Nation of Residence: Netherlands (EUR foreign money)

Worldwide Way of life: No plans to stay overseas in future

Age: Near 50

Present asset allocation:

- About 25x dwelling bills in shares (index funds; worldwide, together with EM and SC)

- About 3x dwelling bills in money

- House-ownership with about 20% LTV mortgage left, rate of interest at 1.5% (mounted till 2030 when most of it’s paid off)

- No different debt

- Social safety/pension built-up to cowl 100% of dwelling bills beginning 20 years from now (that is largely however not totally inflation protected).

Psychology: Fairly stable ‘keep the course’. No worries on inventory efficiency across the 2000 crash nor the 2008 crash. Perceive psychology modifications in withdrawl section versus accumulation change. Not so fearful about this side (sure, I’ve learn the sheepdog and another threads, very informative!), however it’s on my thoughts when contemplating diversification.

Price mentioning: The Dutch tax system isn’t like most others. For these not acquainted, the spotlight (or lowlight) is – in abstract – that we have now a wealth tax that at the moment relies on the kind of asset:

- Money in financial savings accounts / deposits in banks is taxed at <0.5% of the full asset worth yearly

- All different (non-home, non-social safety) belongings are taxed at ±2% of the full worth yearly. This contains shares, bonds, gold, you identify it.

There may be political and authorized dialogue of transferring to a ‘correct’ capital good points tax, however it’s not clear what it’s going to appear to be and when it’s going to begin. It would doubtless take a few years, so let’s assume for this dialogue the system stays unchanged.

Hello all, thanks for making it this far down my submit

As you possibly can see from above, I get near the second I can ‘pull the plug’ and RE, and it is time to think about what it means for my asset allocation. To this point it has been fairly straightforward: Primarily 100% shares all the way in which for accumulation long run. However I do know somewhat about glidepaths and constructs to scale back SORR, particularly across the second of RE. I’m conscious I in all probability must act on this, however unsure how precisely but.

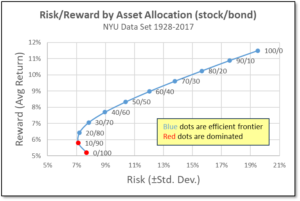

My psychology is fairly risk-tolerant for the very best long-term good points, so I’ve somewhat hurdle to beat to maneuver away from 100% shares. I realise intellectually the previous few a long time have been fairly good (too good?) for shares, even with the dips ±2000, 2008 and 2020 since they’ve bounced again shortly. I additionally realise with backtesting it is intellectually clear that diversification has labored many instances up to now, however I additionally imagine that not every thing is identical because it was (for higher or worse).

So the particular query I’ve been eager about recently, is what’s one of the best ways to diversify in my state of affairs: Having a snug and dependable cushion in about 20 years with social securty/pension means I can afford a bit extra danger than some; and the Dutch tax system’s particulars make investing in low-return (low-risk) belongings much less enticing comparatively.

I’ve used calculators resembling ERN and portfoliocharts to estimate impression of varied asset allocations and properly with ERN I can set an expense ratio of two% to simulate our tax system.

1. One discovering that has me somewhat puzzled, is that gold appears to be a greater diversifier than bonds in lots of instances: increased withdrawl charges, decrease danger. However individuals nonetheless use bonds significantly extra usually than gold. I assume on this discussion board there could also be some bias in direction of bonds, however I really feel I is perhaps lacking one thing. Small notice: I do not actually imagine within the worth of gold, however backtesting suggests it is labored properly up to now 100+ years.

FYI, among the backtesting instructed a 3.5% WR based mostly on 100% worldwide shares, growing to 4.4% in 80/20 with gold, however solely 3.8% in 80/20 with bonds. In a second calculator it appears 20% gold outperformed 20% bonds by 0.2-0.8% factors WR throughout disaster situations.

Any ideas on this? Bond efficiency within the house market could differ rather a lot I assume, and native inflation could have an effect on issues; however the gold-advantage holds when setting house market Netherlands and in addition when setting house market USA (notice shares are worldwide in each instances, so house market ought to solely have an effect on bonds and inflation).

2. I’ve additionally performed with extra variable withdrawl charges. I can cut back my deliberate bills by about 30% for an prolonged time with out struggling an excessive amount of high quality of life (simply no upside for extra enjoyable issues in comparison with now). I even have a house that’s largely paid off and an choice to maneuver to a smaller house if wanted, which is able to doubtless web me a couple of years dwelling bills even in a depressed real-estate market. This offers me some confidence a minimum of that I can cowl the 1-2% failure likelihood a set withdrawl fee would give (even in 100% shares state of affairs). Are there any experiences right here with variable withdrawls like that? Any specific issues to look out for?

3. I suspect know I’m being too grasping and never fearful sufficient of the 100% shares, now that they’re so excessive (CAPE). I am certain most, if not all of you agree with that. It is not likely one thing I must ask. I additionally assume that I would like to vary my mindset from accumulation (long run upside safety) to withdrawl (shorter time period draw back safety). Nevertheless, are there any ideas based mostly on our tax system’s unfavorable remedy of bonds (and gold)? I do know these belongings will not be chosen for the returns they offer, however getting robbed of two% along with the danger of not even maintaining with inflation is a giant hurdle to recover from (notice: This isn’t a political assertion, only a fact-based and psychological one).

4. I admit I do not totally perceive bond funds but. The overall mechanism of bonds I perceive: if rates of interest go up, current bonds with decrease charges are much less enticing, so they are going to be priced decrease to extend the yield (and vice versa). However what useful resource would you advocate that explains (market) pricing of bond funds somewhat extra? Shopping for particular person bonds could also be a great way to take away that pricing fluctuation, however it means holding them to maturity which makes them much less liquid (otherwise you simply get the identical danger if promoting early). Nevertheless, bond funds repeatedly run, so it appears you by no means know what to anticipate as there isn’t any ’till maturity’ for the fund.

5. Associated somewhat to the above (and maybe for context, not likely a query); the bond fund I used to be contemplating is iShares International Combination Bond ESG UCITS ETF EUR Hedged (Acc) ISIN IE000APK27S2. That is another I can simply pay money for, and performs almost equivalent to the same iShares Core International Combination Bond UCITS ETF EUR Hedged (Acc) ISIN IE00BDBRDM35 that I’ve seen talked about right here on the wiki in easy non-us portfolios. (I’ve not picked a gold fund to think about, it appears more durable to seek out low-cost choices I’ve entry to)

Thanks in your ideas!