DOW JONES- DJI Elliott Wave Evaluation Buying and selling Lounge Day Chart,

Dow Jones Elliott Wave technical evaluation

Operate: Counter Pattern.

Mode: Corrective.

Construction: Navy blue wave 4.

Place: Gray wave 1.

Route subsequent larger levels: Navy blue wave 5.

Particulars: Navy blue wave 4 nonetheless is in play as sideways.

Wave cancel invalid degree: 34740.46.

The Dow Jones DJI Elliott Wave evaluation on the day chart offers an in depth technical outlook utilizing the Elliott Wave principle. The first operate of this evaluation is to determine counter-trend actions inside the market. The present mode of the market is described as corrective, indicating a interval of market consolidation or retracement in opposition to the prevailing development.

The construction below focus is Navy blue wave 4, which is an element of a bigger wave sequence. The market is presently positioned at Grey wave 1 inside this construction. This positioning means that the market has initiated a brand new wave cycle inside the corrective section of Navy blue wave 4.

The course for the following larger levels factors to Navy blue wave 5, which is able to comply with the completion of Navy blue wave 4. This suggests that after the corrective section, the market is predicted to renew its major development course, advancing into Navy blue wave 5.

Detailed observations within the evaluation point out that Navy blue wave 4 remains to be ongoing and is characterised by sideways motion. This sideways motion is typical of corrective waves, which regularly contain a consolidation section earlier than the following impulsive wave begins. The continuation of Navy blue wave 4 means that the market remains to be in a state of adjustment and has not but resumed its major development.

A important side of this evaluation is the wave cancel invalid degree, set at 34740.46. This degree is important for validating the present wave construction. If the market value exceeds this threshold, it will invalidate the current wave depend, requiring a reassessment of the Elliott Wave construction and probably altering the market outlook.

In abstract, the Dow Jones DJI day chart evaluation highlights a counter-trend corrective section inside Navy blue wave 4, with the market positioned at Grey wave 1. The evaluation anticipates the continuation of Navy blue wave 4, characterised by sideways motion, earlier than transitioning into Navy blue wave 5. The wave cancel invalid degree at 34740.46 serves as an important marker for validating the present wave depend and guiding future market expectations.

Dow Jones Elliott Wave technical evaluation four-hour chart

Operate: Counter Pattern.

Mode: Corrective.

Construction: Navy blue wave 4.

Place: Gray wave 1.

Route subsequent larger levels: Navy blue wave 5.

Particulars: Navy blue wave 4 nonetheless is in play as sideways.

Wave cancel invalid degree: 34740.46.

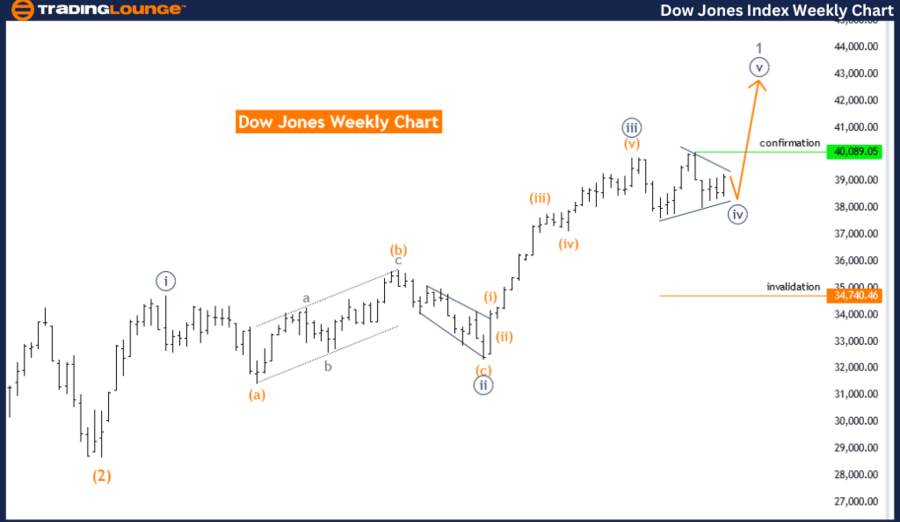

The Dow Jones DJI Elliott Wave evaluation on the weekly chart offers insights into the market’s actions utilizing Elliott Wave principle. The first operate of this evaluation is to determine counter-trend actions inside the market. The present mode of the market is described as corrective, indicating a section of consolidation or retracement in opposition to the prevailing development.

The main target is on Navy blue wave 4, which is an element of a bigger wave sequence. The market is presently positioned at Grey wave 1 inside this construction. This means that the market has initiated a brand new wave cycle inside the corrective section of Navy blue wave 4.

The course for the following larger levels is Navy blue wave 5, which is able to comply with the completion of Navy blue wave 4. This suggests that after the corrective section, the market is predicted to renew its major development course, advancing into Navy blue wave 5.

Detailed observations point out that Navy blue wave 4 remains to be ongoing and is characterised by sideways motion. This sideways motion is typical of corrective waves, typically involving a consolidation section earlier than the following impulsive wave begins. The continuation of Navy blue wave 4 means that the market remains to be adjusting and has not but resumed its major development.

A vital side of this evaluation is the wave cancel invalid degree, set at 34740.46. This degree is vital for validating the present wave construction. If the market value exceeds this threshold, it will invalidate the current wave depend, requiring a reassessment of the Elliott Wave construction and probably altering the market outlook.

In abstract, the Dow Jones DJI weekly chart evaluation highlights a counter-trend corrective section inside Navy blue wave 4, with the market positioned at Grey wave 1. The analysis anticipates the continuation of Navy blue wave 4, characterised by sideways motion, earlier than transitioning into Navy blue wave 5. The wave cancel invalid degree at 34740.46 serves as an important marker for validating the present wave depend and guiding future market expectations.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/1719220751_dow-jones-stock-indexes-7184580_Large.jpg)