In some methods, reviewing Charles Schwab isn’t a lot totally different now than it will have been within the Seventies.

Guided by the philosophy of its founder, the Charles Schwab Company has been an trade chief for many years relating to disrupting the established order to raised serve its clients.

On this article, I’ll clarify why Schwab is a great all-around investment company that cash professional Clark Howard strongly recommends.

Desk of Contents

I up to date this text in July 2024 and I evaluation it each six months.

Charles Schwab Evaluate: Fast Look

| Firm Identify | Charles Schwab |

|---|---|

| Firm Sort | Funding and monetary companies firm |

| Key Options | Sturdy on analysis and ETFs |

| Downsides | Earnings on buyer money aggressively |

| Finest For | Virtually everybody |

What Is Charles Schwab?

| Commissions | Minimal Deposit | Robo-Advisor | Monetary Advisor | Android App Score | iOS App Score |

|---|---|---|---|---|---|

| $0 for shares, ETFs and choices | $0 | Sure | Sure | 2.3 | 4.8 |

Based in 1971 and headquartered in Westlake, Texas, Schwab was managing $8.5 trillion in assets as of January 2024.

Schwab gained recognition early in its historical past by decreasing commissions and making it simpler for particular person buyers to entry the market. The corporate is essentially liable for the time period “low cost dealer.”

Founder Charles R. Schwab offered his firm to Financial institution of America in 1983 however purchased it again in 1987.

The corporate made a splash that rippled throughout the trade when it introduced commission-free trades in October 2019. And Schwab continues to increase every so often: It acquired each USAA and TD Ameritrade in 2019.

Who Ought to Use Charles Schwab?

Schwab is a well-rounded funding firm constructed to satisfy the wants of just about everybody. It has an extended historical past of treating its clients nicely and providing aggressive merchandise.

Listed here are some examples of the buyers Schwab serves nicely:

- Self-directed buyers. In its advertising, Schwab appears to push its advisors (robo and monetary). But it surely’s nonetheless an amazing place to do enterprise if you happen to favor to manage your own investment portfolio. Schwab affords a full vary of options you’d need: research, training, famend customer support, in-person branches, a number of platforms, good order execution, low-cost index funds and extra.

- Passive investors with taxable accounts. Vanguard is probably the most outstanding brokerage agency for index funds (which may be mutual funds or ETFs). However in case you have a taxable account (versus a retirement account), ETFs are preferable. Schwab may be unmatched when it comes to investing in ETFs, from analysis to choice to cost.

- Value investors. For my part, Schwab affords higher analysis than some other funding firm besides maybe Constancy. In case you’re a price investor, you utilize fundamental analysis to seek out firms that commerce for lower than they’re price. You pour by way of firm earnings and third-party analyses earlier than shopping for inventory. Schwab’s analysis instruments strongly help worth buyers.

- Energetic merchants who aren’t professionals. Skilled day merchants are most likely higher served by different choices. Nevertheless, if you happen to’re not a day dealer however generally dabble with extra short-term trades, Schwab’s platforms and instruments ought to meet your wants. (Clark strongly advises in opposition to day buying and selling.)

- Traders drawn to inexpensive, certified monetary advisors. Clark recommends Schwab’s Intelligent Portfolios Premium. After paying a one-time planning charge of $300, you’ll pay $30 monthly to get ongoing entry to a workforce of fiduciary monetary advisors. I’ll go into greater detail on Intelligent Portfolios Premium a bit later.

The place Schwab Shines

It’s laborious to evaluation Schwab and slim the corporate’s strengths right down to a handful of attributes.

However listed here are a few of the best issues to understand about Schwab:

- Analysis and instruments. In case you incorporate know-how and information to assist information your funding selections, chances are high you’ll love Schwab. I’ll talk about why Schwab’s investment research is special later on this article.

- Free trades. Commonest “low cost brokers” provide free trades on inventory, ETF and choices. However Schwab, aggressive on worth for a lot of its historical past, was the primary to do away with commissions altogether.

- Bodily areas. Getting in-person assist can appear quaint if you happen to’re targeted on online-only fintech firms. However Schwab operates 384 branches, so it’s doubtless there’s a location close to you. That’s an actual differentiator.

- ETFs. I’ll go into greater detail in a bit. However to place it merely, Schwab’s ETF choices are robust. ETFs may be actively or passively managed identical to mutual funds. They commerce in the marketplace and don’t create further tax burdens for particular person buyers in taxable accounts.

