Scores for Lululemon Athletica (NASDAQ:LULU) have been offered by 32 analysts previously three months, showcasing a mixture of bullish and bearish views.

The desk under summarizes their current rankings, showcasing the evolving sentiments inside the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Scores | 11 | 12 | 9 | 0 | 0 |

| Final 30D | 0 | 1 | 0 | 0 | 0 |

| 1M In the past | 5 | 4 | 5 | 0 | 0 |

| 2M In the past | 6 | 4 | 2 | 0 | 0 |

| 3M In the past | 0 | 3 | 2 | 0 | 0 |

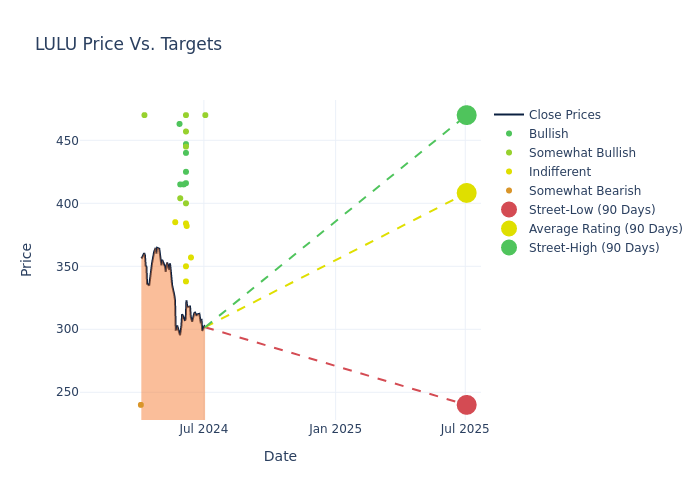

Within the evaluation of 12-month worth targets, analysts unveil insights for Lululemon Athletica, presenting a median goal of $427.34, a excessive estimate of $550.00, and a low estimate of $338.00. This present common represents a 11.34% lower from the earlier common worth goal of $482.00.

Understanding Analyst Scores: A Complete Breakdown

An in-depth evaluation of current analyst actions unveils how monetary consultants understand Lululemon Athletica. The next abstract outlines key analysts, their current evaluations, and changes to rankings and worth targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Mark Altschwager | Baird | Lowers | Outperform | $470.00 | $505.00 |

| Krisztina Katai | Deutsche Financial institution | Pronounces | Maintain | $357.00 | – |

| Aneesha Sherman | Bernstein | Raises | Market Carry out | $382.00 | $376.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $350.00 | $425.00 |

| Jim Duffy | Stifel | Raises | Purchase | $416.00 | $410.00 |

| Adrienne Yih | Barclays | Lowers | Equal-Weight | $338.00 | $395.00 |

| Matthew Boss | JP Morgan | Lowers | Chubby | $457.00 | $509.00 |

| Simeon Siegel | BMO Capital | Lowers | Market Carry out | $384.00 | $420.00 |

| Brian Nagel | Oppenheimer | Maintains | Outperform | $445.00 | $445.00 |

| Tom Nikic | Wedbush | Raises | Outperform | $400.00 | $397.00 |

| Lorraine Hutchinson | B of A Securities | Raises | Purchase | $440.00 | $430.00 |

| Dana Telsey | Telsey Advisory Group | Lowers | Outperform | $470.00 | $550.00 |

| John Kernan | TD Cowen | Raises | Purchase | $447.00 | $437.00 |

| Erwan Rambourg | HSBC | Pronounces | Purchase | $425.00 | – |

| Joseph Civello | Truist Securities | Lowers | Purchase | $415.00 | $498.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $550.00 | $550.00 |

| Paul Lejuez | Citigroup | Lowers | Purchase | $415.00 | $500.00 |

| John Kernan | TD Cowen | Lowers | Purchase | $437.00 | $515.00 |

| Alexandra Steiger | Morgan Stanley | Lowers | Chubby | $404.00 | $490.00 |

| Jim Duffy | Stifel | Lowers | Purchase | $410.00 | $539.00 |

| Brooke Roach | Goldman Sachs | Lowers | Purchase | $463.00 | $521.00 |

| Aneesha Sherman | Bernstein | Lowers | Market Carry out | $376.00 | $384.00 |

| Brooke Roach | Goldman Sachs | Lowers | Purchase | $463.00 | $521.00 |

| Lorraine Hutchinson | B of A Securities | Lowers | Purchase | $430.00 | $530.00 |

