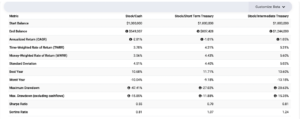

Right here’s my month-to-month roundup of the most effective rates of interest on money as of September 2024, roughly sorted from shortest to longest maturities. There are lesser-known alternatives accessible to particular person buyers, typically incomes more cash whereas preserving the identical stage of security by shifting to a different FDIC-insured financial institution or NCUA-insured credit score union. Take a look at my Ultimate Rate-Chaser Calculator to see how a lot further curiosity you would earn from switching. Charges listed can be found to everybody nationwide. Charges checked as of 9/15/2024.

TL;DR: Charges are dropping in any respect maturities, from cash market funds outward, however actually quick beginning at 1 12 months out. Nonetheless 5%+ financial savings accounts and short-term CDs. Evaluate in opposition to Treasury payments and bonds at each maturity, taking into consideration state tax exemption. I no longer recommend fintech companies as a consequence of the potential for loss as a consequence of poor recordkeeping and/or fraud.

Excessive-yield financial savings accounts

For the reason that big megabanks nonetheless pay basically no curiosity, everybody ought to no less than have a separate, no-fee on-line financial savings account to piggy-back onto your current checking account. The rates of interest on financial savings accounts can drop at any time, so I record the highest charges in addition to aggressive charges from banks with a historical past of aggressive charges and strong person expertise. Some banks will bait you with a brief high fee after which decrease the charges within the hopes that you’re too lazy to depart.

- The highest fee in the meanwhile is at Poppy at 5.50% APY (3-month fee assure). Newcomer Pibank can also be at 5.50% APY. I’ve no private expertise with both, however they’re the highest charges in the meanwhile. CIT Platinum Savings at 4.85% APY with $5,000+ steadiness.

- SoFi Bank is at 4.50% APY + as much as $325 new account bonus with direct deposit. You should preserve a direct deposit of any quantity every month for the upper APY. SoFi has traditionally aggressive charges and full banking options. See particulars at $25 + $300 SoFi Money new account and deposit bonus.

- Here’s a restricted survey of high-yield savings accounts. They aren’t the highest charges, however a gaggle which have traditionally saved it comparatively aggressive such that I like to trace their historical past.

Brief-term assured charges (1 12 months and below)

A typical query is what to do with a giant pile of money that you just’re ready to deploy shortly (plan to purchase a home quickly, simply offered your home, simply offered what you are promoting, authorized settlement, inheritance). My normal recommendation is to maintain issues easy and take your time. If not a financial savings account, then put it in a versatile short-term CD below the FDIC limits till you’ve gotten a plan.

- No Penalty CDs provide a set rate of interest that may by no means go down, however you’ll be able to nonetheless take out your cash (as soon as) with none charges if you wish to use it elsewhere. Marcus has a 7, 11, and 13-month No Penalty CD at 4.50% APY with a $500 minimal deposit. Take into account opening a number of CDs in smaller increments for extra flexibility.

- Merchants Bank has a 1-year certificates at 5.25% APY ($1,000 min). I couldn’t find their early withdrawal penalty. That is their fixed-rate CD, be careful for the flex-rate ones.

Cash market mutual funds

Many brokerage corporations that pay out little or no curiosity on their default money sweep funds (and maintain the distinction for themselves). Observe: Cash market mutual funds are highly-regulated, however in the end not FDIC-insured, so I’d nonetheless follow extremely respected corporations.

- Vanguard Federal Money Market Fund is the default sweep possibility for Vanguard brokerage accounts, which has an SEC yield of 5.19% (modifications every day, but in addition works out to a compound yield of 5.32%, which is best for evaluating in opposition to APY). Odds are that is a lot larger than your individual dealer’s default money sweep rate of interest.

Treasury Payments and Extremely-short Treasury ETFs

An alternative choice is to purchase particular person Treasury payments which are available in a wide range of maturities from 4-weeks to 52-weeks and are totally backed by the US authorities. You may also put money into ETFs that maintain a rotating basket of short-term Treasury Payments for you, whereas charging a small administration payment for doing so. T-bill curiosity is exempt from state and native earnings taxes, which may make a major distinction in your efficient yield.

- You possibly can build your own T-Bill ladder at TreasuryDirect.gov or through a brokerage account with a bond desk like Vanguard and Constancy. Listed here are the present Treasury Bill rates. As of 9/13/24, a brand new 4-week T-Invoice had the equal of 5.03% annualized curiosity and a 52-week T-Invoice had the equal of 4.02% annualized curiosity.

- The iShares 0-3 Month Treasury Bond ETF (SGOV) has a 5.21% SEC yield and efficient length of 0.10 years. SPDR Bloomberg Barclays 1-3 Month T-Invoice ETF (BIL) has a 5.11% SEC yield and efficient length of 0.08 years.

US Financial savings Bonds

Series I Savings Bonds provide charges which are linked to inflation and backed by the US authorities. You should maintain them for no less than a 12 months. In the event you redeem them inside 5 years there’s a penalty of the final 3 months of curiosity. The annual buy restrict for digital I bonds is $10,000 per Social Safety Quantity, accessible on-line at TreasuryDirect.gov. You may also purchase a further $5,000 in paper I bonds utilizing your tax refund with IRS Kind 8888.

- “I Bonds” purchased between Could 2024 and October 2024 will earn a 4.28% fee for the primary six months. The speed of the next 6-month interval might be based mostly on inflation once more. More on Savings Bonds here.

