NIKKEI 225 (N225) Elliott Wave Evaluation Buying and selling Lounge Day Chart,

NIKKEI 225 (N225) Elliott Wave technical evaluation

Perform: Counter Pattern.

Mode: Corrective.

Construction: Orange Wave C.

Place: Navy Blue Wave 4.

Course subsequent larger levels: Navy blue wave 5.

Particulars: Orange wave B of wave 4 trying accomplished, now orange wave C is in play.

Wave Cancel invalid degree: 41239.

The NIKKEI 225 Elliott Wave Evaluation on the each day chart focuses on understanding the present market dynamics by the lens of the Elliott Wave Precept. This evaluation identifies the operate as a counter development, indicating that the market is at present in a part that strikes in opposition to the prevailing development. The mode of this motion is corrective, which means it’s a momentary retracement or consolidation throughout the bigger development.

The first wave construction beneath scrutiny is orange wave C, which is positioned inside navy blue wave 4. This implies that the market is within the fourth wave of a bigger wave sequence, and particularly, throughout the third sub-wave of this fourth wave. The route for the following larger diploma is in the direction of navy blue wave 5, which signifies that after the present corrective part is full, the market is predicted to renew its main development route within the fifth wave.

Particulars from the evaluation spotlight that orange wave B of wave 4 is probably going accomplished, setting the stage for orange wave C to come back into play. Orange wave C is a part of the corrective sample and represents the ultimate leg of the correction earlier than the development resumes. The completion of orange wave B signifies a pivotal level available in the market, the place the correction is probably going transferring in the direction of its finish part, making ready for the continuation of the primary development.

An invalidation degree is ready at 41239. This degree is essential as a result of if the market value reaches or exceeds this level, it will invalidate the present wave rely and necessitate a reevaluation of the wave construction. This invalidation degree acts as a safeguard for merchants, making certain they will alter their methods if the market behaves unexpectedly.

In abstract, the NIKKEI 225 Elliott Wave Evaluation on the each day chart gives an in depth outlook of the market’s corrective part inside a counter development. With orange wave B of navy blue wave 4 probably accomplished, the main target is now on orange wave C. Merchants ought to pay attention to the invalidation degree at 41239, which serves as a essential level for reassessing the wave rely. This evaluation aids in making knowledgeable selections by anticipating the following part of market motion throughout the Elliott Wave framework.

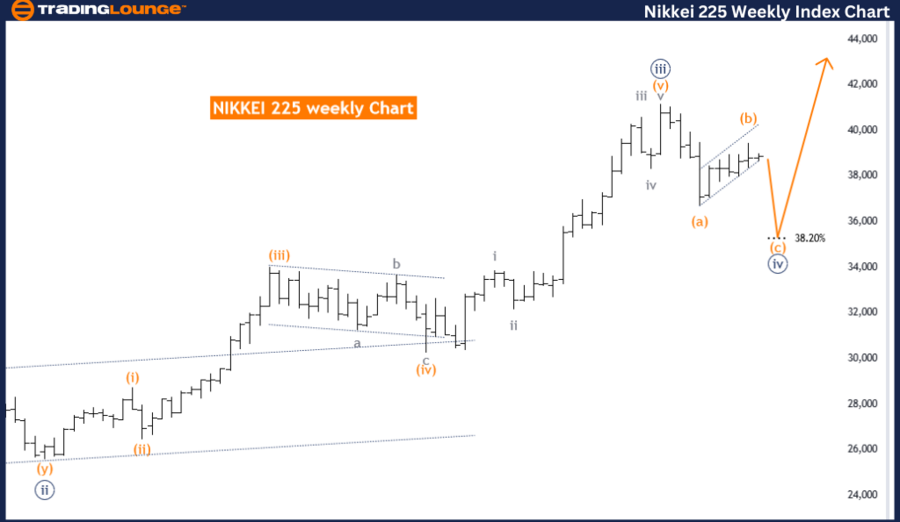

NIKKEI 225 (N225) Elliott Wave Evaluation Buying and selling Lounge Weekly Chart

NIKKEI 225 (N225) Elliott Wave technical evaluation

Perform: Counter Pattern.

Mode: Corrective.

Construction: Orange wave C.

Place: Navy Blue Wave 4.

Course subsequent larger levels: Navy Blue Wave 5.

Particulars: Orange wave B of wave 4 trying accomplished, now orange wave C is in play.

Wave cancel invalid degree: 41239

The NIKKEI 225 Elliott Wave Evaluation on the weekly chart gives insights into the market’s present conduct utilizing the Elliott Wave Precept. This evaluation identifies the market operate as a counter development, indicating that the present actions are in opposition to the first development. The mode is corrective, suggesting a brief retracement or consolidation part moderately than a continuation of the primary development.

The first wave construction being analyzed is orange wave C, which is an element of a bigger corrective sample. This wave is positioned inside navy blue wave 4, indicating that the market is within the fourth wave of a broader wave sequence. Following the completion of this corrective part, the market is predicted to proceed to navy blue wave 5, resuming the first development route.

The evaluation particulars that orange wave B of navy blue wave 4 seems to be full. This completion indicators a essential level within the corrective sample, because it suggests the market has completed the previous phase of the correction and is now transitioning into orange wave C. This wave represents the ultimate leg of the correction earlier than the market resumes its most important development.

A key facet of the evaluation is the invalidation degree set at 41239. This degree is essential for merchants and analysts as a result of if the market value reaches or surpasses this level, the present wave rely could be invalidated. This implies the anticipated wave construction would now not be legitimate, necessitating a reassessment of the market’s wave patterns. The invalidation degree serves as a safeguard, making certain that methods will be adjusted if the market doesn’t behave as anticipated.

In abstract, the NIKKEI 225 Elliott Wave Evaluation on the weekly chart outlines a corrective part inside a counter development. With orange wave B of navy blue wave 4 probably accomplished, the focus shifts to the event of orange wave C. This part is essential because it marks the ultimate half of the correction earlier than the market resumes its main development in the direction of navy blue wave 5. The evaluation highlights the significance of the invalidation degree at 41239, which helps in validating the present wave rely and adjusting trading strategies accordingly.

Technical analyst: Malik Awais.

NIKKEI 225 (N225) Elliott Wave technical evaluation [Video]

![[original_title]](https://rawnews.com/wp-content/uploads/2024/05/nikkei-225-index-17329557_Large.jpg)