- EUR/USD climbed right into a five-week peak amid broad-market Buck promoting.

- US PPI inflation rose quicker than anticipated in June, however traders pin hopes on fee cuts.

- ECB fee reduce looms forward subsequent week, US Retail Gross sales due subsequent Tuesday.

Broad-market hopes for an accelerated tempo of fee cuts from the US Federal Reserve (Fed) reached a fever pitch on Friday regardless of a notable upswing in US Producer Value Index (PPI) wholesale inflation. The Fiber prolonged into a 3rd straight week of good points as investor threat urge for food will get pinned to the ceiling.

Forecasting the Coming Week: Fed rate cut bets and the ECB should rule the sentiment

June’s core Producer Value Index (PPI) for wholesale inflation within the US rose to three.0% YoY, surpassing the anticipated 2.5%. The earlier interval’s determine was adjusted upward to 2.6% from the preliminary 2.3%. Regardless of the notable improve in producer-level inflation, market focus has shifted to the sooner lower in Client Value Index (CPI) inflation, elevating expectations for a fee reduce.

The CME’s FedWatch device signifies a major chance of a quarter-point fee reduce on the Federal Open Market Committee’s (FOMC) assembly on September 18. Fee merchants are at present factoring in not less than three fee cuts by 2024, greater than the one or two cuts projected by the Fed by December.

Financial Indicator

Producer Value Index ex Meals & Vitality (YoY)

The Producer Value Index ex Meals & power launched by the Bureau of Labor statistics, Department of Labor measures the typical modifications in costs in major markets of the US by producers of commodities in all states of processing. These risky merchandise equivalent to meals and power are excluded so as to seize an correct calculation. Typically talking, a excessive studying is seen as optimistic (or bullish) for the USD, whereas a low studying is seen as destructive (or bearish).

In different US economic data launched on Friday, the College of Michigan’s Client Sentiment Index survey dropped to a seven-month low of 66.0, falling in need of the anticipated improve to 68.5. This displays growing discouragement amongst US shoppers in regards to the financial outlook. Moreover, the College of Michigan’s 5-year Client Inflation Expectations decreased barely in July to 2.9% from the earlier 3.0%. Lengthy-term shopper inflation expectations stay considerably greater than the Fed’s goal annual inflation fee of two.0%

US Retail Gross sales figures are on the docket for subsequent Tuesday, and Euro merchants shall be buckling down for the wait to subsequent week’s newest fee name from the European Central Financial institution (ECB), slated for early subsequent Thursday. The ECB not too long ago delivered a quarter-point fee trim in early June, however odds of a follow-up reduce are wanting unlikely, and markets are broadly forecasting a cautious maintain in July.

Euro PRICE This week

The desk under exhibits the share change of Euro (EUR) in opposition to listed main currencies this week. Euro was the strongest in opposition to the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.62% | -1.35% | -1.74% | -0.07% | -0.50% | 0.31% | -0.19% | |

| EUR | 0.62% | -0.53% | -0.81% | 0.89% | 0.28% | 1.30% | 0.77% | |

| GBP | 1.35% | 0.53% | -0.33% | 1.44% | 0.81% | 1.79% | 1.30% | |

| JPY | 1.74% | 0.81% | 0.33% | 1.71% | 1.29% | 2.26% | 1.64% | |

| CAD | 0.07% | -0.89% | -1.44% | -1.71% | -0.46% | 0.37% | -0.08% | |

| AUD | 0.50% | -0.28% | -0.81% | -1.29% | 0.46% | 0.98% | 0.49% | |

| NZD | -0.31% | -1.30% | -1.79% | -2.26% | -0.37% | -0.98% | -0.48% | |

| CHF | 0.19% | -0.77% | -1.30% | -1.64% | 0.08% | -0.49% | 0.48% |

The warmth map exhibits share modifications of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you decide the Euro from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will symbolize EUR (base)/USD (quote).

