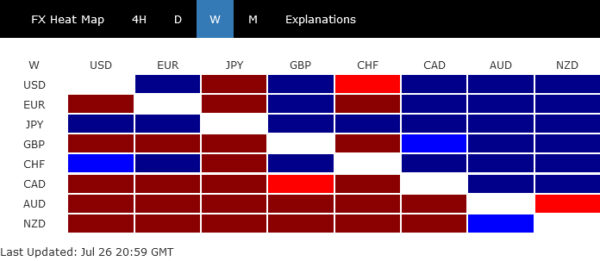

It was a extremely unstable week which can’t be characterised by a single theme. Yen had a pointy and strong rally towards all main currencies, persevering with its rebound from the 38-year lows hit earlier this month, with market members unwinding their long-held quick positions. Alongside Yen, Swiss Franc and Greenback additionally emerged as winners, though they trailed considerably behind the Yen. Conversely, Australian Greenback took the underside spot, adopted by New Zealand Greenback and Canadian Greenback. These positions highlighted clear danger aversion sentiment.

The chance-off sentiment, nonetheless, was not uniformly mirrored throughout all markets. Within the US, whereas NASDAQ and S&P 500 had vital declines, DOW managed to submit a weekly acquire, with Russell 2000 additionally exhibiting resilience. In Europe, FTSE and DAX ended the week larger, with the robust rebound on Friday, whereas CAC hit new lows for the yr. In Asia, Japan’s Nikkei prolonged its plunge from file highs to hit the bottom stage in three months, whereas China’s SSE resumed its downtrend .

A number of themes are at play within the present market setting, creating a posh and even contradictory image. Sector rotation inside shares is a notable development. On the similar time US election danger can be weighing on sentiment. International financial coverage easing continues, with the notable exception of Japan. In the meantime, financial slowdown in China is deepening, as evidenced by current knowledge and the federal government’s panic efforts to stimulate progress via charge cuts. Nevertheless, amidst these various components, the de-inversion of yield curve within the US stands out as a very vital improvement from a medium-term technique perspective.

US Shares Finish Week in Turmoil, Sector Rotation or Extra?

This week has been marked by turbulence within the US inventory markets, pushed by a number of conflicting themes. Regardless of a late-week rally, NASDAQ closed down -2.1%, whereas S&P 500 fell 0.8%. Each indexes skilled consecutive weekly losses for the primary time since April. In distinction, DOW outperformed, rising 0.8% for its fourth straight optimistic week, a milestone not seen since Might.

Sector rotation was evident, with Russell 2000 gaining practically 4% for the week. Nevertheless, it did not surpass final week’s excessive of 2278.12, indicating that this rotation is extra about minimizing losses than making vital beneficial properties. Equally, DOW remained effectively under the earlier week’s excessive of 41376.00.

Political uncertainty can be influencing investor habits. With endorsements from President Joe Biden, former President Barack Obama, and former Home Speaker Nancy Pelosi, Vice President Kamala Harris appears prone to safe the Democratic nomination to problem Donald Trump within the upcoming presidential election. The shift within the Democratic candidate seems to have narrowed Trump’s lead notably, including to the uncertainty.

On the info entrance, June PCE inflation knowledge supplied the Fed with additional justification to contemplate easing financial coverage later within the yr. Q2 GDP knowledge introduced a Goldilocks situation, with stronger-than-expected progress whereas inflation pressures eased.

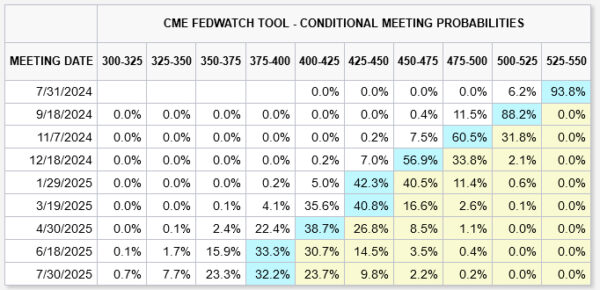

Fed funds futures point out a totally priced-in 25bps charge reduce in September. Markets additionally see a 68% likelihood of a second 25bps reduce in November and a 64% likelihood of a 3rd reduce in December. If these cuts happen, federal funds charge would lower to 4.50-4.75% by the tip of the yr, down from the present 5.25-5.50% stage.