- In mid-October 2024, the CPI might be introduced and you should have a brief interval the place you should have a really shut estimate of the speed for the following 12 months. I’ll have one other submit up at the moment.

Rewards checking accounts

These distinctive checking accounts pay above-average rates of interest, however with distinctive dangers. It’s important to soar via sure hoops which often contain 10+ debit card purchases every cycle, a sure variety of ACH/direct deposits, and/or a sure variety of logins per 30 days. In the event you make a mistake (or they decide that you just did) you danger incomes zero curiosity for that month. Some of us don’t thoughts the additional work and a spotlight required, whereas others would quite not trouble. Charges also can drop instantly, leaving a “bait-and-switch” feeling.

- OnPath Federal Credit Union pays 7.00% APY on as much as $10,000 when you make 15 debit card purchases, choose into on-line statements, and login to on-line or cell banking as soon as per assertion cycle. Anybody can be part of this credit score union through $5 membership payment to affix companion group. You may also get a $50 Visa Reward card if you open a brand new account and make qualifying transactions.

- Genisys Credit Union pays 6.75% APY on as much as $7,500 when you make 10 debit card purchases of $5+ every per assertion cycle, and choose into on-line statements. Anybody can be part of this credit score union through $5 membership payment to affix companion group.

- Credit Union of New Jersey pays 6.00% APY on as much as $25,000 when you make 12 debit card purchases, choose into on-line statements, and make no less than 1 direct deposit, on-line invoice fee, or automated fee (ACH) per assertion cycle. Anybody can be part of this credit score union through $5 membership payment to affix companion group.

- Andrews Federal Credit Union pays 6.00% APY on as much as $25,000 when you make 15 debit card purchases, choose into on-line statements, and make no less than 1 direct deposit or ACH transaction per assertion cycle. Anybody can be part of this credit score union through companion group.

- Pelican State Credit Union pays 6.05% APY on as much as $20,000 when you make 15 debit card purchases, choose into on-line statements, log into your account no less than as soon as, and make no less than 1 direct deposit, on-line invoice fee, or automated fee (ACH) per assertion cycle. Anybody can be part of this credit score union through companion group membership.

- Orion Federal Credit Union pays 6.00% APY on as much as $10,000 when you make digital deposits of $500+ every month (ACH transfers rely) and spend $500+ in your Orion debit or bank card every month. Anybody can be part of this credit score union through $10 membership payment to companion group membership.

- All America/Redneck Bank pays 5.00% APY on as much as $15,000 when you make 10 debit card purchases every month-to-month cycle with on-line statements.

- Discover a locally-restricted rewards checking account at DepositAccounts.

Certificates of deposit (larger than 1 12 months)

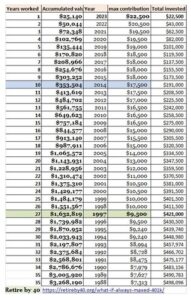

CDs provide larger charges, however include an early withdrawal penalty. By discovering a financial institution CD with an inexpensive early withdrawal penalty, you’ll be able to get pleasure from larger charges however preserve entry in a real emergency. Alternatively, contemplate constructing a CD ladder of various maturity lengths (ex. 1/2/3/4/5-years) such that you’ve got entry to a part of the ladder every year, however your blended rate of interest is larger than a financial savings account. When one CD matures, use that cash to purchase one other 5-year CD to maintain the ladder going. Some CDs additionally provide “add-ons” the place you’ll be able to deposit extra funds if charges drop.

- Lafayette Federal Credit Union (LFCU) has a 5-year certificates at 4.32% APY ($500 min), 4-year at 4.42% APY, 3-year at 4.52% APY, 2-year at 4.78% APY, and 1-year at 5.04% APY. Barely larger charges with jumbo $100,000+ balances. Observe that the early withdrawal penalty for the 5-year is a comparatively massive 600 days of curiosity. Anybody nationwide can be part of LFCU by becoming a member of the Dwelling Possession Monetary Literacy Council (HOFLC) for a one-time $10 payment.

- Advancial Federal Credit Union has has a 5-year certificates at 4.47% APY (larger $50,000 min). Anybody nationwide ought to have the ability to be part of through membership with companion group US Canine Agility Affiliation, however I’d name or test first.

- You should buy certificates of deposit through the bond desks of Vanguard and Fidelity. You might want an account to see the charges. These “brokered CDs” provide FDIC insurance coverage and straightforward laddering, however they don’t include predictable early withdrawal penalties. Proper now, I see a 5-year non-callable CD at 3.80% APY (callable: no, name safety: sure). Be warned that now each Vanguard and Constancy will record larger charges from callable CDs, which importantly means they’ll name again your CD if charges drop later. (Issuers have certainly began calling a few of their previous 5%+ CDs as of September 2024.)

Longer-term Devices

I’d use these with warning as a consequence of elevated rate of interest danger (tbh, I don’t use them in any respect), however I nonetheless monitor them to see the remainder of the present yield curve.

- Keen to lock up your cash for 10 years? You should buy long-term certificates of deposit through the bond desks of Vanguard and Fidelity. These “brokered CDs” provide FDIC insurance coverage, however they don’t include predictable early withdrawal penalties. You may discover one thing that pays greater than your different brokerage money and Treasury choices. Proper now, I see a 10-year CDs at [none available] (non-callable) vs. 3.66% for a 10-year Treasury. Be careful for larger charges from callable CDs the place they’ll name your CD again if rates of interest drop.

All charges have been checked as of 9/15/2024.

Picture by Giorgio Trovato on Unsplash

![[original_title]](https://rawnews.com/wp-content/uploads/2024/09/cash_benjamins.jpeg)