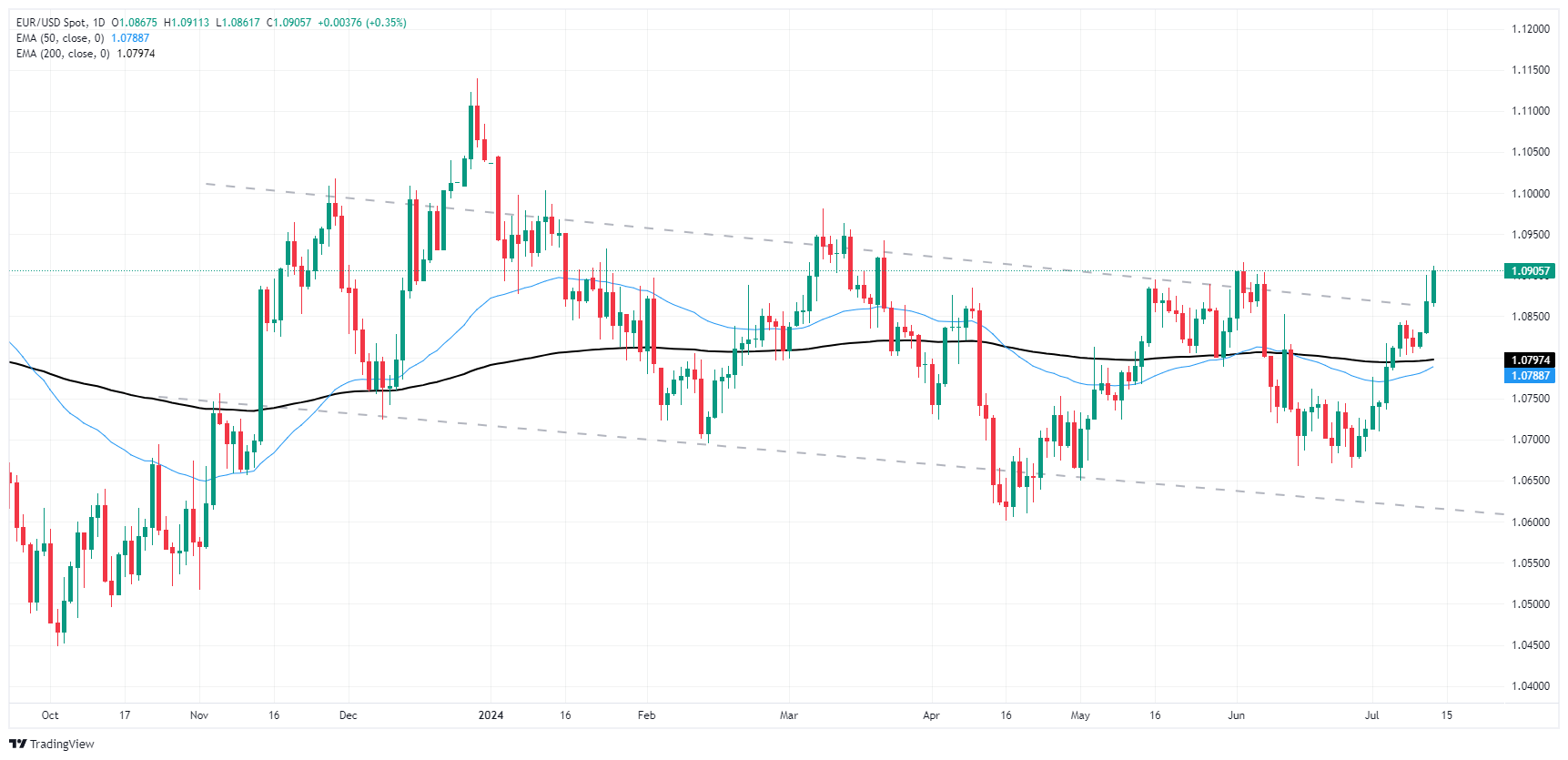

EUR/USD technical outlook

EUR/USD has chalked in a 3rd straight week of good points, closing Friday a hair above the 1.0900 deal with. The pair has risen 2.3% from late June’s swing low into 1.0666, and intraday worth motion is poised for a conflict with technical resistance from June’s early peaks close to 1.0920.

Fiber damaged out of the topside of a tough descending channel on each day candlesticks. Regardless of closing within the inexperienced for all however two of the final twelve consecutive buying and selling days, bullish momentum is poised to expire of fuel and will see a bearish pullback to the 200-day Exponential Transferring Common (EMA) at 1.0797.

EUR/USD hourly chart

EUR/USD each day chart

Euro FAQs

The Euro is the forex for the 20 European Union international locations that belong to the Eurozone. It’s the second most closely traded forex on this planet behind the US Greenback. In 2022, it accounted for 31% of all international change transactions, with a median each day turnover of over $2.2 trillion a day. EUR/USD is probably the most closely traded forex pair on this planet, accounting for an estimated 30% off all transactions, adopted by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Financial institution (ECB) in Frankfurt, Germany, is the reserve financial institution for the Eurozone. The ECB units rates of interest and manages financial coverage. The ECB’s major mandate is to keep up worth stability, which implies both controlling inflation or stimulating development. Its major device is the elevating or reducing of rates of interest. Comparatively excessive rates of interest – or the expectation of upper charges – will often profit the Euro and vice versa. The ECB Governing Council makes financial coverage choices at conferences held eight occasions a yr. Selections are made by heads of the Eurozone nationwide banks and 6 everlasting members, together with the President of the ECB, Christine Lagarde.

Eurozone inflation information, measured by the Harmonized Index of Client Costs (HICP), is a crucial econometric for the Euro. If inflation rises greater than anticipated, particularly if above the ECB’s 2% goal, it obliges the ECB to lift rates of interest to carry it again below management. Comparatively excessive rates of interest in comparison with its counterparts will often profit the Euro, because it makes the area extra enticing as a spot for world traders to park their cash.

Knowledge releases gauge the well being of the financial system and might impression on the Euro. Indicators equivalent to GDP, Manufacturing and Companies PMIs, employment, and shopper sentiment surveys can all affect the route of the one forex. A robust financial system is nice for the Euro. Not solely does it appeal to extra international funding however it might encourage the ECB to place up rates of interest, which is able to straight strengthen the Euro. In any other case, if financial information is weak, the Euro is prone to fall. Financial information for the 4 largest economies within the euro space (Germany, France, Italy and Spain) are particularly vital, as they account for 75% of the Eurozone’s financial system.

One other vital information launch for the Euro is the Commerce Stability. This indicator measures the distinction between what a rustic earns from its exports and what it spends on imports over a given interval. If a rustic produces extremely wanted exports then its forex will acquire in worth purely from the additional demand created from international consumers in search of to buy these items. Subsequently, a optimistic internet Commerce Stability strengthens a forex and vice versa for a destructive stability.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/1720833991_euro-or-dollar-3353142_Large.jpg)