiz primarily based in your information of your private threat tolerance having learn the Wiki article. Common your particular person outcomes to get a joint AA that works for each of you as a group.

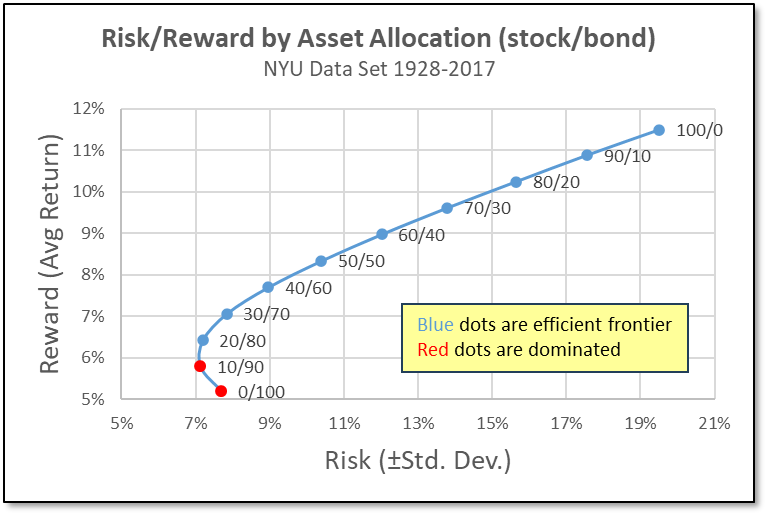

b) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of complete worth can I deal with?” reduce that % in half to get normal deviation, then lookup that std. dev. on the X-Axis of the chart beneath, and at last scan as much as see what AA that corresponds to. For instance, in the event you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a median and you will get what you get along with your distinctive sequence of returns (there’s lots of variance in outcomes because of the related volatility of shares so it most likely will NOT be the common, however one thing roughly).

pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

2) Managing Parental Funds with a Balanced Threat Strategy:

As talked about, I handle roughly $320k in VOO, which is definitely my dad and mom’ cash. They’re each of their 70s and would possibly want entry to those funds within the close to future. If they do not want them, these funds might probably change into my inheritance. I am in search of recommendation on the way to stability the necessity for progress with the necessity for preservation, given their age and potential monetary wants. Ought to I contemplate transferring these funds right into a extra conservative allocation, akin to a mixture of bonds and money?

Since this was “gifted” to you, it is in your books so it provides to the Wash Sale downside you’ve with S&P-500 index in each Taxable and Tax-Advantaged. Do you dad and mom have funding accounts of their very own? Ideally, if they’ve a Tax-Deferred account (Trad IRA and/or 401k), then they may improve their bond holdings in that sort of account, such that when included with the $320K in VOO (shares) their inventory/bond AA is acceptable for his or her timeframe (20 years assuming they reside to 90) and risk-tolerance (they need to additionally take the Vanguard Quiz or choose a “I can tolerate a portfolio drop of about -X%” from the chance/reward chart). As @invest4 mentioned, this is likely to be a separate publish to determine what else they’re holding after which add this $320K you are holding again into their general portfolio evaluation.

pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

3) Streamlining Positions for Tax-Loss Harvesting (TLH) Effectivity:

I notice that I used to be not very strategic with the location of sure investments between our Roth IRA and after-tax brokerage accounts. This has made tax-loss harvesting (TLH) tougher. What steps can I take to simplify TLH in our present portfolio setup and if it is sensible to do it? What different TLH methods might assist optimize our tax effectivity with out considerably impacting our general asset allocation or exposing us to scrub sale guidelines?

