Effectively, that was kinda sudden!

Within the three months or so since we final spoke, the world has develop into a completely totally different place – a minimum of for these of us who sustain with any kind of worldwide, monetary or inventory market information.

The headlines are new, and the issues are in fact very actual. Russia has began one of many greatest, shittiest wars in a era – killing untold 1000’s of individuals, displacing thousands and thousands, and halting trillions of {dollars} of manufacturing and commerce. This has compounded the “every part scarcity” of damaged provide chains that now we have all been feeling for the previous two years, creating much more inflation particularly in oil costs. And simply to amplify every part even additional, China has launched a batshit loopy (and medically unimaginable) “zero covid” coverage, locking down a whole lot of thousands and thousands of its personal individuals who can not produce or export the issues that the remainder of the world’s economic system had grown to depend on.

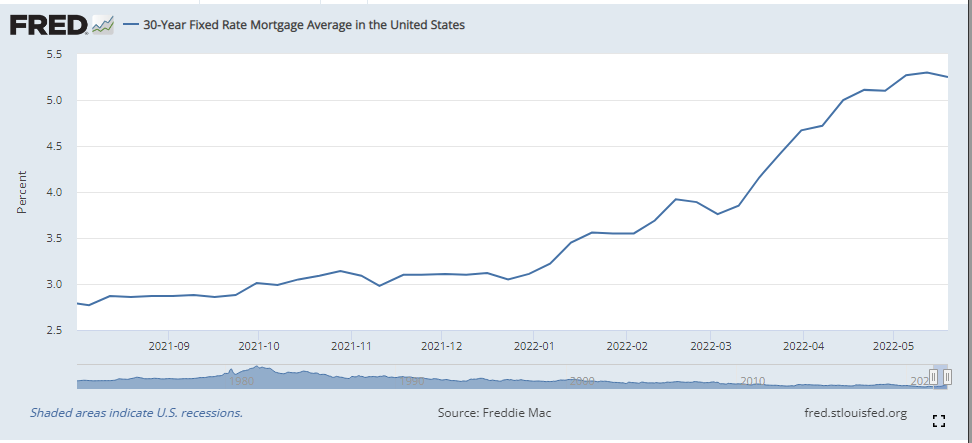

The ensuing scarcity of products and employees has created rising costs (inflation), which has triggered our central bankers to lastly rise from their slumber and begin jacking up rates of interest.

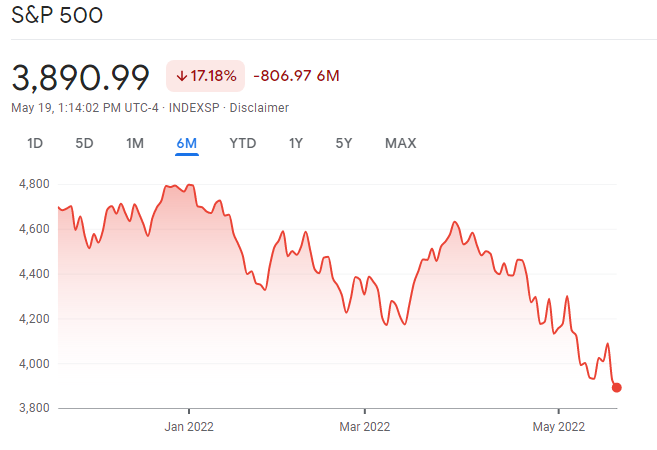

Which has in flip triggered the extra skittish inventory traders to run for the exits and fully change their view of our financial future, flooding the monetary information with crimson ink and scary headlines.

The underside line is that the general US inventory market is down about 20% over the previous three months. Which implies that in the event you add up your web price as I do often, chances are you’ll discover that nearly a fifth of it has all of a sudden gone up in smoke.

Thankfully, that is simply an phantasm. Whereas the human aspect of each battle is terrible and it’s best to assist out in the event you can, the monetary aspect of this panic could be very regular and we had been overdue for one thing like this to occur.