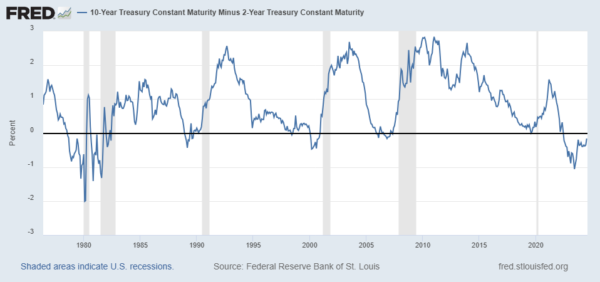

Yield Curve Steepening Indicators Recession Dangers

However above all, essentially the most important improvement within the background is steepening of the yield curve. Since mid-June, the unfold between 10-year and 2-year Treasury yields has narrowed considerably, from -0.47 foundation factors to as little as -0.12 on Thursday, indicating a possible development of normalization from inversion.

Traditionally, recessions within the US have typically adopted the normalization of an inverted yield curve:

- 1990-1991 Recession: The yield curve inverted in 1989 and normalized shortly earlier than the recession started in July 1990.

- 2001 Recession: The yield curve inverted in 2000 and normalized simply earlier than the dot-com bubble burst, resulting in a recession.

- 2008 Monetary Disaster: The yield curve inverted in late 2006. Regardless of partial normalization in 2007, the US financial system fell right into a extreme recession by December 2007, exacerbated by the housing market collapse and monetary sector failures.

- 2020 COVID-19 Recession: The yield curve inverted in 2019 and normalized earlier than the COVID-19 pandemic-induced recession in 2020, although this case was difficult by the pandemic’s distinctive influence.

As a facet word, former New York Fed President William Dudley warned on Wednesday that Fed ought to reduce rates of interest instantly to stave off a recession, as present financial cooling measures are visibly efficient.

Dudley highlighted that the three-month common unemployment charge has risen 0.43% from its low level over the previous yr, nearing the 0.5% threshold recognized by the Sahm Rule, which has traditionally signaled a US recession.

Notably, as soon as this threshold is breached, unemployment sometimes rises considerably extra, with the smallest improve being practically 2% from trough to peak.

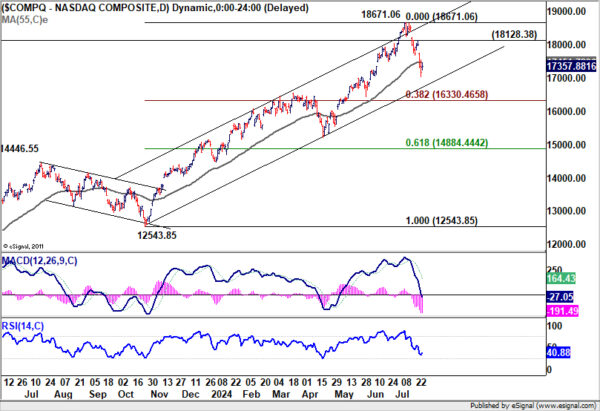

NASDAQ’s Draw back Dangers Materialize Whereas DOW Retains Bullish Outlook

Technically, NASDAQ’s steep decline final week and break of 55 D EMA (now at 17451.72) means that fall from 18671.06 is not less than correcting the rally from 12543.85. Danger will keep on the draw back so long as 18128.38 resistance holds. Deeper fall could be seen to 38.2% retracement of 12543.85 to 18671.06 at 16330.46 earlier than discovering robust help to set the vary for consolidations.

Whereas it’s nonetheless early to name, agency break of 16330.46 will elevate the prospect that NASDAQ is certainly correcting the entire up development from 10088.82 (2022 low). On this extra bearish case, sufficient help may solely be discovered between 38.2% retracement of 10088.82 to 18671.06 at 15392.65, and 55 W EMA (now at 15555.78).

