- Canadian Greenback sheds a fifth of a % in opposition to Dollar.

- Canada noticed an upswing in core Retail Gross sales, however industrial costs cooled.

- US PMIs beat the road, snubbing forecasts and ticking increased in June.

The Canadian Greenback (CAD) is struggling to overhaul the US Greenback (USD) on Friday, buckling beneath the burden of a skinny, five-day win streak in opposition to the Dollar after the US Buying Managers Index (PMI) firmly beat forecasts, bolstering the Dollar and leaving the CAD to compete for second place.

Canada noticed a better-than-expected print in core Retail Sales in April, however floundering industrial and uncooked supplies costs in Could restricted the Canadian Greenback’s upside strikes on Friday. US PMIs lurched increased in June, pushing the US Greenback increased throughout the board. The CAD continues to be broadly increased on the week, holding onto a fifth of a % in opposition to the USD from Monday’s opening bids.

Every day digest market movers: Blended Canadian information flubs broad beats from US

- Canadian core Retail Gross sales surged 1.8% MoM in April, the best MoM achieve since July 2022. Markets had anticipated a print of 0.7% in comparison with the earlier month’s revised -0.8%.

- Canadian Uncooked Materials Worth Index fell a full 1.0% in Could, a steeper decline than the anticipated -0.6% contraction and falling again from the earlier 5.3% (revised from 5.5%).

- Canadian Industrial Produce Costs got here in flat in Could, under the 0.5% forecast and clipping the earlier month’s revised 1.4% as inflation continues to seep out of the Canadian financial system on the industrial stage.

- US S&P World Manufacturing PMIs broadly beat forecasts with the Manufacturing PMI printing at 51.7 versus the forecast decline to 51.0 from the earlier 51.3.

- US Companies PMI additionally stepped increased, clipping into 55.1 in comparison with the median market forecast of 53.7 in opposition to the earlier month’s 54.8.

- Arising subsequent week, Financial institution of Canada (BoC) Governor Tiff Macklem shall be making a public look on Monday; Tuesday will comply with up with Canada’s Client Worth Index (CPI) inflation alongside the BoC’s personal CPI core print.

Canadian Greenback PRICE Right now

The desk under reveals the share change of Canadian Greenback (CAD) in opposition to listed main currencies in the present day. Canadian Greenback was the strongest in opposition to the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.13% | 0.33% | 0.11% | 0.18% | -0.00% | 0.31% | |

| EUR | -0.09% | 0.03% | 0.26% | 0.04% | 0.11% | -0.07% | 0.22% | |

| GBP | -0.13% | -0.03% | 0.22% | -0.01% | 0.08% | -0.10% | 0.20% | |

| JPY | -0.33% | -0.26% | -0.22% | -0.23% | -0.17% | -0.34% | -0.00% | |

| CAD | -0.11% | -0.04% | 0.01% | 0.23% | 0.05% | -0.12% | 0.20% | |

| AUD | -0.18% | -0.11% | -0.08% | 0.17% | -0.05% | -0.21% | 0.12% | |

| NZD | 0.00% | 0.07% | 0.10% | 0.34% | 0.12% | 0.21% | 0.32% | |

| CHF | -0.31% | -0.22% | -0.20% | 0.00% | -0.20% | -0.12% | -0.32% |

The warmth map reveals proportion adjustments of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, for those who decide the Canadian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will signify CAD (base)/USD (quote).

Technical evaluation: Canadian Greenback provides blended efficiency on Friday

The Canadian Greenback (USD) is buying and selling tightly on Friday with positive aspects and losses equally balanced. The CAD is up round a fifth of a % in opposition to the Australian Greenback (AUD) and Japanese Yen (JPY), however struggling to restrict losses in opposition to the US Greenback to one-fifth of 1 %.