A 20% drop in inventory costs is known as a “bear market” they usually historically occur each few years, lasting simply 9 months or so from high to backside. However within the Mustachian Period (the years since 2011 after I started writing this blog), there has solely been one: the 2020 Covid Crash which solely lasted a couple of month. Heck, even in my 25 12 months investing lifetime (roughly 1997 to current), there have solely been a handful:

| Bear market date | Decline (peak to trough) | Length (months) |

| March 2000 – Sept 2001 (dotcom bust) | -36% | 18 |

| Jan – October 2002 (extra dotcom+housing) | -34% | 9 |

| Oct 2007-Nov 2008 (nice monetary disaster) | -52% | 14 |

| Jan – Mar 2009 (extra GFC) | -28% | 2 |

| Feb-March 2020 (covid crash) | -34% | 1 |

| April 2022 – ??? (the present blowup) | -20% up to now | What’s your guess? |

.

So in the event you’re underneath 40, a few of this will likely really feel unfamiliar.

Now that we’ve coated the background, we are able to get into some higher information:

- That is all a standard, wholesome a part of the financial cycle. In truth, our central bankers have intentionally created this case in your personal good they usually in all probability ought to have executed it a 12 months in the past.

- In case you are nonetheless shopping for or holding shares (versus actively promoting them), this inventory market crash is definitely making you richer

- Even if you’re retired and residing totally off of your investments, inventory market declines are to be anticipated and mustn’t derail your lifetime of leisure – so long as you’re following a tough approximation of the 4% rule and stay versatile and perceive the idea of a Safety Margin.

In the event you actually perceive the factors above and actually really feel excited about them, you may drop the concern and stress out of your investing life, which suggests you’ll reside a life that’s each wealthier, and extra enjoyable. So let’s cowl every level correctly, so that you may be enthusiastic about all this as I’m.

1) Why is that this wholesome once more?

First, the half concerning the Federal Reserve and why a central banking system is so helpful (regardless of the claims of economic anarchists like Bitcoin lovers):

When one thing unhealthy occurs (just like the sudden deliberate recession we induced attributable to our personal 2020 Covid shutdowns), the Fed can drop rates of interest and “print cash” in different methods to spice up funding and demand within the economic system. And it really works – this is the reason our economic system bounced again so rapidly from the most important slowdown in historical past.

Some may say it labored too properly – whereas now we have benefited from report low unemployment, now we have additionally seen costs of homes, shares, and every part else rise with alarming pace. So ultimately, they needed to flip off the booster.

By elevating rates of interest, the central bankers put a slight drag on enterprise spending, client borrowing and inventory market exuberance. This lowers demand for every part, which pours some chilly water on inflation. The deflating of essentially the most overpriced shares exhibits that the coverage is working. And over the subsequent 12 months, increased mortgage charges must also finish the loopy bidding battle of a housing market we’ve been seeing in most cities.

However inventory market crashes and even temporary recessions are good for extra than simply combating inflation. They’re good for combating a persistent flaw in human nature itself.

People are lazy creatures at coronary heart. When issues get too simple, we lose our edge and our motivation to be taught, innovate and make modifications. It occurs on the particular person stage, as I discover after I waste sure evenings on the sofa conducting nothing. And it occurs much more within the collective sense, if a gaggle of individuals secures a pleasant stream of energy and revenue that continues to be unchallenged.

Think about that you just’re operating an organization. Your prospects preserve shopping for your stuff it doesn’t matter what you do, traders bid your inventory worth as much as the moon no matter your monetary efficiency, and there’s no competitors on the horizon. What do you assume will occur to your monopoly?

There’s no want to invest on this, as a result of it has occurred to various levels because the starting of financial time. The reply is that you begin to suck. Your product innovation stagnates, your prospects develop much less and fewer blissful, and your traders develop nervous. Ultimately, one thing comes alongside to poke at this bubble of complacency – on this case battle and covid and inflation – after which POP! – your gross sales dry up, your inventory worth crashes, and your cozy company desk has become a tattered garden chair within the parking zone and your corporation is finished.

However wait! Whilst you had been including that last layer of lipstick to your out of date movie digicam or handbook typewriter or gasoline-powered line of automobiles and vans, there truly had been rivals on the market, inventing higher merchandise and providing higher customer support and conserving their steadiness sheets lean, as a result of they needed to, as a result of issues for them had been onerous.

Your inefficient firm goes out of enterprise, and your extra nimble rivals welcome your former prospects. They might even suck up one of the best of your former workers and purchase your previous manufacturing unit to start out making new, higher merchandise.

This occurs on a regular basis, and whereas it may be painful for individuals who weren’t ready, it’s a wholesome factor for enterprise general. And a wholesome factor for overpriced housing markets, and the speculatively inflated costs of oil, lumber, copper and every part else.

