With that being mentioned, that is the one information I used to be given in regards to the retirement plans supplied at my hospital: they use AHRP

➢EmployEE Contribution

• 403(b) Plan

o Automated enrollment at 6% inside 60 days of rent with worker possibility to extend, lower or opt-out

o Instant vesting at 100%

• 457(b) Plan

o Elective plan along with, and separate from 403(b)

o Requires separate enrollment via Human Useful resource Administration

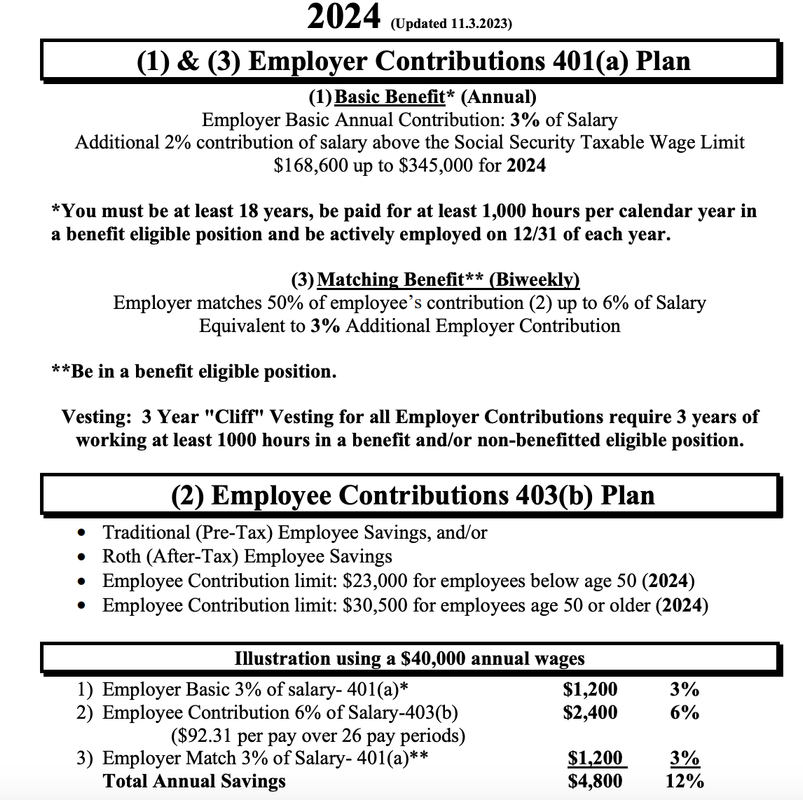

➢EmployER Primary Contribution

• 3% of gross wages

• 3-year vesting at 100% based mostly on minimal of 1,000 hrs/yr

• Funded yearly

➢EmployeER Matching Contribution: 403(b) plan

• 50% on the primary 6% of wages contributed by worker as much as IRS restrict

• Funded every pay interval

So based mostly on my understanding, I do know that I will probably be getting the 403b that can auto put in 6% per examine w/a 3% match contribution + 3% annual contribution (so long as I match the standards).

So my query is ought to I enroll into the 457b and why? (additionally non-governmental as this hospital can be a personal uni)

I assume that is the place my ignorance is available in as a result of what’s the level of constructing it if I’m not getting any contributions from the hospital? The 403b is getting the all the contributions, so technically the cash would not develop if I left it within the 457b, proper? I sort of see it like a checking account the place the cash simply sits till I put in my very own contribution. Would not it make sense to place the cash that may’ve been in a 457b right into a HYSA the place I do know it is going to achieve cash over time? Until I’m actually lacking one thing in regards to the 457b, as a result of that was actually the one info I obtained.

EDIT (9/16): So, I used to be lastly given entry to my advantages web page the place I used to be capable of finding extra paperwork/types in regards to the retirement plans, and I discovered extra info that wasn’t supplied to me through the orientation.

So apparently I haven’t got simply a 403b, I’ve a 401a as effectively.

- 401a = will probably be receiving the annual 3% contribution & 3% match

- 403b = the 6% or nonetheless % I need to put in from my examine

I additionally discovered that the 403b can both be: conventional (pre-tax) or roth (after-tax). I referred to as the HR retirement specialist and she or he advised to do the standard (pre-tax) possibility as that’s extra fashionable, so I am assuming I ought to go together with that except in any other case?

I additionally discovered final night time and sort of answered my query, that I can enhance cash within the 457b via investments, which I did not understand that I might do. So now I am simply questioning whether it is even price making use of for the 457b because it’s non-gov, and I plan to depart after a couple of years because the pay is low relative to different hospitals within the space. My cash can be in danger and likewise I can not roll it over to a diff retirement account (solely choices are lump sum vs installment durations from 0-20 years vs defer distribution) after I go away.

Edit 2: I additionally need to add that I’m 24 y/o, residing at residence, I break up grocery payments w/my brother and I will probably be paying for my automobile insurance coverage + fuel. I’m not in a rush to maneuver out and I do not actually purchase loads of issues except absolute obligatory.

My pay will probably be $44.15 for 1 yr (residency program), and can then enhance to $48.15. I additionally get a $4 differential if I work nights or weekends.

Sorry for all my edits ![]() !

!