David Jay wrote: ↑Solar Sep 15, 2024 6:10 pmCyclingDuo wrote: ↑Solar Sep 15, 2024 9:24 amDavid Jay wrote: ↑Solar Oct 22, 2023 9:46 pmOnly a few folks can really deal with greater than a few 15% drop in portfolio stability earlier than the human “flight” intuition kicks in and the intestine screams “get me out of right here!”One can anticipate maybe 5 or 6 40% inventory market drops over one’s investing lifetime and one ought to set their AA accordingly.

Unsure that solely a choose group of only a few folks can really deal with greater than a 15% drop earlier than their intestine screams “get me out of right here”. Are you saying that each one those that will not be within the choose group of only a few folks then observe up by promoting resulting from what their intestine says?

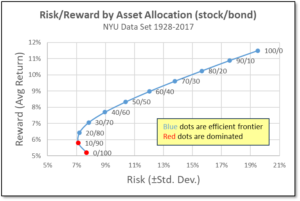

That’s precisely what I’m saying, with “only a few” referring to a proportion of the final inhabitants. I’m a type of few and apparently you’re as properly. I used to be 100% shares to age 58, solely diminished my AA as I approached retirement at age 62.

It may be exhausting for us who’re wired so our head can firmly over-ride our intestine (I name it “going Spock”) to grasp these with the extra typical (once more, as a inhabitants) flight responses. However there are way more of them then there are of us. My sister and brother-in-law offered out on the very backside in 2008 and put every thing into annuities! Even amongst the BH inhabitants the worry of some is palpable throughout what is just a minor downturn like 2020. Return and browse the threads.

Sure, I’m fairly conscious and have learn lots of the threads since becoming a member of the boards in January of 2017 which captured the previous three 15%+ drops…

2018 = -19.8% drop

2020 = -33.9% drop

2022 = -25.4% drop

I’ve additionally learn the notorious thread in regards to the 2007-09 drop the place a discussion board member on the time was contemplating pulling the plug.

Looking back concerning the GFC, we had been too busy with our lives and youngsters throughout that individual bear market to essentially even take discover. Baseball, soccer, monitor, choir, orchestra, soccer, debate and attending all of these occasions that our youngsters had been concerned in plus our personal busy careers (that weren’t in any means disrupted) meant we had been merely means too busy to even discover a lot outdoors of what we sometimes caught on the information. Office retirement plans had been on automated pilot, so each two weeks cash from our twin incomes went into further shares of our index funds in addition to into our school financial savings funds for the children.

Relating to the OP, for our explicit careers that coincide with the desk under from RetireBy40.org reveals that maxing out one’s 401k within the S&P 500 (not together with any employer match) would have grown to an appropriate quantity in the beginning of 2024 despite the 90/91 Gulf Conflict, the dot-com bust, the GFC, Covid, the 2022 bear market, and so on… with none promoting or listening to the intestine.

https://retireby40.org/what-if-always-maxed-401k/

Promoting when issues drop, and determining when to purchase once more – or get again out there with the funds that had been offered resulting from a intestine response – looks like an train in futility in comparison with simply letting it trip by means of thick and skinny just by wanting on the desk above. I nonetheless do not suppose it is just a small choose group that may deal with a -15% or extra drop within the markets, however c’est la vie. If traders have not discovered their classes alongside the best way of what bailing out does to their returns, then here is to them figuring it out in some unspecified time in the future sooner or later. There will likely be extra drops for all of us within the coming many years. ![]()

There’s a plethora of data out there to “keep the course”, so the thought baffles me that solely a choose few have discovered to not promote throughout a downturn within the markets. I might welcome any information you possibly can present that helps the bulk are operating for the hills when the going will get powerful.

Along with studying the threads throughout market selloffs right here at Bogleheads, my spouse and I additionally noticed Invoice Bernstein spend practically your entire Boglehead Convention 2022 on his cellphone which we assumed was probably resulting from talking with involved purchasers because the convention coincided with the lows of that individual bear market in October 2022. So clearly there are those that reply to what their intestine is feeling. Not one of the attendees we spoke with and socialized with whereas on the convention had been feeling any considerations or speaking about bailing out because of the 2022 bear market.

The OP, sadly, solely got here to the US and commenced his/her investing profession 7-8 years in the past, with a predicted 15 extra years of retiring round age 59. Not the same old 35-40 12 months profession of accumulation that many people expertise, however possibly the OP could have time to reassess and think about working and accumulating past age 59 to show his/her human capital into a bigger monetary capital stash to fund their retirement.

CyclingDuo (simply ending my thirty ninth 12 months of working, spouse retired final 12 months)

“Save like a pessimist, make investments like an optimist.” – Morgan Housel |

“Choose a bushel, save a peck!” – Grandpa

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/Holding-100-VTSAX-Bogleheadsorg.jpg)