To a sure extent, the excessive costs had been helpful in sending a sign that we have to produce extra of these items. However past that restrict, folks began shopping for overpriced shares, homes, cryptocoins and commodities just because they hoped to make a fast buck by flipping them to another person at the next worth. As an alternative of investing in a productive asset, these speculators had been simply assuming the latest momentum would proceed. One of these playing is a waste of everybody’s time, and a superb worth crash is the best way we flush the monetary bathroom.

2) My web price has simply cratered by 20%. How precisely does this imply I get richer?

The very first thing to ask your self is, “20% of what?”

Positive, inventory costs are down from a latest peak, however that peak itself was simply an arbitrary fleeting second of investor enthusiasm. Was that earlier worth actually the “proper” worth for shares, or did you simply develop hooked up to it due to our identified human weak point of Loss Aversion?

To place it one other method, what if as a substitute of our investments because the monetary media likes to painting them, which is like this:

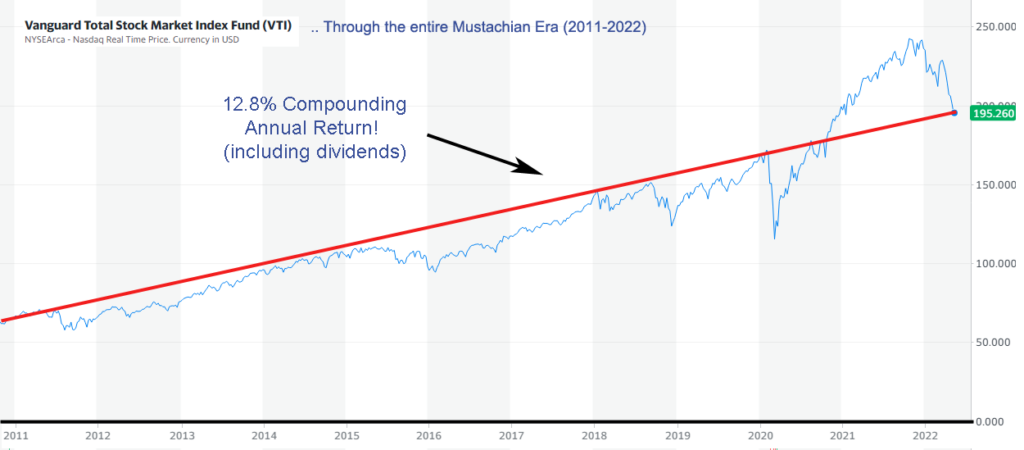

What if we determined to be extra smart, begin the damned Y axis at zero as each graph ought to do, and zoom out to an affordable time horizon,such because the Age of Mustachianism which occurred to start in 2011. And ignore the wiggly blue line and comply with the extra significant crimson line.

Effectively, how attention-grabbing. Not solely has this crash returned us to a roughly straight line of long run inventory market progress, however that line itself is very beneficiant, representing a 12.8% annual compound acquire in the event you consider a quarterly reinvestment of dividends (which usually add about 2% to your annual returns however aren’t proven in these charts). Over longer durations like 50 years, inventory returns have been nearer to 10% after dividends, which suggests we’ve nonetheless had greater than our share of excellent occasions.

Within the lengthy return, inventory costs are decided by this method:

Inventory worth = firm earnings x BRM*

*(Bullshit Random Multiplier)

The BRM, extra formally often known as the Worth-to-Earnings ratio or P/E, is meant to be primarily based on a mathematical estimate of the current worth of all future dividends you’ll obtain in the event you maintain a inventory for the whole lifetime of the corporate.

Once we anticipate increased rates of interest or inflation over the subsequent 20 years, the P/E ought to fall as a result of these distant future earnings develop into price much less in right this moment’s {dollars}. In the meantime, if we one way or the other understand that the long-term way forward for the enterprise world is much more rosy than we thought, the P/E ought to rise as a result of traders can precisely predict a bigger stream of future earnings.

However the “bullshit” issue is available in attributable to issues just like the “He Stated She Stated” nature of no matter Elon posted on Twitter right this moment, momentum buying and selling algorithms, meme inventory merchants banding collectively to drive up random shares no matter underlying worth, and extra. In brief, the brief time period BRM is only a measure of the current second’s steadiness of greed and concern.

