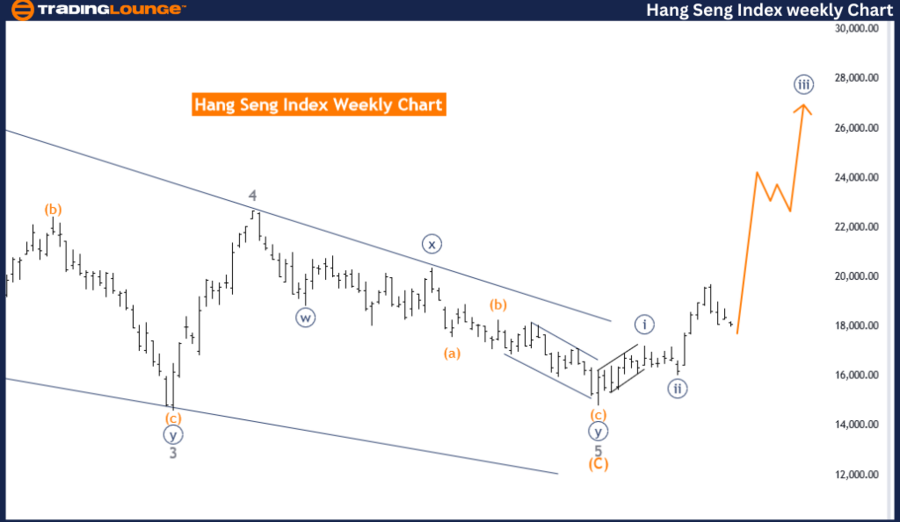

Dangle Seng Index Elliott Wave Evaluation Buying and selling Lounge Day Chart,

Dangle Seng Index Elliott Wave technical evaluation

Operate: Development.

Mode: Corrective.

Construction: Orange wave 2.

Place: Navy blue wave 3.

Path subsequent larger levels: Orange wave 3.

Particulars: Orange wave 2 nonetheless is in play, after that orange wave 3 will begin.

Wave cancel invalid degree: 16044.39.

The Dangle Seng Index Elliott Wave evaluation on the weekly chart focuses on figuring out the pattern inside a corrective part. The present wave construction is classed as orange wave 2, which is a part of the bigger navy blue wave 3. This evaluation means that the market is present process a corrective wave earlier than probably resuming its main pattern course.

The operate of this evaluation is to trace the pattern, with the mode specified as corrective. This means that the market is experiencing a reversal or consolidation inside the bigger pattern. The particular construction beneath statement is orange wave 2, indicating that the correction continues to be ongoing and has not but concluded.

The present market exercise is positioned inside navy blue wave 3, which usually follows a major upward motion marked by navy blue wave 2. The market is anticipated to full the corrective part of orange wave 2 earlier than transitioning into the subsequent part, orange wave 3, which often signifies a return to the first pattern course.

The course for the subsequent larger levels is recognized as orange wave 3, suggesting an anticipated upward motion following the completion of the present corrective wave. This suggests that when orange wave 2 concludes, the market ought to resume its upward pattern, shifting right into a extra impulsive part.

A vital side of this evaluation is the wave cancel invalid degree, set at 16044.39. This degree is crucial for sustaining the validity of the present wave depend. If the market worth drops beneath this degree, it could invalidate the present wave construction, necessitating a reassessment of the Elliott Wave evaluation and probably altering the anticipated market course.

In abstract, the Dangle Seng Index weekly chart evaluation signifies the market is in a corrective part, particularly inside orange wave 2 of navy blue wave 3. This part is anticipated to conclude earlier than the market resumes its main pattern course with orange wave 3. The wave cancel invalid degree at 16044.39 is essential for the validity of the present wave depend, guiding merchants in anticipating future market actions primarily based on the Elliott Wave rules.

Dangle Seng Index Elliott Wave evaluation weekly chart

Operate: Development.

Mode: Impulsive.

Construction: Navy blue wave 3.

Place: Grey wave 1.

Path subsequent larger levels: Navy blue wave 3 (proceed).

Particulars: Navy blue wave trying accomplished at 16044.39, now navy blue wave 3 is in play.

Wave cancel invalid degree: 16044.39.

The Dangle Seng Index Elliott Wave evaluation on the weekly chart identifies the pattern inside an impulsive part. The present wave construction is classed as navy blue wave 3, which is positioned inside grey wave 1. This evaluation signifies that the market is experiencing an upward motion, attribute of an impulsive wave sample.

The operate of this evaluation is to trace the pattern, with the mode specified as impulsive. This implies that the market is in a powerful, directional part, usually related to vital worth actions. The particular construction beneath statement is navy blue wave 3, indicating that the market is within the midst of an upward pattern.

The present market exercise is positioned inside grey wave 1, which marks the start of the subsequent impulsive sequence inside navy blue wave 3. This placement means that the market has lately accomplished a major motion, as indicated by the completion of navy blue wave 2, and is now progressing via navy blue wave 3.

The course for the subsequent larger levels is recognized because the continuation of navy blue wave 3. This means that the market is anticipated to take care of its upward trajectory, reinforcing the impulsive nature of the present wave construction. Merchants can anticipate additional upward motion because the market progresses via this part.

A vital side of this evaluation is the wave cancel invalid degree, set at 16044.39. This degree is crucial for sustaining the validity of the present wave depend. If the market worth drops beneath this degree, it could invalidate the present wave construction, necessitating a reassessment of the Elliott Wave evaluation and probably altering the anticipated market course.

In abstract, the Dangle Seng Index weekly chart evaluation reveals the market is in an impulsive part, particularly inside navy blue wave 3 of grey wave 1. This part is anticipated to proceed, with additional upward motion anticipated. The wave cancel invalid degree at 16044.39 is essential for the validity of the present wave depend, guiding merchants of their expectations of future market actions primarily based on the Elliott Wave rules.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/hang-seng-index-17354816_Large.jpg)