kaktusUSA wrote: ↑Sat Sep 07, 2024 9:35 pm

I’m divorcing and can be left with $500k in money and a paid off house as my total web value. I am 40 with no youngsters and do not know after I’ll have the ability to retire.I earn a modest revenue ($50k) and wished to construct a portfolio that was going to be completely dividends to complement my revenue as I do want the revenue however I am fairly novice at this.

I used to be considering:

20% VTI

20% AVGV

15% TLTAfter which for the revenue element:

20% spead throughout varied reit etfs

25% unfold throughout dividend aristocrat etfs and particular person sharesWould this be an awesome set and neglect portfolio so I can profit from development in VTI whereas incomes a modest further revenue from the dividends?

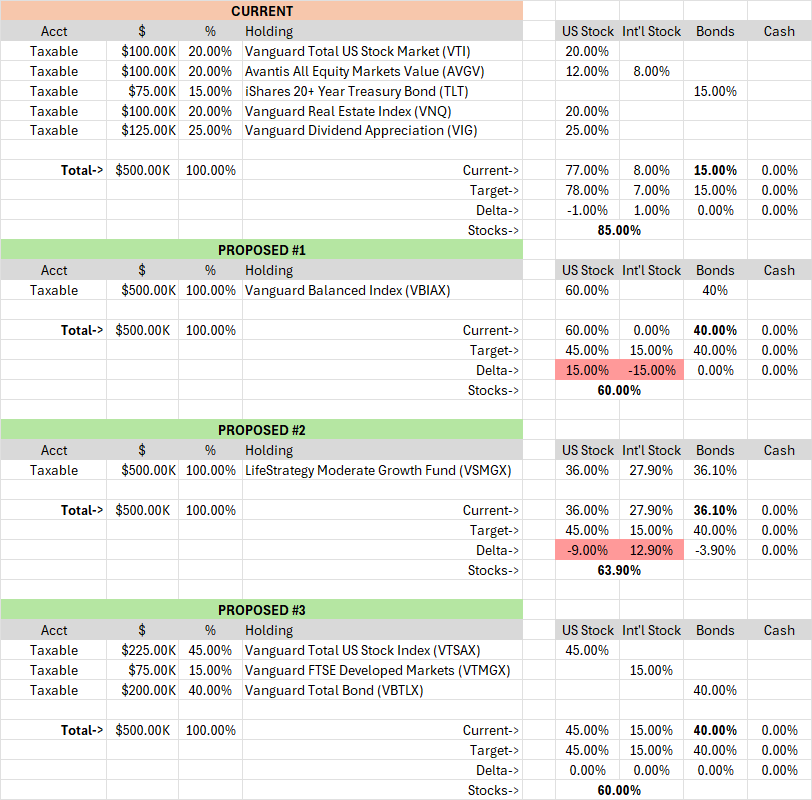

What you are proposing above is about 85% shares / 15% bonds, with about 9.4% of shares in worldwide. In a later put up you mentioned you’d think about 25% of shares in worldwide, however no fundamental allocation amongst shares and bonds.

Somewhat than specializing in dividends, it could be higher to take a look at Safe Withdrawal Rates primarily based on whole return (dividends + capital appreciation). In case you want the revenue to final till you are 95, that is a 55-year withdrawal interval , so the 4% rule for 30 years from the Trinity Examine is diminished to three.15% for a 55-year interval. 3.15% of $500K is about $15,750/yr of withdrawals to complement your $50K/yr wage. You can enhance withdrawals every year by +3%/yr for inflation and the portfolio would have a 90%+ probability of not operating out earlier than you attain age 95.

The Trinity Study Update confirmed that any Asset Allocation (AA) between 35/65 and 90/10 is more likely to help a 4% withdrawal charge for 30 years. Given that you could be be new to investing, a less-aggressive AA may appear appropriate, however the level is that your AA would not drive portfolio survivability a lot because the constant-dollar withdrawal quantity (4% is a reference to be tailor-made) and the withdrawal interval (once more 30 years is a reference to be tailor-made). You need to select an AA primarily based in your Sleep Properly At Night time (SWAN) issue… what inventory allocation are you able to deal with such that you just will not lose sleep over anxiousness and that you just will not panic-sell in a correction/crash? To reply that query, listed below are two workouts that may assist (choose one or do each!).

Management Your Danger

1) Learn the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was advisable by the quiz primarily based in your data of your private danger tolerance having learn the Wiki article.

2) Alternatively (or along with), ask “How a lot of a drop in portfolio worth as a % of whole worth can I deal with?” lower that % in half to get commonplace deviation, then lookup that std. dev. on the X-Axis of the chart under, and eventually scan as much as see what AA that corresponds to. For example, should you can solely abdomen a -24% drop in portfolio worth, that is a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is a mean and you will get what you get along with your distinctive sequence of returns (there’s a whole lot of variance in outcomes because of the related volatility of shares so it most likely will NOT be the common, however one thing kind of).

If we assume that 85/15 is a bit too aggressive and that you just wished one thing much less risky like 60/40 with 25% of shares in int’l, then here is a take a look at what you initially proposed below “Present” and a few a lot easier various proposals. Take into account any of those will doubtless work primarily based on the Trinity Examine Replace findings; you are specializing in one thing that meets your SWAN issue and is simple to handle (which often means easier!).

Your authentic setup is probably going bigger than 7 holdings since you talked about a number of REIT ETFs and dividends ETFs/particular person shares, which is probably going simply including complication with out a whole lot of diversification or different added worth.

Proposals #1 and #2 are by the far the best, as they’re one-fund options, however #1 has no worldwide publicity and #2 has the world-cap weighting of 40% moderately than your diminished goal of 25%. #3 is easier than your authentic solutions (7+ holdings down to three), however continues to be fairly easy to judge and rebalance yearly and higher meets your goal AA (and it avoids rising markets like Africa & Center East).

My advice could be #2 because it gives int’l publicity within the world-cap weighting, however should you really need 25% of shares vs 40% in int’l, then #3 is probably going a greater match (#3 additionally is just not Complete Int’l like #2, it is developed markets that keep away from rising markets in Africa and Center East). Since these are utilizing mutual funds moderately than ETFs, it must be simple to set all of them to auto-reinvest any distributions after which additionally setup an automatic withdrawal plan in some proportion from every fund for #3 (it is easy for #2 since you simply break up your $15K/yr into 12 month-to-month withdrawals from a single fund). I’ve heard organising automated withdrawals from ETFs is just not all the time potential, thus I’ve instructed mutual funds moderately than ETFs for #3, however should you actually favor ETFs you may nonetheless make that work.

The proposals above are from a present/proposed rebalancing template I developed which is linked under.

Asset Allocation Sheet

AA Current and Proposed

I feel any of the proposal above will fulfill your want for present revenue (the quantity every year is mounted by the three.15% secure withdrawal, though you would possibly need to take a look at Alternative Withdrawal Methods because the constant-dollar technique used within the Trinity Examine is nice for portfolio survival evaluation, however is probably going not the perfect method to make use of for real-world software… VPW appears very doubtless the perfect should you do not care to depart a big residual to heirs).

Ask follow-on questions if one thing’s not clear. No matter you determine, attempt to preserve it easy. Selecting a fundamental allocation amongst shares & bonds to your SWAN issue is fairly essential to get that determined immediately.

“Simplicity is the grasp key to monetary success.” — John C. Bogle

Do not do what Bogleheads inform you. Hearken to what we are saying, think about different sources, and make your personal selections, since it’s important to stay with the dangers & rewards (not us or anybody else).

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/New-500k-portfolio-Bogleheadsorg.png)