As an investor, nevertheless, you don’t care concerning the BRM. In truth, you don’t even actually care concerning the share costs of your investments, as a result of the value of a person share solely issues twice in your lifetime:

- The second you purchase it,

- And the second you promote it.

Every little thing else is simply foolish noise.

Proper now, most of us are nonetheless incomes cash and accumulating extra shares. Even Mr. Cash Mustache, as an individual who retired 17 years in the past, remains to be on this boat for the straightforward purpose that my retirement earnings from dividends and pastime companies remains to be larger than my annual residing bills (which nonetheless hover round $20,000 per 12 months).

On high of this, if you’re holding principally index funds as you need to be, your shares ship a pleasant serving to of dividends each three months, which you could have set to routinely reinvest into nonetheless extra shares of those self same index funds. In right this moment’s market, you’re getting about 25% extra shares for every greenback that you just make investments. Which interprets to a full 25% extra wealth from these shares in your future.

(It’s enjoyable math – a 20% drop in costs means you get 25% extra shares in your greenback, and a 50% drop means twice as many, or 100% extra shares per greenback invested.)

3) Okay, however I actually am retired and making an attempt to reside off my investments now. How is that this not a catastrophe for me?

To begin with, you’re nonetheless getting the dividends that we celebrated in level 2) above. When the inventory market crashes, dividend funds often stay much more steady as a result of the large, established corporations in your index funds proceed to generate income.

It’s fairly just like proudly owning a portfolio of rental homes unfold all through the world: whereas home costs fluctuate on a regular basis in numerous cities, the full lease paid by a gaggle of 1000’s of tenants will have a tendency to stay fairly steady and simply rise on the fee of inflation.

So this stream of cash will preserve coming in and protecting a considerable portion of your residing bills (between 30% and 50% for many retirees in right this moment’s market circumstances in the event you retired utilizing the 4% rule).

Even in the event you don’t regulate your spending or earnings throughout this bear market, the top result’s that you just must promote a tiny proportion of your shares at a reduction in the course of the bear market – which suggests your portfolio shrinks a bit sooner.

