Within the previous three months, 5 analysts have launched rankings for Expeditors Intl (NYSE:EXPD), presenting a big selection of views from bullish to bearish.

The next desk summarizes their current rankings, shedding gentle on the altering sentiments throughout the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Rankings | 0 | 0 | 4 | 1 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 0 | 1 | 0 | 0 |

| 2M In the past | 0 | 0 | 2 | 0 | 0 |

| 3M In the past | 0 | 0 | 0 | 1 | 0 |

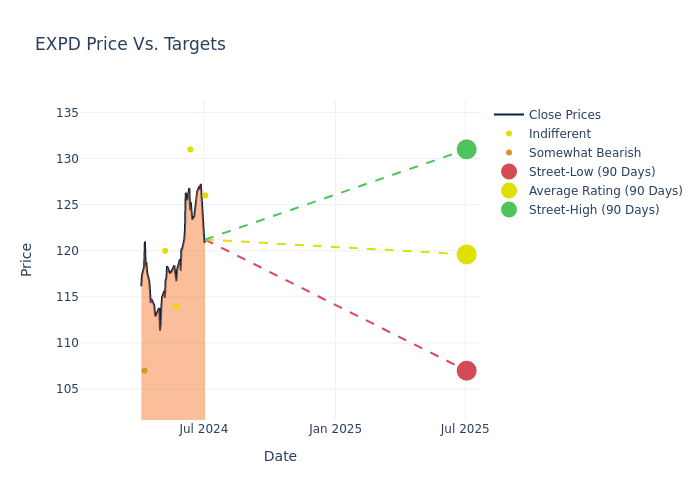

Insights from analysts’ 12-month worth targets are revealed, presenting a mean goal of $119.6, a excessive estimate of $131.00, and a low estimate of $107.00. Witnessing a optimistic shift, the present common has risen by 4.18% from the earlier common worth goal of $114.80.

Deciphering Analyst Rankings: A Nearer Look

A complete examination of how monetary specialists understand Expeditors Intl is derived from current analyst actions. The next is an in depth abstract of key analysts, their current evaluations, and changes to rankings and worth targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| Benjamin Hartford | Baird | Raises | Impartial | $126.00 | $118.00 |

| Ken Hoexter | B of A Securities | Raises | Impartial | $131.00 | $126.00 |

| J. Bruce Chan | Stifel | Raises | Maintain | $114.00 | $112.00 |

| Bascome Majors | Susquehanna | Raises | Impartial | $120.00 | $112.00 |

| Brian Ossenbeck | JP Morgan | Raises | Underweight | $107.00 | $106.00 |

Key Insights:

- Motion Taken: Analysts often replace their suggestions primarily based on evolving market situations and firm efficiency. Whether or not they ‘Preserve’, ‘Elevate’ or ‘Decrease’ their stance, it displays their response to current developments associated to Expeditors Intl. This data gives a snapshot of how analysts understand the present state of the corporate.

- Ranking: Gaining insights, analysts present qualitative assessments, starting from ‘Outperform’ to ‘Underperform’. These rankings replicate expectations for the relative efficiency of Expeditors Intl in comparison with the broader market.

- Worth Targets: Analysts gauge the dynamics of worth targets, offering estimates for the long run worth of Expeditors Intl’s inventory. This comparability reveals tendencies in analysts’ expectations over time.

Understanding these analyst evaluations alongside key monetary indicators can provide useful insights into Expeditors Intl’s market standing. Keep knowledgeable and make well-considered selections with our Rankings Desk.

Keep updated on Expeditors Intl analyst rankings.

All You Must Know About Expeditors Intl

Expeditors Worldwide of Washington is a non-asset-based third-party logistics supplier, centered on worldwide freight forwarding. Its presents freight consolidation and forwarding, customs brokerage, warehousing and distribution, buy order administration, vendor consolidation, and quite a few different value-added logistics companies. It employs refined IT methods and contracts with airways and ocean carriers to maneuver clients’ freight throughout the globe. The agency operates greater than 200 full-service workplace areas worldwide, along with quite a few satellite tv for pc areas. Expeditors derives round 34% of consolidated web income from airfreight, 30% from ocean freight, and 36% from customs brokerage and different companies.

Expeditors Intl: Delving into Financials

Market Capitalization: Indicating a lowered measurement in comparison with trade averages, the corporate’s market capitalization poses distinctive challenges.

Adverse Income Pattern: Inspecting Expeditors Intl’s financials over 3 months reveals challenges. As of 31 March, 2024, the corporate skilled a decline of roughly -14.89% in income progress, reflecting a lower in top-line earnings. As in comparison with its friends, the income progress lags behind its trade friends. The corporate achieved a progress price decrease than the typical amongst friends in Industrials sector.

Web Margin: The corporate’s web margin is a standout performer, exceeding trade averages. With a powerful web margin of 7.67%, the corporate showcases sturdy profitability and efficient price management.

Return on Fairness (ROE): Expeditors Intl’s monetary power is mirrored in its distinctive ROE, which exceeds trade averages. With a exceptional ROE of 7.38%, the corporate showcases environment friendly use of fairness capital and powerful monetary well being.

Return on Belongings (ROA): Expeditors Intl’s monetary power is mirrored in its distinctive ROA, which exceeds trade averages. With a exceptional ROA of 3.75%, the corporate showcases environment friendly use of property and powerful monetary well being.

Debt Administration: With a below-average debt-to-equity ratio of 0.26, Expeditors Intl adopts a prudent monetary technique, indicating a balanced method to debt administration.

Understanding the Relevance of Analyst Rankings

Analysts are specialists inside banking and monetary methods that usually report for particular shares or inside outlined sectors. These folks analysis firm monetary statements, sit in convention calls and conferences, and converse with related insiders to find out what are often known as analyst rankings for shares. Usually, analysts will price every inventory as soon as 1 / 4.

Analysts might improve their evaluations by incorporating forecasts for metrics like progress estimates, earnings, and income, delivering extra steerage to traders. It’s important to acknowledge that, though specialists in shares and sectors, analysts are human and specific their opinions when offering insights.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/1720057146_analyst_ratings_image_0.png)