| Tom Nikic | Wedbush | Lowers | Outperform | $397.00 | $492.00 |

| Jay Sole | UBS | Lowers | Impartial | $385.00 | $475.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $550.00 | $550.00 |

| Adrienne Yih | Barclays | Lowers | Equal-Weight | $395.00 | $546.00 |

| Aneesha Sherman | Bernstein | Lowers | Market Carry out | $384.00 | $430.00 |

| Mark Altschwager | Baird | Lowers | Outperform | $505.00 | $555.00 |

| Abbie Zvejnieks | Piper Sandler | Lowers | Chubby | $470.00 | $525.00 |

| Brian Nagel | Oppenheimer | Lowers | Outperform | $445.00 | $540.00 |

Key Insights:

- Motion Taken: Analysts adapt their suggestions to altering market situations and firm efficiency. Whether or not they ‘Keep’, ‘Elevate’ or ‘Decrease’ their stance, it displays their response to current developments associated to Lululemon Athletica. This data gives a snapshot of how analysts understand the present state of the corporate.

- Score: Analysts unravel qualitative evaluations for shares, starting from ‘Outperform’ to ‘Underperform’. These rankings supply insights into expectations for the relative efficiency of Lululemon Athletica in comparison with the broader market.

- Value Targets: Analysts navigate by changes in worth targets, offering estimates for Lululemon Athletica’s future worth. Evaluating present and prior targets presents insights into analysts’ evolving expectations.

Seize priceless insights into Lululemon Athletica’s market standing by understanding these analyst evaluations alongside pertinent monetary indicators. Keep knowledgeable and make strategic choices with our Scores Desk.

Keep updated on Lululemon Athletica analyst rankings.

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic attire, footwear, and equipment for girls, males, and women. Lululemon presents pants, shorts, tops, and jackets for each leisure and athletic actions resembling yoga and operating. The corporate additionally sells health equipment, resembling luggage, yoga mats, and tools. Lululemon sells its merchandise by greater than 700 company-owned shops in about 20 international locations, e-commerce, shops, and wholesale accounts. The corporate was based in 1998 and is predicated in Vancouver, Canada.

Key Indicators: Lululemon Athletica’s Monetary Well being

Market Capitalization Evaluation: The corporate’s market capitalization surpasses business averages, showcasing a dominant dimension relative to friends and suggesting a powerful market place.

Optimistic Income Development: Analyzing Lululemon Athletica’s financials over 3 months reveals a optimistic narrative. The corporate achieved a noteworthy income progress charge of 10.4% as of 30 April, 2024, showcasing a considerable enhance in top-line earnings. As in comparison with its friends, the corporate achieved a progress charge increased than the typical amongst friends in Client Discretionary sector.

Internet Margin: Lululemon Athletica’s internet margin is spectacular, surpassing business averages. With a internet margin of 14.55%, the corporate demonstrates robust profitability and efficient price administration.

Return on Fairness (ROE): Lululemon Athletica’s ROE stands out, surpassing business averages. With a formidable ROE of 7.61%, the corporate demonstrates efficient use of fairness capital and powerful monetary efficiency.

Return on Belongings (ROA): Lululemon Athletica’s ROA stands out, surpassing business averages. With a formidable ROA of 4.62%, the corporate demonstrates efficient utilization of property and powerful monetary efficiency.

Debt Administration: With a below-average debt-to-equity ratio of 0.33, Lululemon Athletica adopts a prudent monetary technique, indicating a balanced method to debt administration.

How Are Analyst Scores Decided?

Analysts are specialists inside banking and monetary methods that sometimes report for particular shares or inside outlined sectors. These folks analysis firm monetary statements, sit in convention calls and conferences, and communicate with related insiders to find out what are generally known as analyst rankings for shares. Sometimes, analysts will charge every inventory as soon as 1 / 4.

Analysts might improve their evaluations by incorporating forecasts for metrics like progress estimates, earnings, and income, delivering extra steering to buyers. It’s important to acknowledge that, though consultants in shares and sectors, analysts are human and specific their opinions when offering insights.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/analyst_ratings_image_4.png)