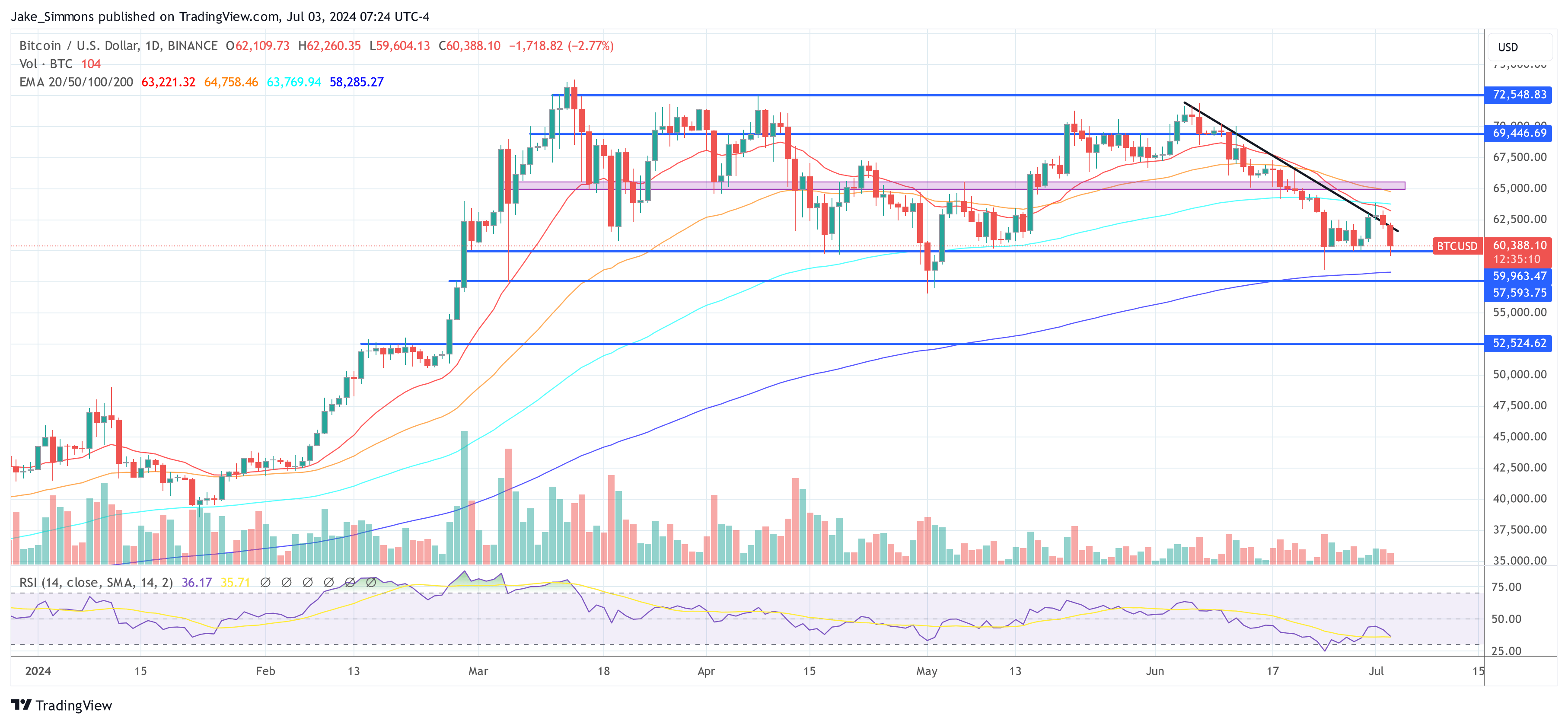

The Bitcoin worth has fallen to a low of $59,604 right this moment, marking a 4% lower. Based on a number of famend crypto analysts, this motion was largely pushed by the phenomenon often known as the CME hole, an idea vital in Bitcoin futures buying and selling on the Chicago Mercantile Alternate (CME).

Why Is Bitcoin Down Right this moment?

A “CME hole” is a time period used to explain the worth hole that emerges on the Bitcoin CME futures chart. Not like Bitcoin’s spot markets that function 24/7, the CME Bitcoin futures market solely trades 5 days per week, closing over the weekend and on holidays. This distinction in buying and selling hours can lead to a worth discrepancy between the final traded worth on Friday and the market’s opening on Monday.

Right this moment’s Bitcoin worth motion can in all probability be instantly linked to the closure of such a niche. Over the weekend, a noticeable hole fashioned. Daan Crypto Trades (@DaanCrypto), a distinguished dealer and analyst, confirmed this through X, explaining, “Bitcoin closed many of the hole that was created throughout this weekend. On Monday it additionally closed the hole that was created per week in the past and topped out proper at that time. [..] The hole has now been totally closed. No main gaps in close by proximity as we converse.”

Associated Studying

Different market individuals echoed this sentiment. Titan of Crypto (@Washigorira) indicated the bullish potential post-gap closure, stating on X, “Bitcoin CME Futures GAP received crammed! As anticipated. Nothing holds BTC again now. Time to ship.” This view means that filling the hole might take away resistance for Bitcoin’s worth, probably resulting in an uptick.

Crypto analyst Ninja (@Ninjascalp) confirmed, “this was only a CME hole fill guys […] it’s bullish promoting. It’s all going to be okey. Don’t panic.” One other analyst commented “For anybody questioning who’s operating the BTC market within the quick time period, it’s market makers! There was no method they had been going to depart a $1,650 CME hole from the weekend.”

What To Anticipate Now?

Marco Johanning offered a extra nuanced take, emphasizing the precarious nature of the present worth degree. His commentary through X highlighted each potential and danger.

Associated Studying

“Principal state of affairs: Bitcoin has misplaced the trendline and closed the CME hole. The worth is sitting on an area assist, from which it may now pump. That may be a typical mid-week reversal with the liquidity behind the equal highs at 63.8k as the principle goal. Nevertheless, the present degree can also be fragile. If the assist is misplaced, we might see one other 1k-2k drop. I can hardly await Bitcoin to lastly go away this exhausting time capitulation range,” Johanning acknowledged.

The analysts from Alpha dōjō (@alphadojo_net) provided an in-depth evaluation, dissecting the day’s worth motion and potential future developments. Their report highlighted the vital ranges that merchants are watching: “The evaluation is kind of easy: BTC must bounce right here, or if it loses the $60k degree, a lot decrease costs are doubtless. So long as we don’t break beneath $60k or above $63.5k, it’s finest to take it sluggish and await a clearer course.”

In addition they famous a major liquidity pool across the $60,000 mark which could act as a assist, whereas declaring {that a} sturdy selling presence above this degree at $64,000 might cap upward actions. “Within the order books, the promote facet stays very sturdy, whereas the bid facet fails to indicate any enhance.”

At press time, BTC traded at $60,388.

Featured picture created with DALL·E, chart from TradingView.com

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/Bitcoin-Price-Drops-Below-60000-Key-Reason-Explained-1024x618.jpg)