Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Blackstone, Creation Worldwide and TPG Capital are amongst an extended record of personal fairness corporations learning bids for Bausch + Lomb, in line with individuals near the discussions, after the eyecare firm kicked off a sale course of to interrupt the deadlock over a spin-off from its indebted guardian.

Bausch + Lomb was put up on the market after a deliberate separation from its guardian firm Bausch Health, previously often called Valeant, unravelled amid tensions between activist traders and collectors owed $21bn by the guardian firm.

Non-public fairness teams KKR, CVC Capital and Hellman & Friedman are additionally contemplating bids for the eyecare enterprise, forward of a tender deadline later this week, in line with individuals accustomed to the matter.

The corporations have held conferences with Bausch + Lomb’s administration crew — which is led by chief govt Brent Saunders, a well known dealmaker — in latest weeks, they added.

Potential bidders should specific curiosity in making a proposal by Friday to remain within the course of, individuals accustomed to the matter stated. There isn’t a assure that the sale course of will lead to a deal. Bausch Well being can be exploring different choices, together with refinancing a few of its debt.

Bausch + Lomb, which is being suggested by Goldman Sachs, needs to enter into unique talks over a potential sale by the top of October. A goal sale value for the enterprise couldn’t be ascertained, however is more likely to come at a premium to the present enterprise worth together with debt of $11.5bn.

TPG is especially all in favour of Bausch + Lomb because it might extract synergies with BVI Medical, an ophthalmology firm it already owns, one individual stated.

Bausch + Lomb and Goldman Sachs in addition to Creation, Blackstone, H&F, KKR and TPG declined to remark. Bausch Well being and CVC didn’t instantly reply to a request for remark.

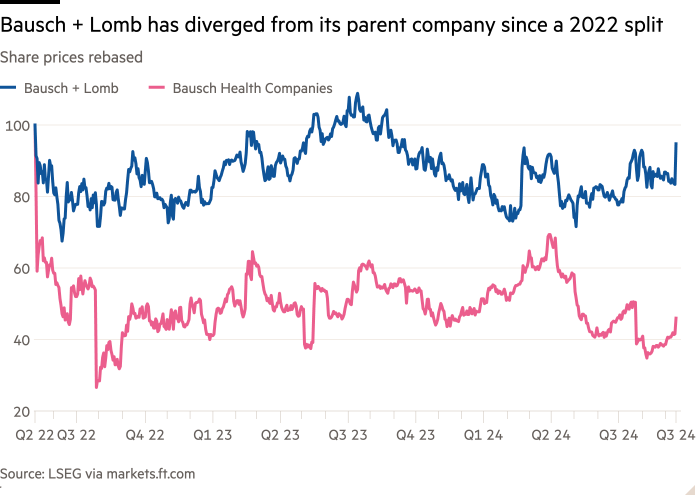

After asserting a spin-off 4 years in the past, Bausch + Lomb was listed as a separate firm in 2022 however Bausch Well being retained an 88 per cent shareholding. Due to issues from lenders over the well being of Bausch Well being’s steadiness sheet, the unique plan to strike a take care of traders to trade Bausch Well being inventory for Bausch + Lomb got here undone.

Bausch Well being collectors, together with Apollo Administration, Elliott Administration, GoldenTree Asset Administration and Silver Level Capital, opposed a spin-off over issues that it might depart the guardian firm bancrupt, as it might lose its extra worthwhile subsidiary simply forward of roughly $10bn price of maturities coming due earlier than the top of 2027.

In distinction, Bausch Well being’s prime shareholders, activist investor Carl Icahn and John Paulson’s fund Paulson & Co, who’ve board illustration at each the guardian firm and its subsidiary, had supported the completion of a spin-off as it might give them a big shareholding within the extra worthwhile eye care enterprise. A sale, nevertheless, might fulfill each events, as it might realise a sizeable return for shareholders and provides Bausch Well being money to pay its money owed.

Bausch + Lomb is projected to generate practically $860mn in adjusted earnings earlier than curiosity, taxation, depreciation and amortisation from $4.7bn in revenues this yr, practically three-fifths of which comes from gross sales of contact lenses and dry eye medication Xiidra and Miebo. The corporate additionally sells surgical gear to ophthalmologists.

Because the Monetary Instances reported over the weekend that Bausch + Lomb was working with advisers to check curiosity from personal fairness patrons, its share value has elevated 19 per cent, valuing its fairness at $6.5bn as of Tuesday’s market shut.

David Saxon, a Needham analyst, stated in a observe earlier this week that he believed personal fairness was “the almost certainly purchaser”. However he added that “it’s unsure a [Bausch + Lomb] sale would alleviate traders’ issues round [Bausch Health’s] solvency and might be challenged by [Bausch Health’s] collectors.”

Bausch Well being faces additional uncertainty as its lead drug — Xifaxan, a gastrointestinal medicine — is about to return off patent by 2029. Bausch Well being’s market worth has risen by 13 per cent to $2.6bn this week, however stays under its worth earlier than the corporate confronted authorized challenges over its Xifaxan patents.