- We count on the Financial institution of England (BoE) to maintain the Financial institution Fee unchanged at 5.25% on 1 August. We stress that it’s a very shut name not least as a result of very restricted quantity of communication from the MPC over the previous months.

- Total, we count on the BoE to ship a dovish twist to its ahead steering priming markets for a forthcoming begin to a chopping cycle.

- We count on EUR/GBP to drop upon announcement however that the dovish communication within the assertion and press convention will restrict the draw back potential.

We count on the Financial institution of England (BoE) to maintain the Financial institution Fee unchanged at 5.25% on 1 August. Consensus expects a 25bp lower to five.00% and markets at the moment value -12bp for the assembly. We count on the vote cut up to be very tight with the bulk voting for an unchanged choice. The shut name is additional amplified by new member Clare Lombardelli (changing Ben Broadbent) becoming a member of the committee for her first assembly. Observe, this assembly will embody up to date projections and a press convention following the discharge of the assertion.

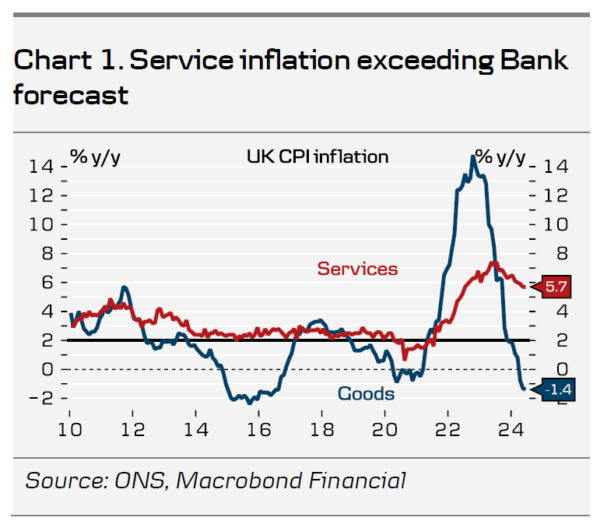

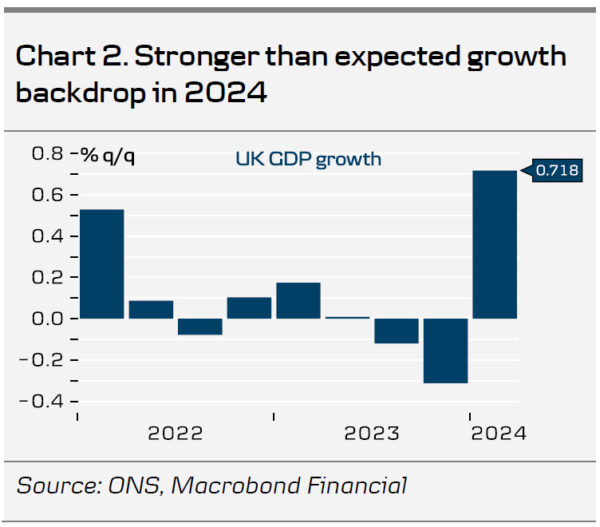

Total, we count on the MPC so as to add a dovish twist to its earlier steering, priming the markets for a forthcoming begin to a chopping cycle. We count on them to retain a lot of its wording by way of ahead steering, repeating that “financial coverage might stay restrictive even when Financial institution Fee have been to be lowered, provided that it was ranging from an already restrictive stage and that “the coverage choice at this assembly was finely balanced” for some members. Because the final financial coverage choice in Could, information has general been stronger than anticipated throughout each inflation, exercise and partly labour markets. Exercise picked up in Q1 with the economic system rising 0.7% q/q (vs BoE forecast of 0.4%) underpinned by a restoration in actual wages. Service inflation remained elevated in Q2 at 5.8% y/y (vs BoE forecast of 5.3%) with underlying momentum nonetheless sturdy. The labour market continues its gradual loosening, however wage progress stays elevated leaving a small upside threat to the BoEs Q2 forecast underpinned by the latest rise within the Nationwide Dwelling Wage.

Given the UK normal election, communication from the MPC has been very restricted over the previous months. Notably, Tablet delivered hawkish commentary noting that “providers value inflation and wage progress proceed to level to an uncomfortable energy in these underlying inflation dynamics” and that indicators “have hinted in the direction of some upside threat to my evaluation of inflation persistence“. In a notoriously divided committee, Bailey and Tablet have voted in unison at each assembly since Tablet joined the MPC in 2021.

BoE name. We count on the BoE to ship the primary lower of 25bp in September. Subsequently, we count on quarterly cuts by means of 2024 and 2025. Markets are pricing 50bp for the rest of the yr with the primary 25bp lower totally priced by November.

FX. In our base case of a dovish “unchanged” choice, we count on EUR/GBP to drop upon announcement however that the dovish communication within the assertion and press convention will restrict the draw back potential. We count on EUR/GBP to proceed its latest transfer decrease pushed by indicators pointing to a continued (modest) rebound within the international manufacturing cycle, tight credit score spreads and low FX volatility. The important thing threat is coverage motion from the BoE.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/f-boe28.jpg)