To unravel the issue of wash gross sales and make TLH simpler, you wish to eradicate all of the VTI, VOO/FXIAX, and VXF holdings within the tax-advantaged accounts (you are leaving Taxable alone to keep away from a tax-bill for swapping issues there). Discover some large-cap fund that’s NOT following the identical index as S&P-500 or the index VTI follows. That is likely to be a problem in your 401k. The choice is eliminating these three funds out of your Taxable account, in order that there is no duplication with tax-advantaged, however that might carry an enormous tax-bill, which is why I am suggesting you discover swaps within the tax-advantaged accounts as an alternative of Taxable. For those who checklist the fund selections in your 401k, we are able to seemingly assist. If you should buy ETFs within the Roth, HSA, and 529, then maybe Vanguard Giant Cap ETF (VV) is likely to be appropriate in these three accounts.

pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

4) Reinvestment Technique After Promoting Rental Property:

I’m contemplating promoting our rental property as a result of I’m uninterested in the obligations related to being a landlord. If I promote, I’m considering reinvesting the proceeds in a bond ETF like BND inside our after-tax account (however not sure) or simply hold as money in MM fund attending to ~10% allocation. I perceive this might not be probably the most tax-efficient possibility given the abnormal earnings tax therapy of bond curiosity. What different reinvestment methods would you suggest that would present a extra tax-efficient earnings stream or capital appreciation?

Whether or not you place the proceeds into bonds or money ought to be pushed by your desired/goal AA, which is the roadmap in your funding portfolios (retirement and non-retirement). Do not put it into 10% money until you’re one of many very, only a few which might be investing geniuses like Buffet and Koltrones. If you’re like most buyers, you must choose an AA that fits your risk-tolerance and make investments your cash amongst shares and bonds such that your AA is preserved (not off track by greater than ±5%).

pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

5) Do we want particular person life and LTD insurance coverage (with our NW)? Each of us at the moment have group LTD protection and life insurance coverage equal to 1x wage (each moveable) by our employers. Nonetheless, my partner has a power situation and is unable to acquire particular person life and LTD protection. I’ve no pre-existing circumstances and may qualify for particular person insurance policies. We’re planning to have a toddler quickly. We preserve group well being, P&C insurance coverage and umbrella insurance coverage equaling NW.

Getting life insurance coverage while you’re youthful and wholesome is way, a lot simpler than when your older -OR- have had any severe medical points in your file. Usually Term Life Insurance is healthier than entire/common sort insurance policies. The quantity of protection ought to be applicable to cowl bills for some particular interval (like 10 years, 30 years, 50 years, and so forth.), so 1X wage appears insufficient, as @invest4 mentioned.

pualius38 wrote: ↑Mon Sep 02, 2024 11:16 am

6) For property planning, our kin are abroad and are non-U.S. residents; it is simply my partner and me right here within the U.S. Based mostly on recommendation from a number of BH threads, important paperwork but to acquire embody a Will, Dwelling Will, and Healthcare Energy of Legal professional – please advise if I miss something. It’s also essential to make sure beneficiaries are designated on all accounts – are there any specifics I could miss? Nonetheless, this turns into complicated since our kin are abroad, until we identify one another as beneficiaries for every little thing. We nonetheless have a niece and nephew who’re worldwide college students within the U.S. and marvel if they are often named as beneficiaries. We contemplate ourselves rookies in property planning and would respect extra recommendation on the way to navigate these complexities.

You may seemingly wish to search an lawyer that focuses on property planning. Along with a will, dwelling will, and healthcare energy of lawyer, you may need a monetary energy of lawyer. For a very giant property, an property belief may also be thought-about since execution of a will entails probate by a court docket and a belief bypasses probate. Retirement accounts that enable for particular designation of main and contingent beneficiaries may also bypass probate (which even for modest estates can take nicely in extra of a 12 months to settle). As you famous, non-US residents might have difficulties acquiring their inherited belongings from a US brokerage, since Vanguard (for one) by default needs beneficiaries to create a web-based account, however that requires an SSN and an handle within the US. I am nonetheless working by that myself (my youngsters are Canadian and reside there, not right here). I am not conscious of how Constancy and Schwab would deal with overseas citizen beneficiaries, however most US brokerages have related guidelines to Vanguard (SSN and US handle required). Nonetheless, there have to be a strategy to take care of it as a result of you’ll be able to designate anybody as a beneficiary… US citizenship and residency will not be a requirement.

Earlier than you see an lawyer, you would possibly do nicely to learn by the hyperlinks within the Wiki subject on Estate Planning, so you’ve some concept of what you want/need earlier than you go in chilly and are paying $300/hour simply to come back in control on what property planning actually entails.

Do not do what Bogleheads let you know. Take heed to what we are saying, contemplate different sources, and make your individual selections, since you need to reside with the dangers & rewards (not us or anybody else).