Individuals take potshots at it however, identical to an S&P 500 index fund, it is a completely sensible choice.

The mortgage-backed securities factor appears look a boogeyman to me. To begin with, it is solely 20% of the fund. Second, these will not be just like the subprime stuff, these are government-insured mortgages with virtually no default danger.

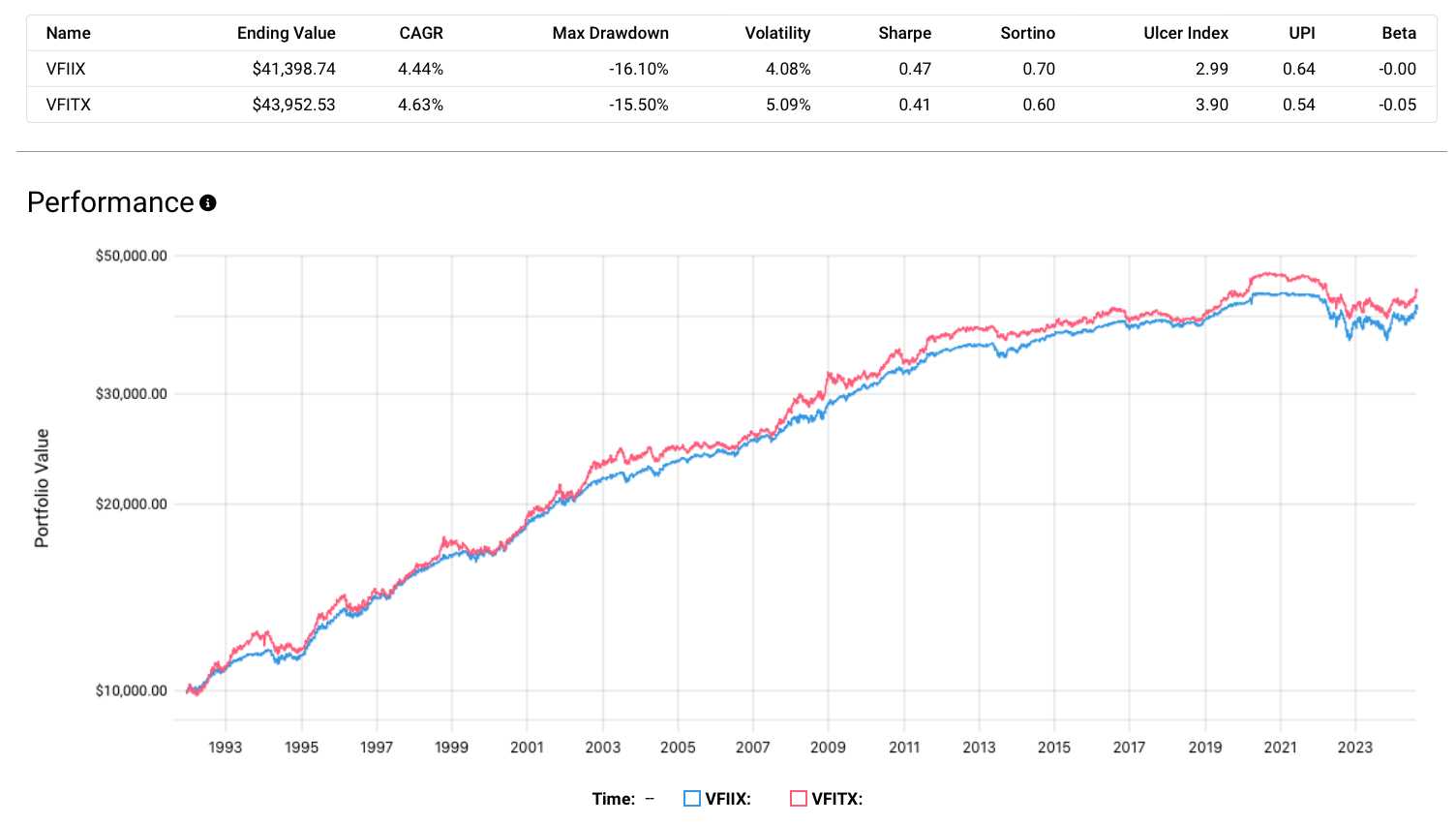

The objections to it are considerably technical. The declare is that as a result of mortgage holders are allowed to prepay, if rates of interest drop, they may payoff their high-interested mortgages and thus these bonds will give up paying holders the excessive charges they’d deliberate on getting. The mortgage holders who’re paying excessive charges will not be locked into these excessive charges. The impact known as “convexity.” That is all effectively and good, however it’s awfully onerous to seek out proof that this supposed prepayment danger has proven up in any vital approach. For instance, right here is the Vanguard GNMA Fund, VFITX, 100% mortgage-backed (blue) and the Intermediate-term Treasury fund, VFIIX (pink).

Over this time interval of over thirty years, the place do you see any proof of unreasonable danger in GNMA bonds?

For those who suppose you want BIV higher, or an all-Treasury fund higher, no matter. However I would not be in any rush to ditch BND simply due to it holding 20% mortgage-backed securities. They most likely have a small quantity of additional danger due to the contract permitting the mortgage holders to be unpredictable, so that they most likely do not match quantitive fashions. But it surely’s solely a small quantity, and it might be compensated by a small quantity of additional reward.

Now, TIPS are trickier for me to speak about, as a result of I personally am an enormous TIPS fan, and my fastened revenue holdings are greater than half VAIPX, Vanguard’s intermediate-term TIPS fund. I do not suppose there’s any pure bond fund that holds each TIPS and nominal bonds, so in order for you each you have to to carry two funds.

My very own analyses present up time and time once more: you probably have any significant allocation to shares, their danger goes to dominate the portfolio, and the consequences of various quantities of danger on the bond facet are going to be very small.

The vital factor is to carry some bonds, not which taste of bonds to carry, and the choice of inventory/bond share is far more vital than the choice of which fund or funds to make use of on the bond facet.

Annual revenue twenty kilos, annual expenditure nineteen nineteen and 6, end result happiness; Annual revenue twenty kilos, annual expenditure twenty kilos ought and 6, end result distress.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/08/1723494916_846_Help-Flailing-to-figure-out-the-bond-side-of-my-1024x581.png)