Officers making ready Eire’s upcoming price range face a state of affairs most of their friends elsewhere would like to have: an €8.6bn surplus and an financial system that grew 5 instances quicker than anticipated final 12 months.

However deciding what to do with the nation’s large fortune is proving trickier than anticipated.

“Eire’s drawback isn’t that it doesn’t come up with the money for — it has masses,” stated Gerard Brady, chief economist at Ibec, Eire’s greatest enterprise foyer. “The issue is that it’s struggling to search out methods to show that cash into actual issues that individuals want.”

Greater than a decade on from a crash that required the EU and IMF to step in with €67.5bn in loans and impose a controversial austerity programme, the federal government stays cautious and stresses it’s saving prudently for future pension, local weather and infrastructure challenges.

However some economists consider failing to deploy its large fortune misses a chance to repair infrastructure issues that danger strangling Ireland’s growth.

“There may be an awesome want for public funding and a once-in-a-generation alternative to finance that out of your again pocket,” stated economist David McWilliams.

There are lots of areas the place the cash might be properly spent — from tackling a housing crisis in a rustic the place inhabitants progress is quick outstripping new provide, to assuaging electrical energy grid, water provide, well being service and public transport challenges. “Not often has a rustic been given such a unprecedented alternative to vary society and been suggested to not do it,” McWilliams stated.

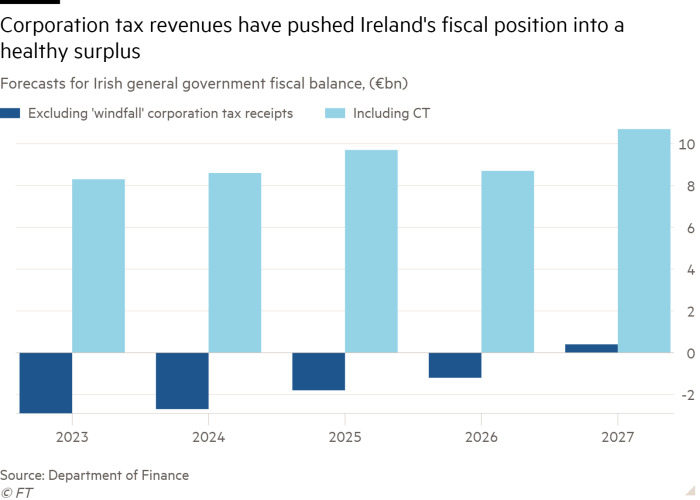

The nation is on the right track for a bumper surplus for the third consecutive 12 months in 2024, after being €8.3bn within the black final 12 months and €8.6bn in 2022, based on official information.

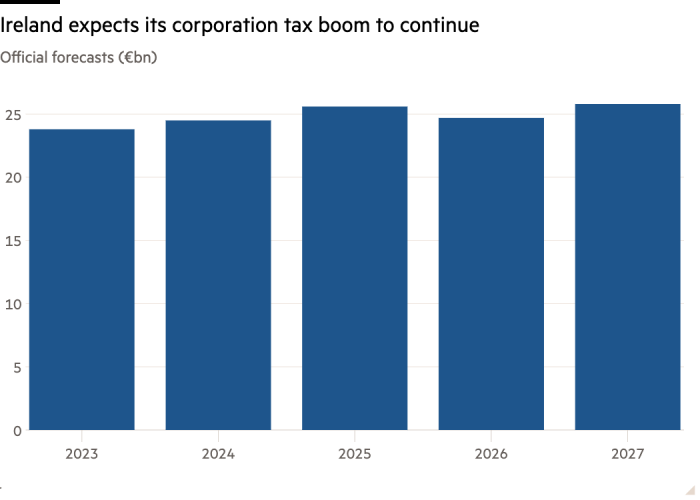

Surging company tax receipts from Irish-based world corporations, largely in tech and prescription drugs, are behind the overflowing authorities coffers.