- Buyer help. Schwab affords 24/7 telephone and on-line chat help, and its buyer help employees has developed a fame for being nice and useful. With exuberance within the inventory market in 2021 and early 2022, new clients poured into most brokerage corporations together with Schwab. The corporate was clear concerning the busier telephone traces and made energetic efforts to keep away from buyer frustration.

The place Schwab Falls Quick

Funding firms need to make some worth judgments. The way to earn cash, which merchandise to supply and the way detailed to make its options and data are all questions with out good solutions.

With that in thoughts, right here’s the place Schwab’s selections depart one thing to be desired:

- Aggressively leverages buyer money for revenue. If brokerages provide free inventory, mutual fund and choices trades, they’ve to seek out another option to flip a revenue. Schwab focuses fairly closely on money. It sweeps uninvested money into an account that pays a meager 0.48% rate of interest. Its robo-advisor portfolios additionally dedicate an outsized share to money when measured in opposition to rivals. The SEC even hammered Schwab with a huge penalty for these practices in 2022. Extra on that shortly.

- Instruments unfold throughout a number of platforms. Totake full benefit of every part Schwab affords, you’ll must obtain a software program program to your pc along with utilizing the cell app and web site.

- Info overload. I sympathize with the design workforce that has to determine a logical path for navigating Schwab’s website. The draw back to Schwab’s meticulous effort to be nearly every part to nearly everybody makes web site simplicity almost unimaginable. Simply take a look at the principle menu from Schwab.com’s homepage:

Charles Schwab Evaluate: What Makes Its Funding Analysis So Good?

Schwab’s layered method to instruments, training and platforms is a double-edged sword. It takes some thought — and admittedly, some effort — to determine the subset that’s finest for you.

Schwab compounds the problem with names that aren’t all the time intuitive, so I’ve sussed out the definitions:

- Commerce Supply: Schwab’s web-based buying and selling platform. It’s designed for buy-and-hold buyers. It excludes a few of the bells and whistles extra energetic merchants would possibly need.

- Schwab Cellular: the corporate’s cell buying and selling app. It syncs nicely with Commerce Supply. Schwab has performed a pleasant job of making cohesion between the 2.

- StreetSmart Edge: Schwab’s desktop-based buying and selling platform. It’s a downloadable, customizable interface that’s designed for energetic merchants.

- All-In-One Commerce Ticket: lets you enter orders throughout all of Schwab’s platforms, whether or not you’re attempting to purchase a single inventory or execute a multi-leg choices commerce.

- StreetSmart Central: a web-based platform for futures buying and selling.

- Schwab Insights: a content material hub that mixes real-time market insights and evaluation with easily-filtered academic content material.

The web site, app and desktop software program every have a distinct ecosystem of options. But when you may get oriented, Schwab most likely delivers the perfect analysis of any brokerage agency.

Schwab’s in-house training and market commentary content material consists of frequent, well timed updates. There are almost a dozen Schwab webcasts that broadcast reside each weekday, and there’s a quarterly journal.

Prospects can learn third-party studies from giants like Morningstar, MarketEdge and Credit score Suisse. You will discover real-time information and earnings studies.

Schwab’s screening instruments, used to search for particular kinds of firms or trades, are thorough and customizable. StreetSmart Edge goes deep, providing instruments, charts and options for energetic merchants.

TD Ameritrade runs one other in style buying and selling platform known as thinkorswim. Schwab has built-in that into its present choices.

Charles Schwab Evaluate: Why Ought to I Use Schwab for ETFs?

Schwab constantly receives accolades as the perfect funding firm for exchange-traded funds (ETFs), however its web site instruments are decidedly middle-of-the-road for ETFs. What provides?

Effectively, to unlock Schwab’s ETF powers, you first must obtain the StreetSmart Edge software I discussed earlier. On StreetSmart Edge, you’ll discover what’s most likely the perfect ETF screener in the marketplace.

A screener is one thing that helps you filter an information set. For instance, if you happen to had a spreadsheet crammed with hundreds of birthday dates, the best code might pick each particular person born on a Tuesday.

The screener inside StreetSmart Edge lets you filter ETFs by way of greater than 150 standards together with efficiency and asset class. It’s customizable so you’ll be able to mix a number of standards. It additionally permits you to save and reuse combos of filters.

Schwab supplies customers with studies from third-party analysts like Morningstar. You may also seek for and evaluate shares, ETFs and mutual funds facet by facet, which I’ve discovered distinctive within the trade.

Even non-customers can obtain and use StreetSmart Edge. And all ETF trades are commission-free by way of Schwab.

Schwab’s Clever Portfolios Premium

Cash professional Clark Howard has three major suggestions for people who find themselves looking for a financial advisor:

- Seek for fee-only Licensed Monetary Planners (CFPs) close to you through the Garrett Planning Network.

