FTSE 100 (UK) Elliott Wave Evaluation Buying and selling Lounge Day Chart.

FTSE 100 (UK) Elliott Wave technical evaluation

Perform: Pattern.

Mode: Impulsive.

Construction: Orange wave 5.

Place: Navy blue wave 3.

Path subsequent decrease levels: Navy blue wave 4.

Particulars: Orange wave 4 wanting accomplished. Now orange wave 5 of navy blue wave 3 is in play.

Wave cancel invalid degree: 7760.18.

The FTSE 100 Elliott Wave evaluation on the every day chart goals to establish and monitor the market development utilizing an impulsive mode. The present wave construction is assessed as orange wave 5, positioned throughout the broader context of navy blue wave 3. This signifies that the market is in an impulsive section, which is characterised by a robust directional motion.

The perform of this evaluation is to look at and interpret the development conduct throughout the FTSE 100 market. The impulsive mode signifies that the market is at present experiencing a strong directional motion as a part of the general wave sample. Particularly, orange wave 5 is in play, indicating that the market is advancing throughout the framework of navy blue wave 3.

The path for the subsequent decrease levels is recognized as navy blue wave 4. This means that after the completion of the present impulsive section in orange wave 5, the market is anticipated to transition into the subsequent section, often called navy blue wave 4. This section will probably mark a corrective motion following the completion of the present impulsive development.

Detailed observations within the evaluation point out that orange wave 4 seems to be accomplished. Which means the market has probably completed the previous corrective section and is now advancing into orange wave 5 of navy blue wave 3. This ongoing wave will proceed the impulsive sample throughout the broader navy blue wave 3 context.

An necessary side of this evaluation is the wave cancel invalid degree, set at 7760.18. This degree serves as a crucial level for sustaining the validity of the present wave construction. If the market value exceeds this degree, the present wave rely can be invalidated, necessitating a reassessment of the Elliott Wave evaluation and doubtlessly altering the market outlook.

In abstract, the FTSE 100 every day chart evaluation signifies that the market is at present in an impulsive section inside orange wave 5, which is a part of the bigger navy blue wave 3. As soon as orange wave 5 is full, the market is predicted to transition into navy blue wave 4, initiating a corrective sequence. The wave cancel invalid degree at 7760.18 is essential for confirming the present wave rely and guiding future market expectations primarily based on Elliott Wave rules.

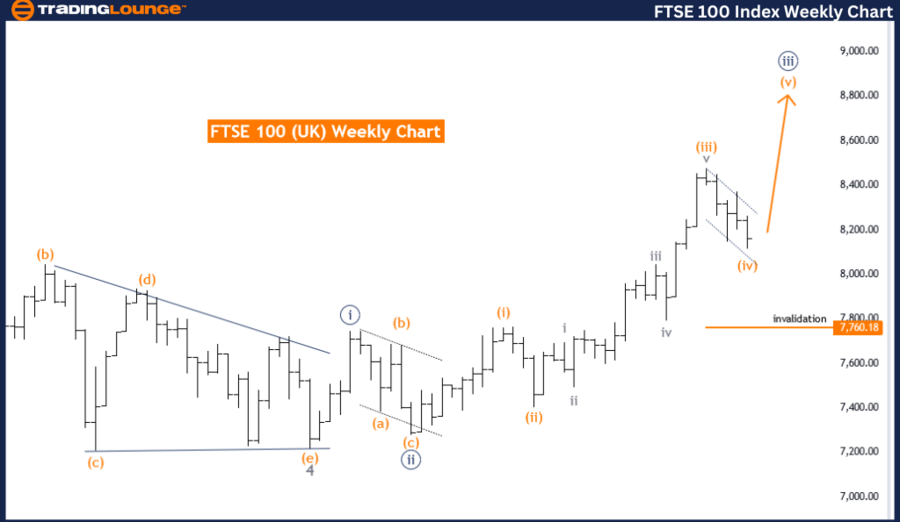

FTSE 100 (UK) Elliott Wave evaluation weekly chart

Perform: Pattern.

Mode: Impulsive.

Construction: Orange wave 5.

Place: Navy blue wave 3.

Path subsequent decrease levels: Navy blue wave 4.

Particulars: Orange wave 4 wanting accomplished. Now orange wave 5 of navy blue wave 3 is in play.

Wave cancel invalid degree: 7760.18.

The FTSE 100 (UK) Elliott Wave evaluation on the weekly chart gives an in depth examination of the market development utilizing an impulsive mode. This evaluation focuses on figuring out the present wave construction and predicting future actions throughout the Elliott Wave framework. The construction below commentary is orange wave 5, positioned throughout the bigger context of navy blue wave 3.

The perform of this evaluation is to trace the continued development within the FTSE 100 market, which is at present in an impulsive section. This section is characterised by a robust directional motion that’s a part of a broader wave sample. The impulsive mode signifies that the market is shifting forcefully in a single path, particularly throughout the orange wave 5 construction of navy blue wave 3.

The path for the subsequent decrease levels is recognized as navy blue wave 4. This means that following the completion of the present impulsive section in orange wave 5, the market is anticipated to transition right into a corrective section, often called navy blue wave 4. This section will probably contain a pullback or consolidation after the present upward motion.

Detailed evaluation reveals that orange wave 4 seems to be accomplished. This completion signifies that the market has completed its earlier corrective section and is now advancing into orange wave 5 of navy blue wave 3. This ongoing wave represents the continuation of the impulsive development throughout the bigger navy blue wave 3 framework.

An integral part of this evaluation is the wave cancel invalid degree, set at 7760.18. This degree acts as a crucial threshold for validating the present wave construction. If the market value exceeds this degree, it could invalidate the present wave rely, necessitating a reassessment of the Elliott Wave evaluation and doubtlessly altering the market outlook.

In abstract, the FTSE 100 weekly chart evaluation signifies that the market is at present in an impulsive section inside orange wave 5, which is a part of the bigger navy blue wave 3. As soon as orange wave 5 is full, the market is predicted to transition into navy blue wave 4, initiating a corrective sequence. The wave cancel invalid degree at 7760.18 is essential for confirming the present wave rely and guiding future market expectations primarily based on Elliott Wave rules.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/close-up-of-apple-iphone-screen-with-stock-exchange-16817528_Large.jpg)