The federal government says company tax receipts, which introduced in €23.8bn in 2023 and are forecast to lift €24.5bn this 12 months, are unstable, momentary and unlikely to maintain increasing at their latest tempo.

It estimates half its company tax haul might be “windfall”, or momentary, in nature and has opted to place greater than €100bn of the excess in two sovereign wealth funds by 2035 to handle future pension, local weather and infrastructure challenges.

The federal government has slashed its price range surplus forecast for the years forward — it had predicted €65bn for 2023-26 — however remains to be anticipating a complete of €38bn for 2024-2027.

Outdoors of the large tax haul, Eire’s financial system is performing strongly.

Eire’s GDP figures are distorted by its outsized multinational sector, however modified home demand, the federal government’s most well-liked measure of progress, rose 2.6 per cent final 12 months. That in contrast with a earlier official estimate of 0.5 per cent for 2023.

With the financial system operating near full employment and with annual inflation having surged as excessive as 9.2 per cent as not too long ago as 2022, the federal government has vowed to spend rigorously for concern of overheating — regardless of worth pressures now falling again to 1.1 per cent.

However Dermot O’Leary, chief economist at brokerage Goodbody, stated there was proof of “spending creep”.

“The federal government has been speaking sport in relation to the necessity for prudence, the transfer to arrange these financial savings funds. But the precise actuality has been considerably much less prudent when it comes to spending progress,” he stated.

Dublin has used a number of the cash for debt compensation, decreasing its debt-to-GNI ratio to simply below 76 per cent, and to fund Covid-19 measures and value of residing help.

However with a basic election due by 2025, expectations of a giveaway price range on October 1 are mounting.

“A humiliation of riches is tough for ministers to handle, notably this facet of an election. So definitely politics is coming into it,” O’Leary stated.

Up to now, the federal government has stated the price range will embrace €6.9bn in spending and €1.4bn in tax measures — strikes it admits will breach its self-imposed rule of accelerating spending by not more than 5 per cent a 12 months.

Emma Howard, a lecturer on the Technological College Dublin, stated Eire ought to use a few of its surplus money to “look past the macro to societal issues”.

Eire ranks because the loneliest country in Europe, with nearly a fifth of individuals lonely most or all the time and almost two-thirds of individuals endure from nervousness or melancholy, based on EU information. One in seven kids stay in properties beneath the poverty line, outlined as 60 per cent of the median disposable family revenue.

“There may be cash we may spend proper now that would enhance some social points. We must be that, as a result of we are able to afford it,” she stated.

McWilliams stated Eire ought to use its surpluses to create start-up funds to foster entrepreneurialism. “It’s a failure of creativeness,” he stated.

Others say Eire may improve its 5.3mn residents’ wellbeing and the nation’s financial system by bettering a planning system that may maintain up infrastructure developments for years.

The federal government is looking for to legislate to reform the system, together with setting deadlines for planning selections.

Housebuilding is lastly accelerating, however stays properly wanting projected want. A brand new nationwide kids’s hospital, now set to price €2.24bn, is approach delayed and 4 instances over its preliminary price range. It’s unlikely to open till subsequent 12 months on the earliest.

“We may . . . ship extra with the assets we now have — so cash isn’t the whole lot,” stated John Fitzgerald, an economist and adjunct professor at Trinity Faculty Dublin.

No matter Eire does with it, the cash seems more likely to preserve coming.

Below one a part of a two-pillar OECD tax reform plan, supposed to take away benefits for multinationals doing enterprise in low-tax jurisdictions, Eire has elevated its 12.5 per cent company tax price to fifteen per cent for big corporations.

However the different half — a requirement for firms to pay tax the place their clients are situated, which might funnel away a few of Eire’s company tax receipts — is successfully lifeless.

“We’re in a really, very sturdy place in the meanwhile,” Seamus Coffey, chair of the Irish Fiscal Advisory Council, instructed a latest convention. “The hope is that we don’t make a large number of it.”