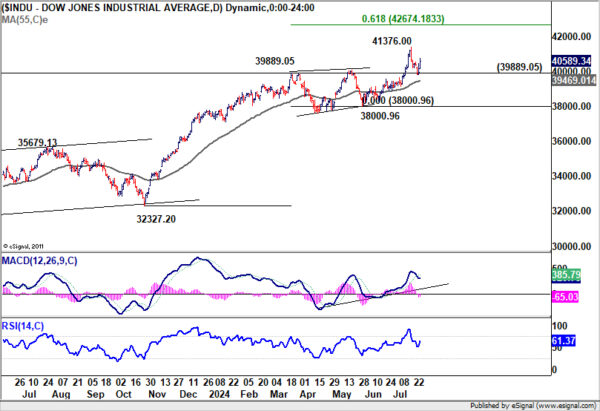

Conversely, DOW’s robust bounce from 39889.05 resistance turned help is maintaining close to time period bullishness intact. One other rise may very well be seen via 41376.00 to 61.8% projection of 32327.20 to 39889.05 from 38000.96 at 42674.18. Nevertheless, decisive break of 39889.05 would open up deeper fall to 38000.96 help as bigger scale correction.

Greenback Index’s actions have been blended because it struggled to discover a clear path, on whether or not the market is risk-on, or danger off. The index can be struggling round 55 W EMA (now at 104.30). Danger will keep on the draw back so long as 105.20 resistance holds. Agency break of 103.65 and sustained buying and selling under 55 W EMA will carry deeper fall to 102.35 and even additional to 100.61.

Nevertheless, break of 105.20 will argue that value actions from 106.51 is merely a corrective sample that has accomplished with three waves to 103.65. Greenback index ought to then be able to rise via 106.13/51 resistance zone to renew the rebound from 100.61.

Chinese language Investor Sentiment Deteriorates Amid Panic-Pushed Fee Cuts

One other improvement to notice is the continued deterioration in investor sentiment in China, pushed by what seems to be panic measures from the Folks’s Financial institution of China to bolster an financial system rising at its slowest tempo in additional than a yr.

On Thursday, PBoC made a shock, off-schedule reduce to its one-year medium-term lending facility charge, reducing it from 2.5% to 2.3%. This transfer injected CNY 200B of liquidity into the market and marked the biggest discount since 2020. Earlier within the week, PBoC introduced its first reduce in practically a yr to a key short-term coverage charge, lowering the seven-day reverse repo charge from 1.8% to 1.7%.

These aggressive charge cuts have underlined the authorities’ urgency and contributed to a way of panic relatively than lifting market sentiment.

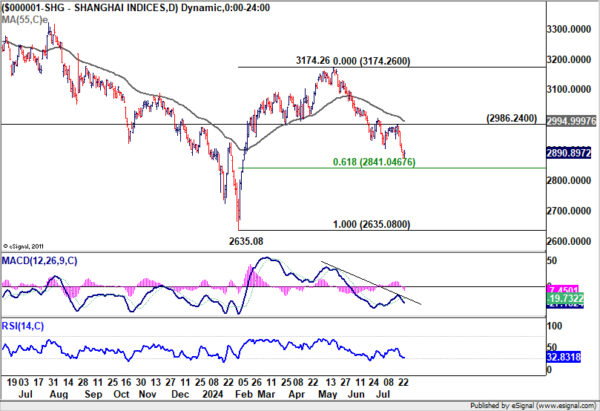

Shanghai SSE Composite resumed the autumn from 3174.26 to shut at 2890.89, lowest in February. Technically, close to time period focus is now on 61.8% retracement of 2635.08 to 3174.26 at 2841.04. Sturdy bounce from this stage, adopted by break of 2986.24 resistance, will counsel that fall from 3174.26 might be only a corrective transfer, and has probably accomplished.

Nevertheless, sustained break of 2841.04 would danger deeper sell-off again to 2635.08. Extra importantly, It will elevate the prospect that SSE is certainly making an attempt to renew entire down development from 3731.68 (2020 excessive), as its rebound try has been repeatedly rejected by falling 55 W EMA.

AUD/JPY and NZD/JPY Plunge Amid Broad Yen Rally and Regional Danger-Off Sentiment

AUD/JPY and NZD/JPY have been the most important movers final week, each misplaced greater than -4.5%. The robust, broad-based rally in Yen was actually an element. The robust, broad-based rally within the Yen performed a significant position on this decline, compounded by a prevailing risk-off sentiment in each China and Japan.