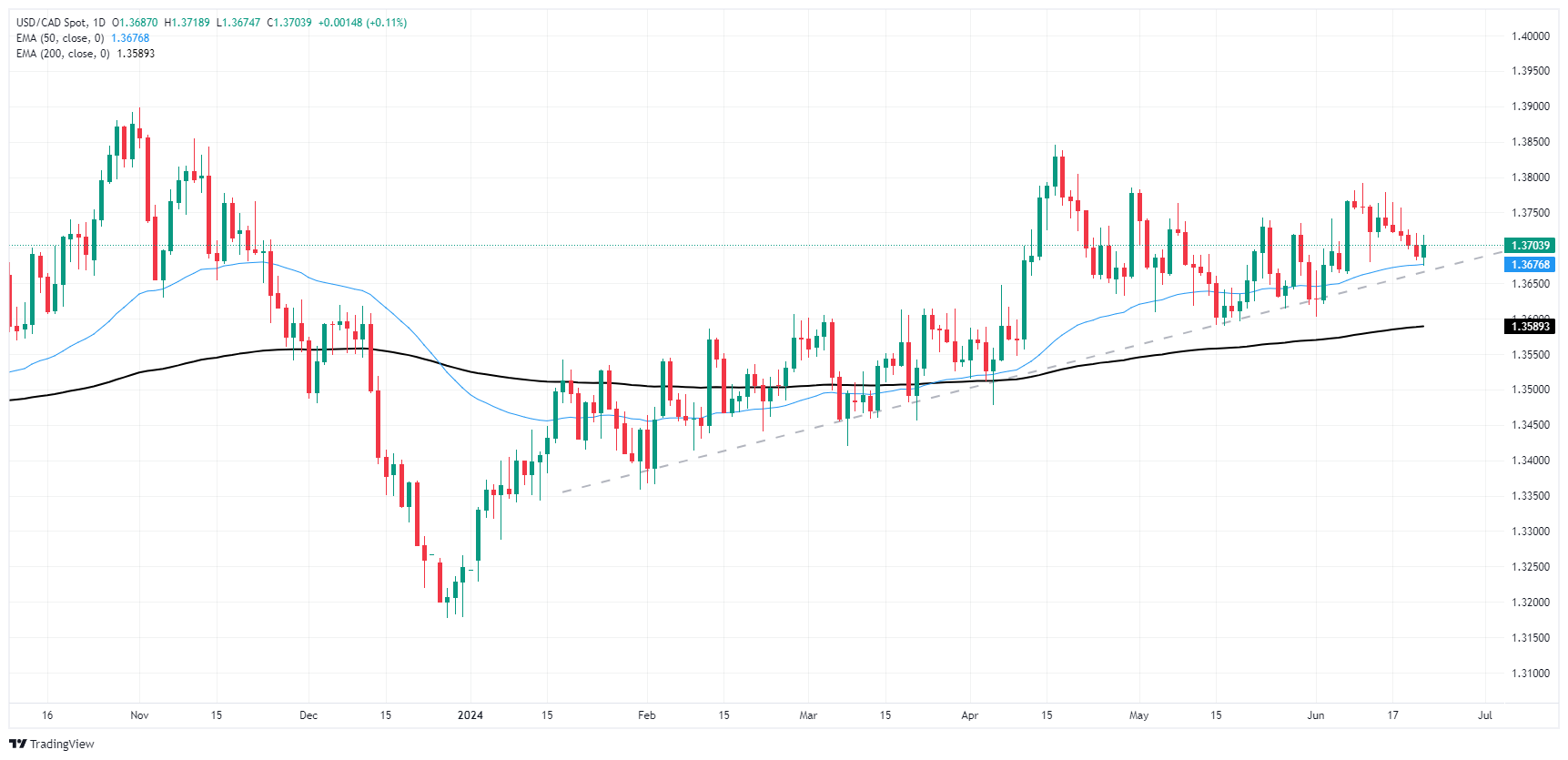

USD/CAD bumped increased on Friday, bouncing from a recent weekly low of 1.3675 to briefly check again above the 1.3700 deal with earlier than working into intraday technical resistance on the 200-hour Exponential Shifting Common (EMA) at 1.3715.

Every day candlesticks are on tempo to chalk in a primary inexperienced candle after tender declines for 5 straight buying and selling days, rebounding from near-term assist on the 50-day EMA close to 1.3675. USD/CAD is mired in tough consolidation as merchants grapple with a tough rising trendline, and long-term technical assist continues to bolster bids because the 200-day EMA rises into 1.3600.

USD/CAD hourly chart

USD/CAD each day chart

Canadian Greenback FAQs

The important thing elements driving the Canadian Greenback (CAD) are the extent of rates of interest set by the Financial institution of Canada (BoC), the value of Oil, Canada’s largest export, the well being of its financial system, inflation and the Commerce Steadiness, which is the distinction between the worth of Canada’s exports versus its imports. Different elements embody market sentiment – whether or not traders are taking up extra dangerous belongings (risk-on) or looking for safe-havens (risk-off) – with risk-on being CAD-positive. As its largest buying and selling accomplice, the well being of the US financial system can also be a key issue influencing the Canadian Greenback.

The Financial institution of Canada (BoC) has a major affect on the Canadian Greenback by setting the extent of rates of interest that banks can lend to at least one one other. This influences the extent of rates of interest for everybody. The primary objective of the BoC is to take care of inflation at 1-3% by adjusting rates of interest up or down. Comparatively increased rates of interest are usually constructive for the CAD. The Financial institution of Canada can even use quantitative easing and tightening to affect credit score circumstances, with the previous CAD-negative and the latter CAD-positive.

The value of Oil is a key issue impacting the worth of the Canadian Greenback. Petroleum is Canada’s largest export, so Oil worth tends to have an instantaneous affect on the CAD worth. Typically, if Oil worth rises CAD additionally goes up, as mixture demand for the forex will increase. The other is the case if the value of Oil falls. Greater Oil costs additionally are inclined to lead to a larger probability of a constructive Commerce Steadiness, which can also be supportive of the CAD.

Whereas inflation had at all times historically been considered a adverse issue for a forex because it lowers the worth of cash, the alternative has truly been the case in trendy occasions with the relief of cross-border capital controls. Greater inflation tends to guide central banks to place up rates of interest which attracts extra capital inflows from world traders looking for a profitable place to maintain their cash. This will increase demand for the native forex, which in Canada’s case is the Canadian Greenback.

Macroeconomic information releases gauge the well being of the financial system and might have an effect on the Canadian Greenback. Indicators resembling GDP, Manufacturing and Companies PMIs, employment, and client sentiment surveys can all affect the path of the CAD. A powerful financial system is nice for the Canadian Greenback. Not solely does it appeal to extra overseas funding however it might encourage the Financial institution of Canada to place up rates of interest, resulting in a stronger forex. If financial information is weak, nonetheless, the CAD is more likely to fall.

![[original_title]](https://rawnews.com/wp-content/uploads/2024/06/1718990447_canadian-money-2682954_Large.jpg)