KOSPI Composite Elliott Wave Evaluation

KOSPI Composite Elliott Wave Technical Evaluation – Each day Chart.

Perform: Pattern.

Mode: Impulsive.

Construction: Grey Wave 3.

Place: Orange Wave 3.

Path subsequent decrease levels: Grey Wave 4.

Particulars: Grey wave 2 seems accomplished. Now grey wave 3 of three is in play.

Wave cancel invalid degree: 2636.93.

The KOSPI Composite Elliott Wave evaluation on the every day chart provides an in depth view of the market’s pattern and potential future actions based mostly on Elliott Wave idea. This evaluation identifies the first perform as a pattern, indicating a directional market motion.

The pattern is described as impulsive, which in Elliott Wave terminology signifies a powerful and dominant market motion within the course of the first pattern. This impulsive nature is proven within the wave construction, recognized as grey wave 3. Grey wave 3 is a component of a bigger sequence, essential for understanding total market momentum.

At the moment, the market is positioned in orange wave 3, throughout the bigger grey wave 3 sequence. The third wave in Elliott Wave idea is commonly essentially the most highly effective and prolonged, suggesting important market exercise and value motion.

The following decrease levels course focuses on the event of grey wave 4. This suggests that after grey wave 3 is accomplished, the market will transition right into a corrective section characterised by grey wave 4. This wave sometimes interrupts the impulsive pattern quickly earlier than the market resumes its main course.

Detailed observations point out that grey wave 2 appears accomplished. The completion of grey wave 2 suggests the market has completed a corrective section and has now transitioned into grey wave 3 of three. This section is important as a result of wave 3 of three typically entails the strongest value actions throughout the impulsive sequence, indicating strong market momentum.

A necessary side of this evaluation is the wave cancel invalid degree, set at 2636.93. This degree is a key threshold for validating the present wave rely. If the market value exceeds this degree, it will invalidate the present wave construction, necessitating a reassessment of the Elliott Wave rely and doubtlessly altering the market outlook.

Abstract: The KOSPI Composite every day chart evaluation signifies an impulsive pattern inside grey wave 3, at the moment positioned at orange wave 3. It suggests the completion of grey wave 2, with grey wave 3 of three now in play. The wave cancel invalid degree at 2636.93 is important for validating the present wave construction and guiding future market expectations.

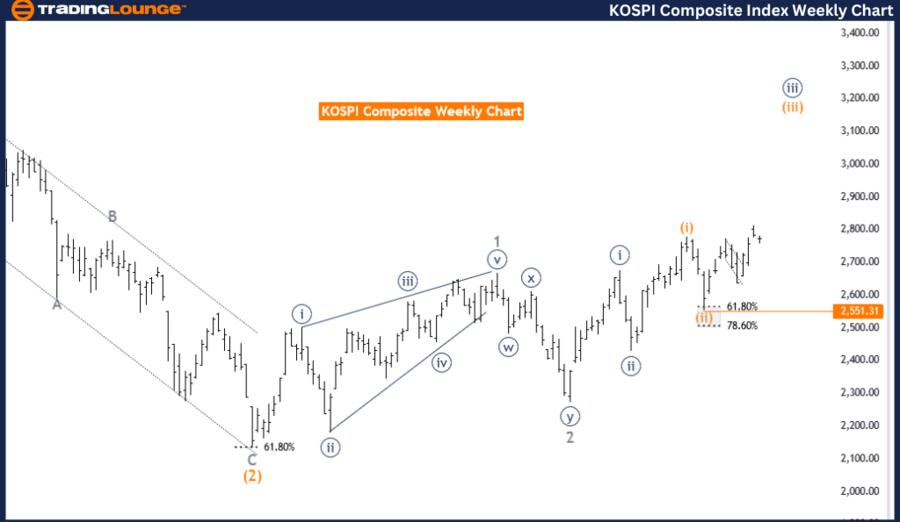

KOSPI composite Elliott Wave technical evaluation – Weekly chart

Perform: Pattern.

Mode: Impulsive.

Construction: Orange Wave 3.

Place: Navy Blue Wave 3.

Path subsequent decrease levels: Orange Wave 4.

Particulars: Orange wave 2 seems accomplished. Now orange wave 3 of three is in play.

Wave cancel invalid degree: 2551.31.

The KOSPI Composite Elliott Wave evaluation on the weekly chart provides an in depth perspective on the long-term market pattern utilizing Elliott Wave idea. This evaluation identifies the first perform as a pattern, indicating a directional market motion.

The pattern is described as impulsive, which in Elliott Wave terminology signifies a powerful, dominant motion aligned with the first market momentum. The construction of the market motion is recognized as orange wave 3, suggesting the market is at the moment within the third wave of this sequence. In Elliott Wave idea, the third wave is commonly essentially the most highly effective and prolonged, indicating important market exercise and value development.

The present place inside this construction is navy blue wave 3, implying that the market is advancing inside a bigger, overarching navy blue wave sequence. This signifies continued robust motion out there.

The evaluation signifies that the market is anticipated to transition into orange wave 4 after finishing the present wave. Orange wave 4 represents a corrective section sometimes following the completion of an impulsive wave. This section is crucial for consolidating good points earlier than doubtlessly resuming the first pattern.

Detailed observations spotlight that orange wave 2 seems accomplished, suggesting the market has completed its corrective section and is now transitioning into orange wave 3 of three. This section is essential as wave 3 of three is mostly related to the strongest and most dynamic actions throughout the wave sequence, indicating strong market momentum.

A important side of this evaluation is the wave cancel invalid degree, set at 2551.31. This degree acts as a threshold for validating the present wave rely. If the market value exceeds this degree, it will invalidate the present wave construction, necessitating a reassessment of the Elliott Wave rely and doubtlessly altering the market outlook.

Abstract: The KOSPI Composite weekly chart analysis identifies an impulsive pattern inside orange wave 3, at the moment positioned at navy blue wave 3. The completion of orange wave 2 alerts the start of orange wave 3 of three. The wave cancel invalid degree at 2551.31 is essential for validating the present wave construction and guiding future market expectations.

Technical analyst: Malik Awais.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/wall_street_nyse2-637299021353183737_Large.jpg)