I’d assume they’d need the best returns relatively than additional dividends (which aren’t free cash). It is complete return that issues. If you happen to take a look at the returns beneath VTI outperformed. Now possibly that was simply since 2015 or 2017 however nonetheless, you realize with VTI you may get the return of the market.

PE for VTI is 25, PE for VTV is 20. PE shouldn’t be essentially a predictor of future returns.

You do not have “different industries” with VTV that you do not have already got with VTI as a result of VTI is TOTAL. You’ll have completely different weightings to the identical industries (and possibly that is what you meant by “higher”) however you do not have something with VTV that you do not have with VTI.

Here is VTI:

Primary Supplies 1.80%

Client Discretionary 13.60%

Client Staples 4.30%

Power 4.00%

Financials 11.20%

Well being Care 11.50%

Industrials 12.60%

Actual Property 2.70%

Know-how 33.60%

Telecommunications 1.90%

Utilities 2.70%

And VTV:

Primary Supplies 1.60%

Client Discretionary 7.50%

Client Staples 9.10%

Power 7.10%

Financials 20.20%

Well being Care 17.10%

Industrials 15.30%

Actual Property 3.10%

Know-how 10.10%

Telecommunications 3.30%

Utilities 5.40%

You see, each funds have the identical industries. Completely different allocations to these industries, however not completely different industries.

The most important variations with VTV I see are : 1. a much bigger allocation to financials and a pair of. a smaller allocation to know-how.

However you all the time need to ask your self, why you assume you realize greater than the market?

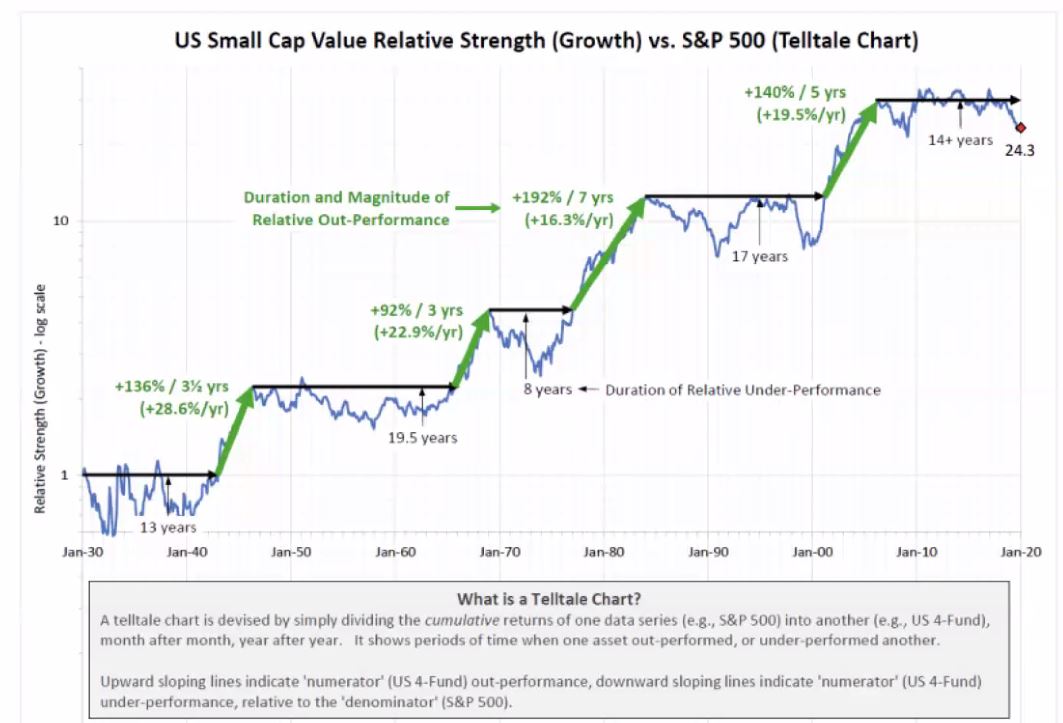

The next is not only purely worth, it is small cap worth, however the concept is identical. Typically buyers discover holding worth very laborious as a result of it will probably have very lengthy durations of underperformance (relative to the market) after which quick bursts of outperformance that (previously) has made it worthwhile to carry (to get the outperformance relative to the market, long run). However it’s a must to have extraordinary endurance. Some have argued the behavioral facet is why there even is a worth premium; as a result of so many surrender on the factor proper earlier than the outperformance reveals up. Are you a affected person individual? Investor know thyself:

once more, unsure how you might be defining diversfication. VTI has ALL shares out there. VTV is overlapped by 42% (supply: https://www.etfrc.com/funds/overlap.php) however you are not getting something that VTI does not already comprise.

If you’d like diversification you’d need to maintain Vanguard Whole Worldwide Inventory Market Index Fund (or ETF). That provides you among the identical sector diversification (when it comes to extra weighting to different sectors relatively than know-how) AND DIFFERENT firms not already contined in VTI.

Take a look at the primary chart I posted above. VTV had a drawdown of -59.27%. VTI had a drawdown of -55.45%. If you happen to take into account the volatility of VTV: 18.93% vs the volatility of VTI: 19.04% vital, okay, however I do not see these as very a lot completely different when it comes to normal deviation/volatility, and many others. (the ulcer index was greater for VTV than VTI) And total VTI had greater threat adjusted returns (sharpe and sortino) than VTV, which suggests you took some threat with VTV that you just weren’t rewarded for taking.

what do you assume now?

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Besides-higher-dividends-with-etf-vanguard-value-vs-vanguard-total-1024x468.jpg)