IBEX 35 (Spain) Elliott Wave Evaluation Buying and selling Lounge Day Chart,

IBEX 35 (Spain) Elliott Wave technical evaluation

Perform: Development.

Mode: Corrective.

Construction: Orange wave 4.

Place: Navy blue wave 3.

Course subsequent greater levels: Orange wave 5.

Particulars: Orange wave 4 nonetheless is in play and searching close to to finish.

Wave cancel invalid stage: 4618.

The IBEX 35 Elliott Wave evaluation on the every day chart is primarily involved with monitoring the development throughout the market utilizing a corrective mode. The present wave construction is recognized as orange wave 4, positioned throughout the bigger context of navy blue wave 3. This implies the market is present process a corrective part earlier than transitioning to the subsequent upward wave.

The principle operate of this evaluation is to observe the development throughout the IBEX 35 market. The corrective nature of the mode signifies that the market is at present adjusting inside orange wave 4. This wave is a part of the broader development, positioned inside navy blue wave 3, highlighting the short-term nature of the correction earlier than resuming the upward motion.

The route for the subsequent greater levels is recognized as orange wave 5. This means that after orange wave 4 completes, the market is anticipated to transition into the upward part of orange wave 5, persevering with the general development.

Particulars within the evaluation emphasize that orange wave 4 remains to be ongoing however is approaching its finish. This signifies that the corrective part is nearing completion, and the market is making ready to shift into the subsequent part, which is orange wave 5. This upcoming wave will resume the upward development following the completion of the present correction.

A important side of this evaluation is the wave cancel invalid stage, set at 4618. This stage is important for sustaining the validity of the present wave rely. If the market worth drops under this stage, the present wave construction can be invalidated, requiring a reassessment of the Elliott Wave evaluation and probably altering the anticipated market route.

In abstract, the IBEX 35 every day chart evaluation signifies that the market is within the ultimate levels of a corrective part inside orange wave 4, a part of the broader navy blue wave 3. Upon the completion of orange wave 4, the market is anticipated to enter the upward part of orange wave 5, persevering with the general development. The wave cancel invalid stage at 4618 is essential for confirming the present wave rely and guiding future market expectations based mostly on Elliott Wave ideas.

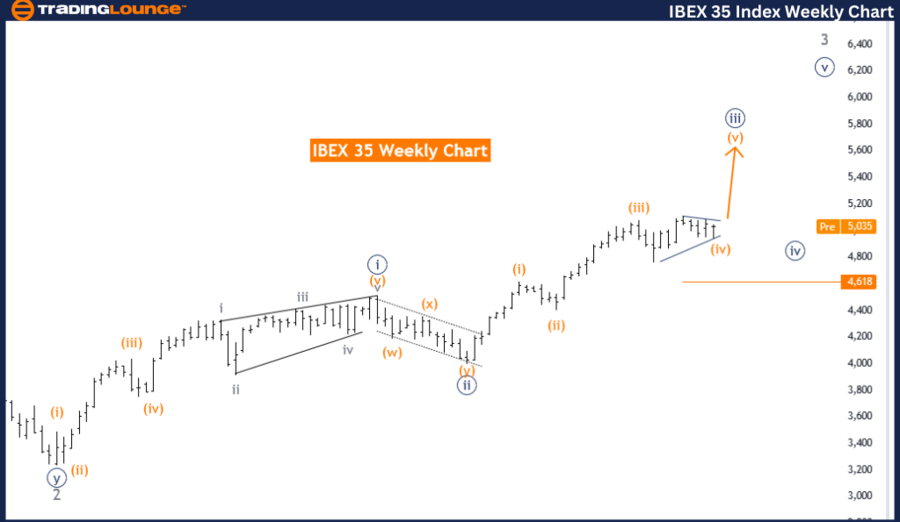

IBEX 35 (Spain) Elliott Wave evaluation weekly chart

Perform: Development

Mode: Corrective

Construction: Orange wave 4

Place: Navy blue wave 3

Course subsequent greater levels: Orange wave 5

Particulars: Orange wave 4 nonetheless is in play and searching close to to finish.

Wave cancel invalid stage: 4618

The IBEX 35 Elliott Wave evaluation on the weekly chart focuses on figuring out and monitoring the development throughout the market utilizing a corrective mode. The present wave construction is characterised as orange wave 4, which is positioned throughout the broader context of navy blue wave 3. This signifies that the market is present process a correction inside an total upward development.

The first operate of this evaluation is to watch and interpret the development conduct within the IBEX 35 market. The corrective mode signifies that the market is at present in a part of adjustment, particularly inside orange wave 4. This wave is a part of the bigger development and signifies a short lived pause or retracement within the ongoing upward motion represented by navy blue wave 3.

The evaluation factors to the subsequent greater levels route as orange wave 5. This implies that following the completion of the present corrective part in orange wave 4, the market is anticipated to transition into the subsequent upward part, often called orange wave 5. This transition will proceed the general development, resuming the upward motion.

Detailed observations within the evaluation spotlight that orange wave 4 remains to be energetic however nearing its finish. This implies the present corrective part is sort of full, and the market is making ready to transfer into orange wave 5. This upcoming wave will mark the continuation of the upward development following the correction.

An necessary side of this evaluation is the wave cancel invalid stage, which is about at 4618. This stage serves as a important level for sustaining the validity of the present wave construction. If the market worth falls under this stage, the present wave rely can be invalidated, necessitating a reassessment of the Elliott Wave evaluation and probably altering the market outlook.

In abstract, the IBEX 35 weekly chart evaluation signifies that the market is within the ultimate levels of a corrective part inside orange wave 4, which is a part of the bigger navy blue wave 3. As soon as orange wave 4 is full, the market is anticipated to shift into the upward part of orange wave 5, persevering with the general development. The wave cancel invalid stage at 4618 is essential for confirming the present wave rely and guiding future market expectations based mostly on Elliott Wave ideas.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/typewriter-241751_960_720.jpg)