- Use Vanguard’s Personal Advisor (PA).

- Use Schwab’s Intelligent Portfolios Premium.

Intelligent Portfolios is Schwab’s entry-level robo-advisor (more on that soon). In case you make investments $25,000 or extra, you’re eligible for Premium, which unlocks entry to a workforce of CFPs.

Nevertheless, this service most likely doesn’t make sense until you make investments considerably greater than $25,000.

You’ll pay a one-time preliminary charge of $300. After discussing your monetary targets, a CFP will create a roadmap for you that accounts on your earnings, bills, funding portfolio, retirement plans and extra.

After that, you’ll pay $30 monthly for steady entry to a CFP (not essentially the identical one), your digital monetary roadmap and on-line planning instruments.

Right here’s a take a look at the annual charges you’ll pay within the first yr (together with the one-time $300 cost) and second yr based mostly in your funding quantity:

| Funding | First-Yr Price | Annual Charges | Second-Yr Price | Annual Charges |

|---|---|---|---|---|

| $25,000 | $660 | 2.64% | $360 | 1.44% |

| $50,000 | $660 | 1.32% | $360 | 0.72% |

| $100,000 | $660 | 0.66% | $360 | 0.36% |

| $200,000 | $660 | 0.33% | $360 | 0.18% |

You’ll unlock tax-loss harvesting if you happen to make investments at the least $50,000. The extra you make investments, the smaller the annual charge you’re paying, although the $30 monthly cost stays the identical.

Members of the monetary media usually consult with 1% as a benchmark annual charge for monetary advisors. In fact, the charges monetary advisors cost range broadly. For reference, Vanguard’s PA costs an annual charge of 0.30% with no further upfront price.

Schwab’s Clever Portfolios Premium may be a cheap option to get full entry to a fiduciary monetary advisor. However due to the pricing construction, the quantity you make investments can drastically change your annual prices for the higher.

Personally, I discover Schwab’s worth construction to be misleading to purchasers, deliberately or not. It obscures that Schwab is severely overcharging you in case you have a comparatively small sum of money invested with them by way of this program.

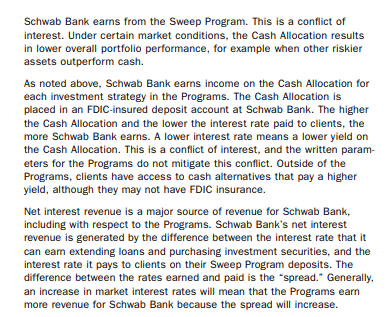

Schwab Fined Almost $200 Million for Money Allocation Scandal

Sadly, Schwab’s obscured excessive charges for purchasers invested in Clever Portfolios Premium isn’t the one means the corporate has lined its checking account in a not-so-obvious means that hurts clients.

Schwab’s robo-advisor, Clever Portfolios, put a noticeably outsized share of purchasers’ portfolios in money. Then the corporate pocketed greater than 1% of the curiosity it earned for itself.

Clark preaches on a regular basis about ensuring all of your monetary recommendation comes from a fiduciary. Meaning somebody with a authorized obligation to look out on your finest pursuits even when they put it forward of your individual. On this case, Schwab hides its income and reduces your returns on the again finish so it may roll out shiny, enticing pricing on the entrance finish.

The Securities and Exchange Commission smacked Schwab with a $187 million fine “for not disclosing that they had been allocating consumer funds in a fashion that their very own inner analyses confirmed could be much less worthwhile for his or her purchasers below most market situations.”

The SEC stated that Schwab “claimed that the amount of money in its robo-adviser portolios was determined by refined financial algorithms meant to optimize its purchasers’ returns when in actuality it was determined by how a lot cash the corporate needed to make.”

Schwab’s new superb print, which I doubt the common investor will learn, spells out that Schwab makes cash this manner. A part of the superb print reads: “Usually, a rise in market rates of interest will imply that the Applications earn extra income for Schwab Financial institution as a result of the unfold will improve.” In different phrases, the upper the rate of interest, the extra of your curiosity that Schwab will conveniently slip into its personal pocket.

By the way in which, Schwab admits that it earned 1.18% in your money in This fall of 2021 when rates of interest at banks had been nearly non-existent. Now that most of the finest high-interest financial savings accounts are paying 4% or extra, who is aware of how way more that Schwab is accumulating?

It additionally elevated its money allocations inside its robo portfolios from 6 to 22.5% to six to 30% within the midst of this scandal. So it’s already beginning to earn again the cash it misplaced by paying the almost $200 million superb.