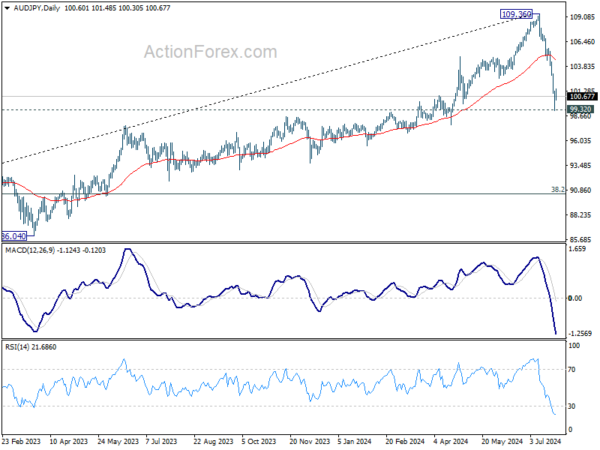

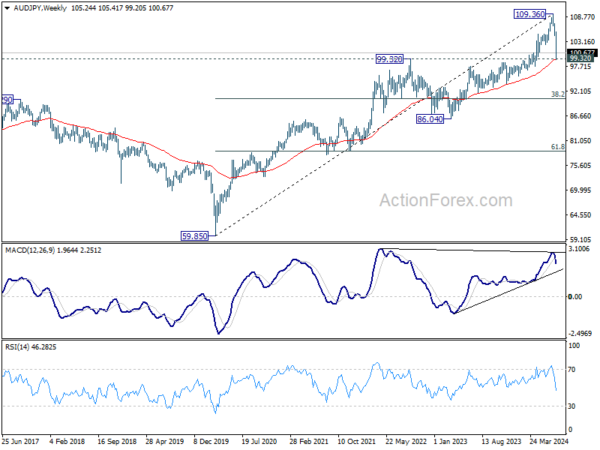

Technically, AUD/JPY is now urgent an vital cluster help zone, together with 99.32 resistance turned help and 55 W EMA (now at 99.26). Some stabilization may very well be seen from present stage to carry rebound. But, danger will proceed to remain closely on the draw back so long as 55 D EMA (now at 104.66) holds. Sustained break of 99.32 will argue that AUD/JPY is not less than correcting the entire rise from 59.85 (2020 low), with danger of bearish reversal. Deeper fall would then be seen to 38.2% retracement of 59.85 to 109.36 at 90.44.

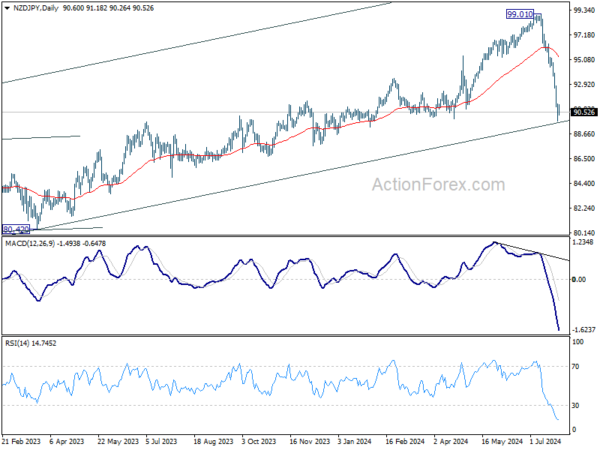

NZD/JPY has damaged 55 W EMA already, and it’s now making an attempt to attract help from long run channel. Some stabilization may very well be seen from present stage to carry rebound. Nonetheless, danger will keep on closely on the draw back so long as 55 D EMA (now at 95.27) holds. Sustained break of the channel help will point out that it’s not less than correcting the entire up development from 59.49 (2020 low) with danger of bearish reversal. Deeper fall would then be seen to 38.2% retracement of 59.49 to 99.01 at 82.389.