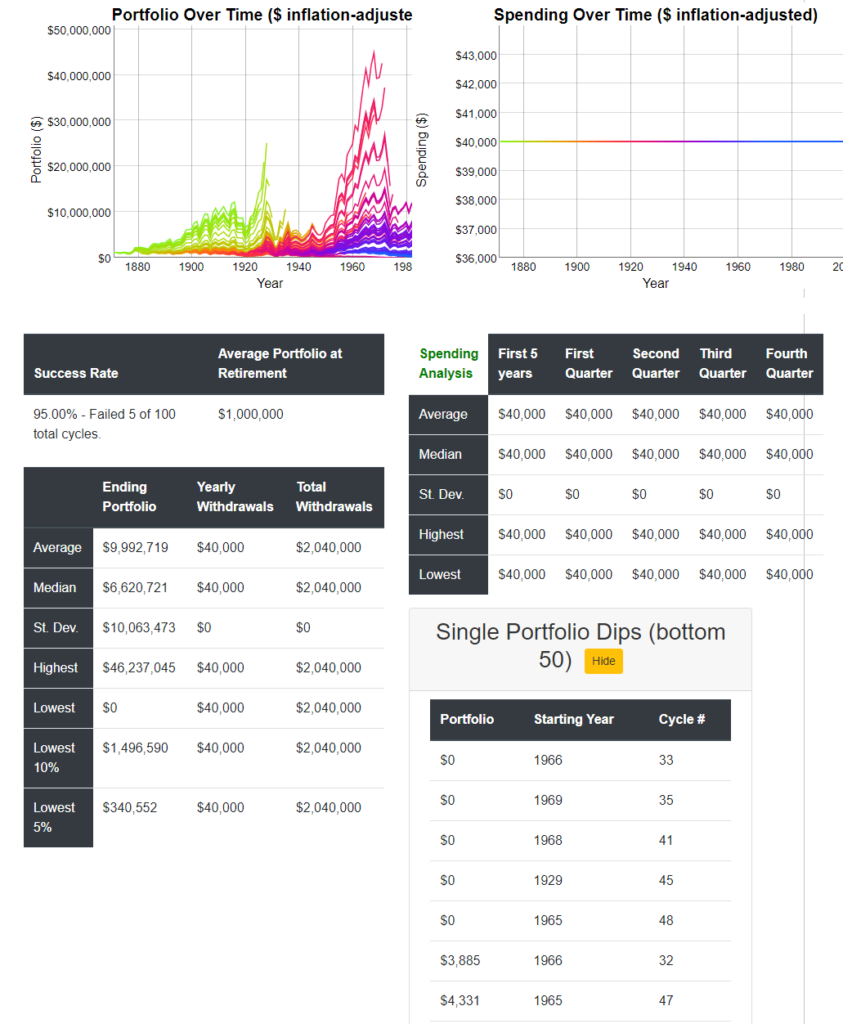

However the 4% rule already takes this under consideration: if there have been no such factor as bear markets, the protected withdrawal fee would truly be equal to the long-term common of inventory market progress, which is nearer to 7% after inflation. By sticking to 4% or barely much less, you’re giving your self a excessive probability of weathering the storm.

cFireSim: Financial Historical past to the Rescue!

Assuming a small $1k enhance from social safety in my 60s, I’d have a 95% historic success fee. Solely the Nice Despair and the Sixties hunch would have foiled this plan, and even then simply barely.

To actually perceive what this implies I reached out to Lauren Boland, the monetary calculations wizard behind the superb cFireSim retirement simulator. Her long-running website provides you one of the best shot at answering the query: “If I retire with a set chunk of cash, what are my possibilities of success?”

I requested her what it actually means when the inventory market drops: does a 20% drop actually make you 20% much less “retired” or is precise consequence extra refined? True to type, she bought again to me inside just some minutes with these ideas:

MMM: How ought to potential retirees consider the latest crash in valuation – has it actually pushed out their retirement date, or not?

Lauren:

It will depend on how versatile you’re prepared to be together with your spending. As shares get costlier (the next price-to-earnings ratio), it may be an ideal time to spend extra (take these positive factors), and after they drop in worth (like proper now), chances are you’ll wish to spend much less to protect your capital.

We have now a reputation for the this concept of inventory crashes that come at simply the mistaken time: the Sequence of Returns Threat. In the event you retire simply BEFORE an enormous inventory market crash, your first few months or years will drain your portfolio a bit greater than you anticipated, till inventory costs recuperate. So, latest retirees live this proper now in the event that they retired with out a lot security margin.

Then again, In the event you HAVEN’T retired but, and your numbers nonetheless look good even now, I feel it could truly be a greater time to retire, since you may hope that historical past repeats itself and there’s a restoration. It’d be like retiring on the backside of 2009 with still-decent numbers.

— (thanks Lauren!) —

Okay, so we’re in all probability not screwed both method. However nonetheless, as a Mustachian this looks like a nice excuse to consult with level #1 above: use the chaos and disruption as an excuse to make your self stronger. Turn into extra environment friendly together with your spending, discover satisfying methods to create worth for others that occur to provide cash for you as properly, and enhance your train, consuming and private progress packages as properly. As a result of hey, why not?

Epilogue: How does all this Distress finish?

Though you now perceive that even the present scenario is regular and wholesome, there may be even higher information on the core of it: It’s a self-correcting downside, and the answer is already within the works.

A scarcity of products, a sloshing overflow of the cash provide and inappropriately low rates of interest led to every part getting costlier. However in the meantime, corporations have constructed extra factories and employed extra employees to extend manufacturing and now the central banks have cranked up rates of interest and reversed their different help packages as properly.

The end result: mortgages value extra so housing gross sales have slowed. Shoppers and companies are each pissed off by latest worth will increase and extra cautious concerning the future so they’re shopping for much less stuff, which reduces the Every little thing-Scarcity that we talked about earlier. All of the sudden, provide catches as much as demand and costs cease rising.

Or to summarize all of this in a a lot pithier method: the answer to excessive costs, is excessive costs.

The world is frightening and the inventory market has plunged, however the basic image hasn’t modified in any respect: billions of people are working onerous and making use of their ingenuity on daily basis to get forward. It’s a messy course of, however on common we proceed to succeed at this process over time. Individuals who perceive this unchanging mechanism will take a look at this 12 months’s sale on productive asset and say, “Cool – signal me up for one more serving to of future wealth, and thanks for the deal!”

Within the feedback – what are YOU doing in response to this bear market? Are you scared, or doubling down on investing?

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/traintrack-art.jpg)