Continuously Requested Questions About Charles Schwab

Does Schwab Supply a Robo-Advisor?

Sure. Schwab’s entry-level robo-advisor is known as Schwab Intelligent Portfolios. It requires a minimal funding of $5,000 and doesn’t cost an account administration charge.

Nevertheless, the money allocation of Schwab’s portfolios tends to be on the excessive facet — usually between 8 and 10% relying in your danger tolerance and different components. It additionally skews towards bonds.

In accordance with Condor Capital’s detailed report on robo-advisors within the first quarter of 2024, Schwab produced a five-year annualized return of 6.22%, which charges twenty fifth out of 27 choices. That’s almost the worst among the many robo-advisors the corporate measured.

Clever Portfolios doesn’t provide tax-loss harvesting until you make investments at the least $50,000.

As such, Clever Portfolios didn’t make my record of the best robo-advisors.

What Are Schwab’s Monetary Advisor Choices?

I’ve already talked about Schwab’s robo-advisor and Intelligent Portfolios Premium.

Nevertheless, Schwab lists different choices if you happen to’re trying to work with a monetary advisor.

In case you have at the least $1 million to take a position, you’ll be able to entry Personal Shopper. The annual charge begins at 0.80% and reduces if you happen to meet sure funding thresholds.

Private Client provides you a workforce of individuals to work with. They’ll provide recommendation on insurance coverage, taxes, retirement planning, funding administration and extra.

In case you have at the least $500,000 to take a position, you’ll be able to search recommendation by way of the Schwab Advisor Community. These are native CFPs who’re affiliated with and vetted by Schwab.

Schwab additionally affords Managed Portfolios ($25,000 minimal for a portfolio of mutual funds or ETFs) and Managed Account Select ($100,000 minimal for a portfolio of shares or bonds) if you happen to’re simply on the lookout for skilled funding steering.

Schwab’s ThomasPartners Strategies affords funding plans particularly constructed for retirement years.

Can I Use Schwab As My Financial institution?

Sure. Schwab Financial institution affords checking and savings accounts.

You may also get a variety of banking products and features by way of your Schwab brokerage account together with:

- 0.48% curiosity on uninvested money

- Free checking

- Debit card

- On-line invoice pay

- ATM entry together with limitless rebates for out-of-network ATMs

- No international transaction charges on debit card purchases

- FDIC insurance coverage as much as $500,000

Does Schwab Supply Fractional Shares?

Sure, Charles Schwab affords fractional shares by way of a program known as “Stock Slices.”

Fractional shares assist you to put money into an organization based mostly on a greenback quantity fairly than by shopping for a particular variety of shares.

The value of 1 Autozone share is greater than $2,800 as of July 2024. Beforehand, in case your portfolio was small and also you needed to diversify, chances are you’ll not have been capable of justify shopping for a share of Autozone. Fractional shares have unlocked that functionality.

Schwab’s “Inventory Slices” are extra restricted than the fractional shares provided by some firms. Schwab lets you put money into as much as 10 firms directly with “slices” that price as little as $5 every. However the firms should be a part of the S&P 500.

Ultimate Ideas

Out of the three low cost brokers that Clark considers his favourite youngsters, Schwab is my least favourite personally.

There’s been a fierce debate about how large funding firms like Robinhood earn cash (through Payment for Order Flow, which provides buyers a barely worse worth once they purchase … we’re speaking fractions).

Constancy argues they don’t revenue on PFOF, which Schwab has protested publicly, calling it a matter of semantics.

However one solely has to have a look at Schwab’s robo-advisor product in comparison with Clark’s two different favorites to grasp why I feel Schwab’s revenue methodology is extra underhanded.

Vanguard: 0.3% charge, 0.07% expense ratio.

Constancy: 0.5% charge, 0% expense ratio.

Schwab: 0.17% expense ratio; if you happen to make investments the minimal $25,000, you’re at 2.28% in annual charges the primary yr and 1.44% after.

Take into account additionally that Vanguard and Constancy beat Schwab on efficiency by a big margin as a result of a lot of Schwab’s portfolios sit in money.

To be truthful, legacy firms can get fats and joyful. Not Schwab. Regardless of being round for 50 years, Schwab remains to be combating to serve its clients and outpace its rivals (new and outdated).

Schwab made main information when it eradicated commissions and purchased TD Ameritrade.

Its analysis and instruments, in addition to an abundance of A-to-Z merchandise, do make it one of many two most substantial all-around funding firms as a result of it serves nearly anybody.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/dreamstime_xxl_158636192-1024x683.jpg)