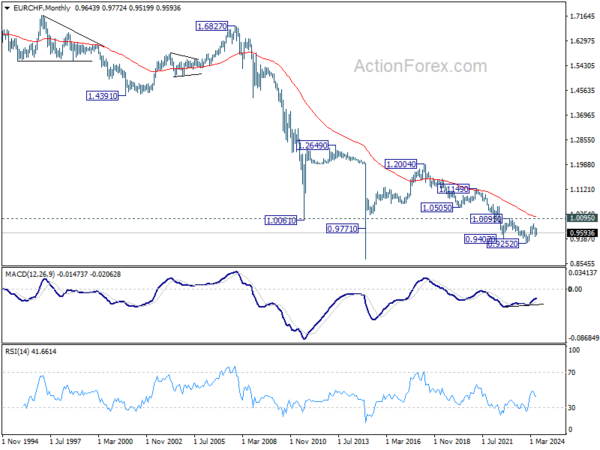

EUR/CHF Weekly Outlook

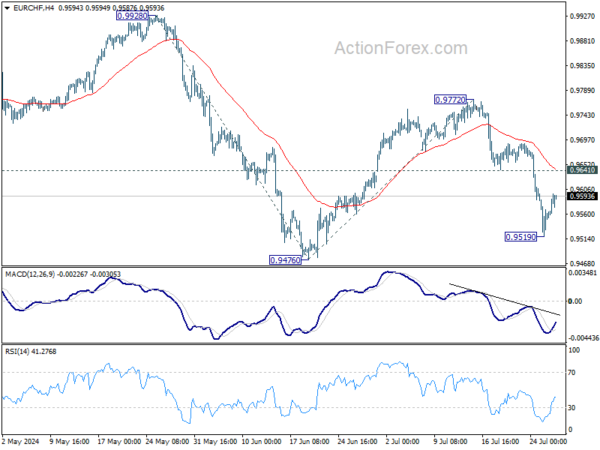

EUR/CHF’s fall from 0.9772 prolonged to 0.9519 final week however recovered since then. Preliminary bias is turned impartial this week for consolidations first. Additional decline is predicted so long as 0.9641 help turned resistance holds. Rebound from 0.9476 ought to have accomplished as a corrective transfer at 0.9772. Under 0.9519 will carry retest of 0.9476. Agency break there’ll resume entire fall from 0.9928 to 100% projection of 0.9928 to 0.94767 from 0.9772 at 0.9320.

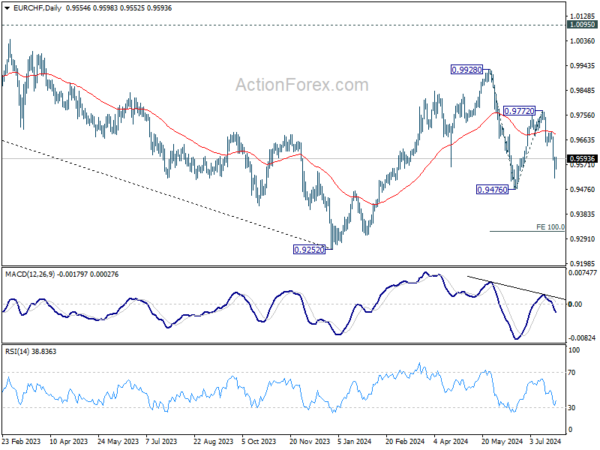

Within the greater image, with 1.0095 key medium time period resistance intact, value actions from 0.9252 (2023 low) are seen as a corrective sample. Fall from 0.9928 is perhaps the second leg and break of 0.9476 would carry deeper decline to retest 0.9252 low. However robust help must be seen there to increase the corrective sample with one other rising leg. In any case, medium time period outlook will probably be impartial at greatest so long as 1.0095 structural resistance holds.

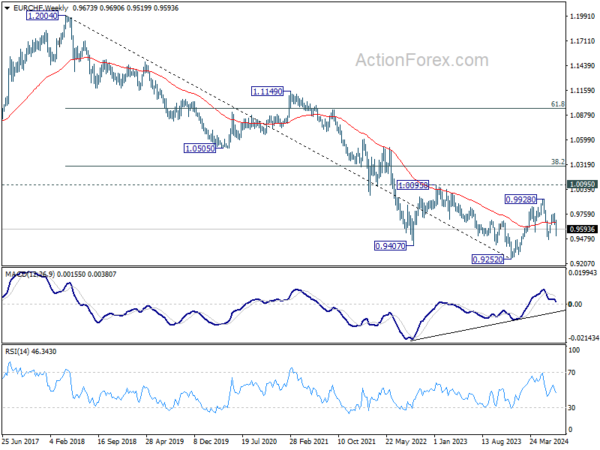

In the long run image, fall from 1.2004 (2018 excessive) is a part of the multi-decade down development. Agency break of 1.0095 resistance is required to be the primary signal of long run bottoming. In any other case, outlook will stay bearish.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/07/f-recession1.jpg)